Navigating the New Superannuation Landscape: Reversionary v Non-Reversionary Pensions

If it becomes law, the introduction of the Division 296 tax regime will target some individuals with superannuation balances over $3 million. This so-called Better targeted superannuation concessions Bill applies to all members of SMSFs, APRA industry and retail funds, regulated funds and exempt public sector schemes, as well as certain defined benefit funds.

Are some people exempt from the $3m unrealised CGT?

Unfairly, it does not apply to certain Commonwealth judges, as well as certain high-paid government employees. So much for the ‘rule of law’ where everyone is treated equally under the law.

Not all judges are exempt from this paper tax

In a nation founded on the principle of the rule of law, where all are meant to be treated equally, the Division 296 superannuation tax reveals a striking departure from this principle. Most judges glide past liability: Commonwealth judges appointed before 1 July 2025 retain exclusion for their judicial pensions, while state judges shelter within the sanctuary of constitutionally protected schemes.

Yet the judges of the ACT Supreme Court stand conspicuously exposed. Their earnings fall squarely within Division 296, as if some unseen Canberraian bureaucrat took a deliberate pen to their protection. One is tempted to imagine that a senior Canberra official, once smarting from the stern hand of an ACT bench, quietly ensured that the exemption would never extend across London Circuit.

And so it is. Parliamentarians, who neither have the time nor the appetite to read the complex tax legislation that crosses their desks, nonetheless vote it through. This reveals the true outcome: Australia is governed not by a single rule of law for all, but by the special exceptions created within the Canberra bubble—a world disconnected from the very people it purports to serve.

Are defined benefit funds able to defer the tax?

Division 296 tax on defined benefit interest may be deferred, whereas other individuals must pay personally or with released amounts from their superannuation. See our Self Managed Superannuation Fund Guide, 3rd Edition, Wolters Kluwer at 20-030 for more details.

What to watch out for if you have both a Reversionary Pension and $3m in your superannuation fund

For those affected, this significantly alters the landscape of retirement and estate planning. Previously, the preference was often for reversionary pensions, mainly due to the benefits under the transfer balance cap (TBC) regime. However, even before the Division 296 changes become law, it’s crucial to reassess this approach because the start date has already passed. This guide will walk you through the key considerations.

Division 296 Tax: A Game Changer for High-Balance Super Members

The government’s new ‘paper profits’ tax has many traps.

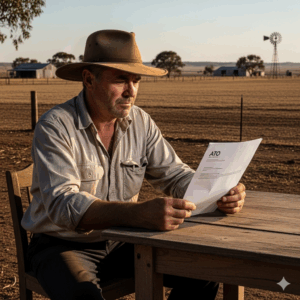

Choosing a Reversionary Pension to protect your spouse could be the very decision that forces them to sell the family farm.

They’ll be hit with a massive tax bill on gains that only exist on paper, forcing them to sell generational assets to pay a tax on money they never received.

Retrospectively, from 1 July 2025, the Division 296 tax will impose an additional 15% tax on unrealised capital increase (earnings) corresponding to the proportion of an individual’s total superannuation balance (TSB) that exceeds $3 million. This new tax has profound implications for estate planning, particularly on the decision to make a pension reversionary.

As of September 2025, the Bill was not yet law. So how were we meant to advise our clients on this tax grab? The start date should be pushed out to a later date.

When to reconsider a reversionary pension:

- High Combined Balances: If a reversionary pension causes the surviving spouse’s TSB to exceed the $3 million threshold, they will be subject to the additional 15% Division 296 tax on the earnings of the excess amount.

- Tax on Unrealised Gains: A significant concern with the Division 296 tax is that it applies to unrealised capital gains. This inevitably would lead to a tax liability even when assets have not been sold, creating cash flow issues.

- Non-Indexed Threshold: The $3 million threshold is not indexed, meaning that over time, more individuals will be affected by this tax due to inflation and investment growth.

The Enduring Benefits of Reversionary Pensions under the TBC Regime

Despite the new tax, reversionary pensions still offer valuable benefits under the existing transfer balance cap (TBC) regime:

- Certainty and Seamless Income: A reversionary pension provides a seamless transition of income to the surviving spouse upon death, ensuring financial continuity during a difficult time. The pension automatically continues, and there’s no need to go through the process of establishing a new death benefit income stream.

- 12-Month Grace Period: The value of a reversionary pension is not counted towards the surviving spouse’s TBC until the 12-month anniversary of the member’s death. This provides valuable time to manage their financial affairs and, if considered necessary, take steps to avoid exceeding their TBC.

- Asset Retention: With a reversionary pension, the assets supporting the income stream can remain within the superannuation fund, allowing for continued investment growth in a tax-advantaged environment where the spouse has additional personal sources of taxable income.

Weighing the Pros and Cons of a Reversionary Pension: A Balancing Act

The decision between a reversionary and a non-reversionary pension is now a complex balancing act. Here’s how to weigh the competing factors:

ECPI and Succession Planning Considerations

- Exempt Current Pension Income (ECPI): The choice between a reversionary and non-reversionary pension can impact a fund’s ECPI claim. With a reversionary pension, the pension continues, and the fund’s assets remain in the retirement phase, preserving the tax exemption on earnings. With a non-reversionary pension, the assets may revert to the accumulation phase upon the member’s death, potentially losing the tax exemption until a new death benefit income stream is commenced.

- Succession Planning, Especially for Blended Families: For blended families, the certainty of a reversionary pension can be appealing, ensuring that a specific beneficiary receives the superannuation benefit. However, the lack of flexibility with a reversionary pension might not be suitable for complex family structures. A non-reversionary pension, combined with a binding death benefit nomination (BDBN), can provide more control over how the death benefit is distributed among different beneficiaries.

Reversionary Pension Checklist

Worked Practical Examples of the impact of Division 296 tax

Example 1: The Impact of Division 296 Tax

- John and Mary are members of an SMSF. John has a TSB of $2.5 million, and Mary has a TSB of $1.5 million. John’s pension is reversionary to Mary.

- Upon John’s death, Mary’s TSB becomes $4 million.

- Mary will be subject to the Division 296 tax on the earnings of the $1 million that exceeds the $3 million threshold.

Example 2: The Flexibility of a Non-Reversionary Pension

- Assume the same scenario as above, but John’s pension is non-reversionary.

- Upon John’s death, Mary can choose to take a portion of the death benefit as a lump sum to keep her TSB below the $3 million threshold.

- For example, Mary could take $1 million as a lump sum and commence a new death benefit income stream with the remaining $1.5 million. Her TSB would then be $3 million, and she would not be subject to the Division 296 tax at least initially.

Example 3: Reducing the total super balance

As the $3 million is not indexed, Division 296 will apply if the assets and earnings increase in value in future years, unless Mary withdraws the excess capital before 30 June each year. If her super balance is $3.2 million during 2026-27, and she withdraws $250,000 before 30 June 2027, her balance will be less than $3 million, and she will not be liable to pay any Division 296 tax for 2026-27.

Division 296 Tax – Most common concerns

Q: How is the Division 296 tax calculated on super balances over $3 million?

A: The tax calculation is a multi-step process designed to tax the proportion of earnings related to your balance above the $3 million threshold. The Australian Taxation Office (ATO) will follow these steps:

-

- Calculate ‘Earnings’: First, the ATO calculates your ‘superannuation earnings’ for the financial year. This is not just investment returns. The formula is:

Earnings = (Closing Super Balance + Withdrawals - Contributions) - Opening Super Balance - Determine the Proportion: Next, it calculates what percentage of your earnings is attributable to the balance over $3 million. The formula is:

Proportion = (Closing Super Balance - $3 million) / Closing Super Balance - Calculate the Tax: Finally, the 15 per cent tax rate is applied to the proportional earnings:

Tax Liability = Earnings × Proportion × 15%

- Calculate ‘Earnings’: First, the ATO calculates your ‘superannuation earnings’ for the financial year. This is not just investment returns. The formula is:

For example, consider Gail, who starts with $5m and ends with $5.3m, while taking $150,000 in pension payments and making $25,500 in contributions. Her earnings are calculated as $424,500. The proportion of her earnings subject to the tax is 43.4%. Her final tax bill is $27,635.

Q: Do I have to pay Division 296 tax on unrealised gains in my super?

A: Yes. The tax is calculated on the movement in your total superannuation balance, not on your fund’s taxable income. This means you pay tax on the increase in the value of your investments, even if you have not sold them. This taxing of unrealised gains is a critical feature of the legislation. It creates the risk that you may pay tax on gains in one year, only to see those gains disappear if the market falls in a subsequent year.

Q: Can I get a refund for Division 296 tax if my super balance goes down?

A: You would have thought that this would be fair. You would have expected it to cut both ways. But, no. There is no refund for Division 296 tax paid in a prior year if you experience negative earnings or your balance drops below $3 million. The tax is a one-way street. However, any calculated losses can be carried forward indefinitely. These losses can then be used to reduce your Division 296 tax liability in a future year where you have positive earnings. In some situations, these carried-forward losses may never be utilised.

Q: How does the $3m super tax cap affect members of an SMSF?

A: The tax is assessed on individuals, not superannuation funds. For a Self-Managed Superannuation Fund (SMSF), the ATO looks at each member’s total superannuation balance separately. Your TSB is the aggregate of your interests in all super funds, including your SMSF. If an individual member’s TSB exceeds $3 million, they are liable for the tax on their portion of the earnings, regardless of the fund’s total assets. The SMSF itself does not pay the tax.

Q: What are the payment options for a Division 296 tax assessment?

A: The tax is legally your personal liability. The ATO will issue the assessment directly to you. You have two options for payment:

-

- Pay Personally: You can pay the tax bill from your personal, non-superannuation savings.

- Release from Super: You can elect to have the money released from your superannuation fund to pay the liability.

The choice has financial consequences. Paying from your super fund reduces the capital that remains in the tax-effective superannuation environment to generate future compound growth.

Q: What is the best strategy to reduce the Division 296 tax?

A: Planning is crucial, but rash decisions can be costly. Since the law is not yet final, the best strategy is to wait until the legislation is passed before making significant changes.

-

- Do not withdraw funds prematurely. If the law changes or does not proceed as expected, you may be unable to re-contribute the funds due to contribution caps.

- Do not sell assets prematurely. Selling investments will not alter your Division 296 tax liability, which is based on the change in balance. It will, however, trigger standard Capital Gains Tax (CGT) consequences.

For many, super remains the most tax-effective structure available. The appropriate strategy is to seek professional advice to model the tax’s impact on your specific circumstances and review alternative investment vehicles.

Q: Will I have to sell my farm if I cannot pay the unrealised capital gains tax

The farmer is forced to sell the family farm to pay tax on an income tax he never got.

The ATO’s new tax on ‘paper profits’ will destroy many Australian farming families.

Yes. The government’s new Division 296 tax on superannuation forces a tax on unrealised capital gains. You are taxed on profits that only exist on paper.

What happens if your superannuation fund is asset-rich—like a family farm—but cash-poor? How are you supposed to pay a massive tax bill on money you have never actually seen?

The harsh reality is this: if the cash is not in your SMSF or your personal bank account, the ATO will still demand its money. For farming families, this could lead to a heartbreaking and devastating outcome: being forced to sell the family farm to pay a tax on fictional gains.

Only a financial planner can give you specific advice

While Legal Consolidated is one of the biggest providers of Reversionary Pension Kits in Australia, the decision to make a pension reversionary or non-reversionary is a complex financial decision that requires careful consideration of an individual’s personal circumstances. This information is of a general nature only. Reversionary Pensions are a financial product. Only a licensed financial adviser can advise you if a Reversionary Pension is right for you. Your accountant needs to be part of this conversation as well.

While any mistakes are mine alone, I am grateful for the review of this article by Australia’s leading superannuation experts, Barbara Smith AO, and Dr Ed Koken. Together, we authored the book Self-Managed Superannuation Fund Guide. Dr Brett Davies, Adjunct Professor, UWA Law School.