Financial Planner Service Trust Agreement

It is common practice for financial planners to use a service trust (service entity). A service trust is often a:

- Family Trust – if just one financial planner (ASIC & your Dealer group normally require a company as trustee)

- Unit Trust – if two or more financial planners (ASIC & your Dealer group normally require a company as trustee)

- Company – not common as profit is trapped and no CGT relief. But useful if you have no family because of the 30% tax rate

Build these 3 types of service trusts on our website.

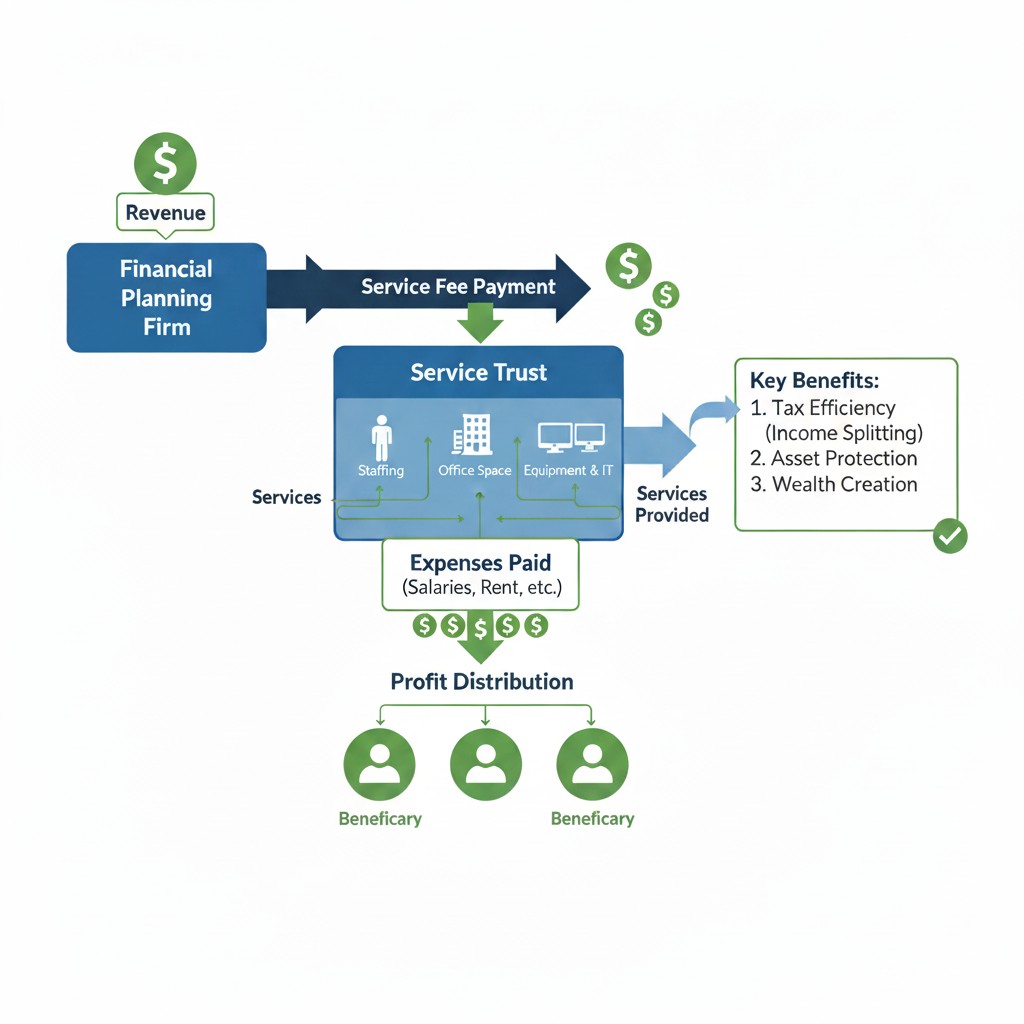

The service trust is a second business. The service trust provides services to the financial planning firm. It charges a fee for providing those services. Service trust profits are shared with the financial planner’s spouse, children, and family. They pay tax at a lower marginal tax rate. Therefore, the service trust saves tax. It helps with superannuation benefits and the spreading of income to family members.

But it is not enough to have just a service trust. You need an agreement between the financial planning practice and the service trust. This agreement is called a Financial Planner Service Trust Agreement. The Service Trust Agreement is a contract. It allows the service trust to supply equipment, staff, receptionists, tools, machines, premises, and administration services to the financial planning firm.

Service Trust Agreements are also popular for:

1. Other professionals such as lawyers, doctors, dentists, and accountants that can’t otherwise share profit easily.

2. Asset protection – one entity holds the high-risk activities (employees, tenancies & advice) the other keeps all the ‘good’ assets (land, intellectual property) in a low-risk entity.

3. Companies wanting to liberate wealth and move profit into a trust structure. Unlike a company, the service trust can access the CGT tax concessions. Therefore, the service trust often holds appreciating assets. These include real estate, franchises, copyrights, and ‘leased out’ business names.

Tax Advantages of Service Trusts for Financial Planners

The service trust is a business. The Financial Planner Service Trust Agreement provides services to the financial planning firm for a profit. The services are provided at ‘market rates’. This is required by the ATO TR 2006/2. The service trust then distributes the ‘profit’ it makes. This is from running the business. The profit goes to the non-working spouse, children, and other taxpayers at a lower tax rate.

Example: How Financial Planners Share Profits with Family

The financial planning firm generates revenue of $3.2 million. The Service Trust provides services to the financial planning firm. The Financial Planner Service Trust Agreement outlines the services provided. Services include office cleaning, providing secretarial support, staff assistance, computer maintenance, marketing, office lease management, and bookkeeping. The service entity owns the equipment and employs the staff.

The Service Trust (via the Service Trust Agreement) charges the financial planning firm $2.8m in fees.

By providing these services, the Service Trust makes a profit of $1.6m. This is after it pays its expenses of $1.2m. That profit is distributed to the financial adviser’s spouse, children, and other trust beneficiaries.

The financial planner cannot share ‘personal services income’. However, the service trust ‘income’ is not personal services income. This is because the service trust is a separate business from the financial planning practice. The service trust operates on an ‘arm’s length basis’. Therefore, the income is distributed to the spouse, children, and other beneficiaries related to the financial planning firm’s partners.

Maximising Tax Savings with Service Trusts for Financial Planners

The tax advantage of using a service trust lies in income splitting (and asset protection) and distributing income to beneficiaries who are taxed at lower marginal tax rates, thereby reducing the overall tax liability of the family unit. Here’s a detailed explanation:

-

Separate Business Entity: The Service Trust is a distinct business entity that provides services to the financial planning firm at market rates, as required by the Australian Taxation Office (ATO) under TR 2006/2. The income generated by the Service Trust is not classified as “personal services income” (PSI) because it operates on an arm’s length basis and provides services such as office management, staffing, and equipment leasing, which are separate from the financial planner’s personal exertions.

-

Profit Distribution to Family Members: In the example, the Service Trust generates a profit of $1.6m after paying its expenses of $1.2m. This profit is distributed to beneficiaries of the trust, such as the financial adviser’s spouse, children, or other family members, who are often in lower tax brackets compared to the financial planner.

-

Income Splitting for Tax Reduction:

-

In Australia, personal income tax rates are progressive, meaning higher income is taxed at higher rates (e.g., up to 45% for incomes above $190,000 in 2025, excluding the Medicare levy).

-

If the financial planner earned the entire $3.2m as personal income, a significant portion would be taxed at the highest marginal tax rate.

-

By channelling $2.8m to the Service Trust for services, the financial planning firm’s taxable income is reduced to $0.4m ($3.2m revenue – $2.8m service fees).

-

The Service Trust, after paying its expenses of $1.2m, distributes the $1.6m profit to beneficiaries. If these beneficiaries (e.g., spouse, adult children) have little or no other income, they may be taxed at lower rates (e.g., 19% or 32.5% for incomes below $135,000) or even fall within the tax-free threshold (up to $18,200).

-

-

Sample Tax Savings Calculation for Financial Planners (simplified for illustrative purposes):

-

Without Service Trust: If the financial planner retains the full $3.2m as personal income, assuming no other deductions, a large portion is taxed at 45%. Estimating an average tax rate of ~40% (blended across tax brackets), this results in approximately $1.28m in tax.

-

With Service Trust: The financial planning firm’s taxable income is $0.4m, which might incur tax of ~$100,000 (assuming a lower effective rate due to the smaller income). The Service Trust’s $1.6m profit is distributed to, say, four beneficiaries (spouse and three children), each receiving $400,000. If each beneficiary’s income is taxed at an average rate of ~25% (due to lower tax brackets), each pays ~$100,000 in tax, totalling $400,000 in tax for the distributed income. The combined tax liability is approximately $100,000 + $400,000 = $500,000.

-

Tax Savings: The difference between $1.28m (without trust) and $500,000 (with trust) is a potential tax saving of $780,000, assuming the beneficiaries are in lower tax brackets.

-

-

ATO Compliance for Service Trusts: The Service Trust must charge market rates for its services (per ATO TR 2006/2) to avoid scrutiny. The trust’s expenses (e.g., $1.2m for staff, equipment, and operations) must be legitimate and reasonable. The ATO also requires that the trust operate as a genuine business, independent of the financial planner’s personal services, to ensure the income is not reclassified as PSI.

-

Additional Benefits of Service Trusts:

-

Asset Protection for Financial Planners: The Service Trust owns assets (e.g., equipment, leases), which may provide some protection from creditors of the financial planning firm.

-

Flexible Income Distribution: The trust can distribute income to different beneficiaries each year, optimising tax outcomes based on their income levels.

-

Key Considerations for Financial Planner Service Trusts

-

ATO Scrutiny: The ATO closely monitors service trust arrangements to ensure compliance with tax laws, particularly regarding PSI rules and arm’s length pricing. Non-compliance could lead to income being reclassified as PSI, negating the tax advantage.

-

Setup and Maintenance Costs: Establishing and running a service trust involves legal, accounting, and administrative costs, which must be weighed against the tax savings.

-

General Anti-Avoidance Rules (Part IVA): The ATO may challenge arrangements perceived as primarily for tax avoidance rather than genuine commercial purposes.

In summary, the tax advantage comes from reducing the financial planner’s taxable income and distributing the Service Trust’s profits to lower-taxed beneficiaries, potentially saving significant amounts in tax (e.g., $780,000 in the simplified example). However, compliance with ATO rules and proper setup are critical to maintaining these benefits.

Independent Contractors Agreement

A Service Trust Agreement is a type of Independent Contractors Agreement (‘contract for services’).

The principal (financial planning firm) requests and pays for the services. The person providing the services is the contractor (service trust). The agreement between the principal and contractor is the Financial Planner Service Trust Agreement.

The contractor is ‘independent’. The contractor is not an employee of the principal (financial planning firm).

What should the Service Trust charge?

Your accountant, each financial year, tells you what to charge. The Service Trust Agreement allows for this. You charge ‘market rates’. Treat the service trust as a separate, non-related business. The Service Trust Agreement allows the service trust to provide many services, including:

(a) plant and equipment (desks, chairs, machines, tools and equipment)

(b) employing the staff (build the Employment Contracts here)

(c) consumables

(d) the premises

(e) budgeting, forecasting, bookkeeping, accounting, and debt collection services

(f) marketing, corporate design, and identity and brand awareness

(g) additional services — as agreed by the parties from time to time

How do I update the Financial Planner Service Trust Agreement?

The Agreement is updated by an exchange of emails. Add more services as your accountant suggests. You can add a scope of work, plans, diagrams, and specifications.

The Service Trust Agreement is silent on what it charges the financial planning firm. So that is never out of date. Your accountant advises you on what the appropriate charges are during the financial year.