Use a Deed of Debt Forgiveness to Qualify for Centrelink Benefits before you retire

Is being owed money an asset that is means-tested for Centrelink?

As you approach retirement, managing your financial affairs is crucial. This is to maximise government benefits such as the age pension. A common scenario involves shareholders in a company—such as a couple nearing pension age—where the company owes them money but is unlikely to repay due to poor financial health. This debt is considered an asset by Services Australia and impacts pension eligibility. One potential strategy to address this is using a Deed of Debt Forgiveness. This paper examines the forgiving of a debt well before you want to seek Centrelink benefits.Does forgiving debt reduce the assets you own for means-testing?

Centrelink loves to look at your old, stale, and forgotten Loan Agreements.

Forgiving the debt reduces assets for Centrelink

Yes, building a Deed of Debt Forgiveness reduces your assets and makes it easier to get the pension:- Reduce Assessable Assets: Forgiving the debt through a formal Deed of Debt Forgiveness lowers your total assets, potentially qualifying you for a higher pension due to reduced assets under Centrelink’s assessment criteria.

- Legal Framework: A Deed of Debt Forgiveness is a legally sound method that demonstrates to Services Australia and the Australian Taxation Office (ATO) that you are managing your financial affairs transparently and legally. The deed must explicitly state that the forgiveness is genuine and that no repayment is expected.

- Simple and Informative Process: The building process of the Deed of Debt Forgiveness is free. As you build the Deed you can read free and educational hints. You pay only at the end if you want the document.

- Full free sample: Before you start the free building process you can see at the top of this page a full sample. It includes the law firm’s cover letter.

A forgiven debt is still considered an asset under the Deprivation Rules.

Centrelink’s deprivation rules prevent people from ‘giving away’ their assets to increase their pension. You are forgiving a debt for ‘love and affection’. That is the very essence of giving something away. Centrelink’s deprivation rules then say that the amount of the loan that was forgiven is still yours. This is for some years after you sign the Deed of Debt Forgiveness. So you want to forgive the debt well before you want to apply for the pension. The rules specify that if you dispose of an asset and do not receive adequate consideration, Centrelink counts the asset’s value against you for a number of years. Therefore, forgiving a debt well before you apply for the pension ensures that the deprivation period expires before your pension assessment, effectively reducing your assessable assets without penalty.On what date does the Deprivation Rules start to operate for Deeds of Debt Forgiveness?

Doing the forgiveness formally through a Deed of Debt Forgiveness and documenting that the forgiveness is irrevocable and unconditional helps prove to Centrelink that the debt is genuinely forgiven. This supports the legitimacy of your financial repositioning ahead of pension assessments. The deprivation time period starts on the date you sign the Deed of Debt Forgiveness.Is forgiving a loan treated as a gift?

Yes, Centrelink treats the loan as still your asset for several years. This is under the deprivation rules. A gift is any money or property that you give away for which you do not receive adequate financial consideration. Forgiving money, to Centrelink, is a gift. Gifts affect your pension or payment because they either directly or indirectly reduce the assets available for your personal use. The maximum amount you can give away, regardless of whether you are a single person or a couple, is a very low amount of $10,000 per year, or $30,000 over a rolling five-year period. The rolling five-year period is the current financial year plus the previous four financial years. This is not indexed for inflation. Gifts over these amounts are assessable under the assets test. These amounts are called deprived assets. So forgive the debt well before you are going to apply for the pension.Joanne forgives her son’s loan so that she can get Centrelink

Even stale and old loans need to be forgiven with a Deed of Debt Forgiveness.

Does Centrelink means test money that Joanne is owed?

Money people owe you is an asset. It has to be declared to Centrelink. Joanne’s asset test for Centrelink includes all her assets and income. This would have included the $50,000 loan even if Joanne does not consider it recoverable.Can Joanne informally forgive the debt – on the back of an envelope?

By informally dismissing the debt—without a formal Deed of Debt Forgiveness—this amount could still be treated as an asset, as Centrelink might not consider her verbal or written forgiveness conclusive. A Deed of Debt Forgiveness requires a number of legal terms, acknowledgments and obligations. Without a formal Deed of Debt Forgiveness, built on Legal Consolidated’s website, Joanne’s decision remains legally ambiguous. Centrelink’s means testing for pension eligibility could still consider the $50,000 as part of her assets. This oversight could significantly impact her pension rate, as her declared assets remain above the threshold for maximum pension benefits. If Joanne were to formalise her forgiveness through a Deed of Debt Forgiveness, she would reduce her assessable assets, thus potentially increasing her Centrelink pension benefits. The deed provides a clear, irrevocable, and legally binding acknowledgment that Joanne has relinquished her claim to the debt, aligning her legal position with her personal feelings. As she does this many years before her retirement, there is no issue with deprivation.Joanne’s Cautionary Tale

Joanne’s story is a cautionary tale about the intersection of personal generosity and financial regulations. For individuals approaching or in retirement, managing assets is not just about numbers; it is about understanding how decisions interact with legal and governmental frameworks. By neglecting to formalise her debt forgiveness, Joanne would have inadvertently jeopardised her financial stability in retirement.But if debt is not recoverable, why does Centrelink still treat it as an asset?

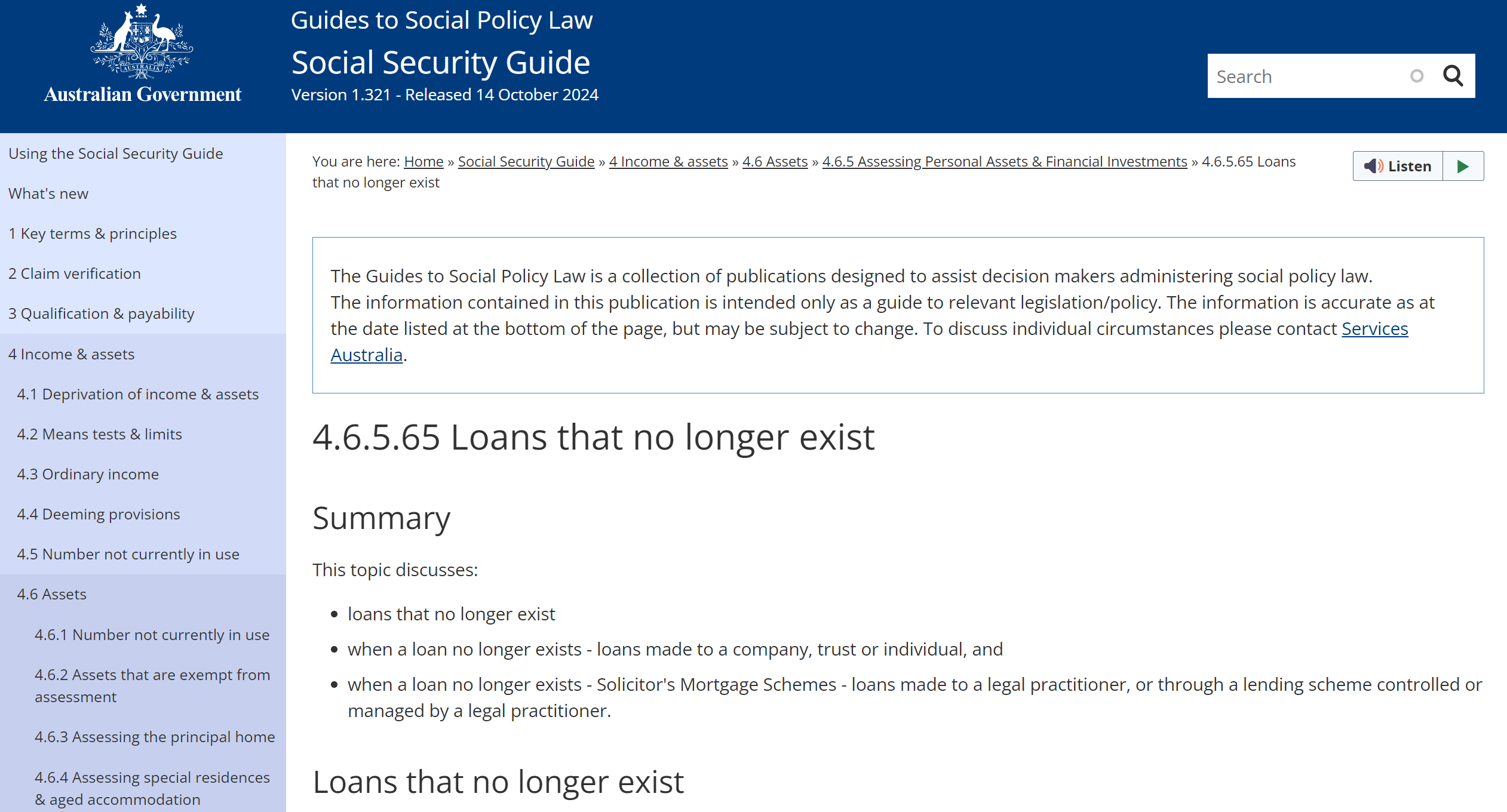

Centrelink’s strange Deprivation Rules for Loans that “No Longer Exist”

Even bad debts need to be formally forgiven. Forgive a debt to get Centrelink Benefits.

Centrelink’s approach to assets is rigorous. Loans, even those seemingly irrecoverable, are often counted as assets unless they meet specific criteria. The section titled “4.6.5.65 Loans that no longer exist” in the Centrelink policy guide sets out three limited circumstances where a loan may be excluded from asset calculations:

- The loan is formally forgiven through a legal document, such as a Legal Consolidated Deed of Debt Forgiveness.

- The debtor has declared bankruptcy.

- The loan is deemed irrecoverable under particular legal conditions, including court decisions or statutory limitations.

Deprivation Rule Exception for a company you own 100%

Are you a Sole Attributable Stakeholder? For example, do you control, own or have 100% of the company or trust? If you do, then you may be able to forgive the debt immediately. You do not have to wait 5 years. This is a potential exception to the 5-year gifting rule.

Usually, you must wait 5 years after forgiving a debt before Centrelink accepts that the asset is no longer with you.

The questions are:

- Are you the “sole attributable stakeholder”?

- Or are you and your spouse the only stakeholders?

If so, you may not have to wait 5 years.

Escape the 5-year Centrelink waiting period if you own 100% of the shares in the company

This 5-year deprivation exemption is found in the Social Security Guide (Version 1.333). It is under section 4.12.6.20 Gifts to a Private Trust or Private Company.

The Centrelink Guide states:

“If a SOLE attributable stakeholder, or members of a couple who are the ONLY attributable stakeholders, make a capital injection into a structure in the form of a gift, that gift will NOT be subject to the disposal provisions but must be included in the value of the structure.”

Why does Centrelink allow the 100% company to be exempt from the deprivation rules?

Centrelink’s logic is simple. You cannot make a gift to yourself.

You are moving money from one pocket (your personal name) to another pocket (your private company).

Therefore, Centrelink generally does not count this as “deprivation”. The 5-year waiting period typically does not apply.

Understanding the ‘Value Shifting’ rules when you own 100% of the company

While you may escape the 5-year deprivation rule, the Centrelink Guide states the gift “must be included in the value of the structure”.

When you forgive the debt, your personal assets drop. But your company’s assets increase.

-

Before: You have a $100,000 loan asset. The company has a $100,000 liability.

-

After: You have $0. The company has $0 in liabilities. The company is now worth $100,000 more.

If your company is solvent, your total assessable assets may stay the same. Speak to your accountant about how this affects your specific means test.

Example of how an insolvent company escapes Centrelink deprivation

This strategy is often helpful for insolvent companies or trusts.

Imagine your company has negative equity. It owes you $200,000. But it only has $10,000 in the bank. It is essentially worthless.

1. You forgive the $200,000 debt.

2. Your personal assets are reduced by $200,000.

3. The company value technically increases, but only back to a net asset value of $10,000.

4. You have legally wiped $190,000 off your assessable assets.

Subject to your accountant’s confirmation, this can be done without the 5-year wait.

Why do I need a Deed of Debt Forgiveness?

You cannot just delete the loan from your books. Centrelink requires proof. Without a formal Deed, Centrelink considers the transaction a sham or an informal waiver. This generally fails the exemption.

To use this exception, the transaction must be a “capital injection… in the form of a gift”.

You must prove it is a gift.

A Legal Consolidated Deed of Debt Forgiveness provides this proof. It formally extinguishes the debt. It releases the company for “natural love and affection”.

This is designed to satisfy the Centrelink requirement for a gift. It confirms the loan is no longer an assessable asset.

Legislation reference: Social Security Act 1991 (Cth) section 1123.

Debts go ‘stale’ every 6 years – do stale debts still need to be forgiven?

There is a statute of limitations on unsecured Loans that sit dormant for 6 years in all states (3 years in NT). However, even stale loans should be expressly forgiven via a Deed of Debt Forgiveness.Why is a formal Deed to Forgive the Debt crucial to comply with Centrelink?

Using a Deed of Debt Forgiveness protects you in three ways:- Legality: It provides a legal acknowledgment that the debt is irrevocably forgiven. This formalisation is important for Centrelink to remove the loan from asset calculations.

- Clarity: It clarifies the financial position of the retiree, ensuring that only actual, recoverable assets are considered in means testing.

- Protection: It protects the retiree from potential legal and financial repercussions associated with the deprivation provisions, which might otherwise assume the forgiver still holds the asset.

Speak with your accountant and financial planner about getting Centrelink benefits

Forgiving a debt through a Deed of Debt Forgiveness is a pivotal step in managing your financial affairs as you approach retirement. This strategy, when implemented early and compliantly, can significantly enhance your pension benefits. However, formally forgiving old debts is only one of many things that you may need to do before you are ready to move into retirement. Speak to your accountant and financial planner.Resources to empower you to comply with Centrelink

Free Centrelink tool kit:

-

Estate Planning:

- 3-Generation Testamentary Trust Wills – stop beneficiaries retaining Centrelink benefits in your Will

- Abandon a gift in a Will to keep the pension?

- Is it legal to prepare Wills for your Grandparents?

- Centrelink compliant Power of Attorney – keeps your family in control, not Centrelink

- Elder abuse using a POA

- Loans to parents – escape ‘means testing’ by Centrelink

- Forgive a Debt to get Centrelink

- Special Disability Trust – in your spouse’s Will to avoid Centrelink deprivation rules

- Contractual Will Agreement when your Grandmother remarries

-

Family Trusts:

- Replacing the Appointor in a Family Trust – succession planning for a person wanting Centrelink

- Company to replace pensioner as trustee of a Family Trust

- Wind up and get rid of the Family Trust – Centrelink-compliant

- Can beneficiaries disclaim a Family Trust distribution?

-

Self-Managed Super Fund:

- Removing a pensioner as a member of an SMSF

- Keep super in the fund when your spouse dies – escape means testing

- Get rid of unused Self-Managed Super Funds Deeds

- Wind-up Unit Trusts

- What to do before the end of year financial year – to appease Centrelink