Business owners, company directors, and professionals like dentists and engineers face financial risks due to their work and responsibilities. Their vulnerability to bankruptcy is heightened by exposure to liability, unpredictable market conditions, and the risks of providing advice. It is prudent to employ asset protection strategies to safeguard their assets.

A straightforward asset protection strategy is to transfer assets from themselves to a low-risk entity. Such safe havens include family trust, a non-working spouse or even your Mum. However, often transferring assets attracts taxes, such as stamp duty and Capital Gains Tax.

An alternative approach is to encumber the assets with debt instead of transferring them. This strategy is called the Gift and Loan-Back scheme (an ‘asset mortgage’ scheme). However, to the author’s knowledge, no court has yet upheld a Gift and Loan-Back scheme.

This article analyses judicial decisions and explores the challenges associated with the Gift and Loan-Back scheme.

How does a Gift and Loan-Back work?

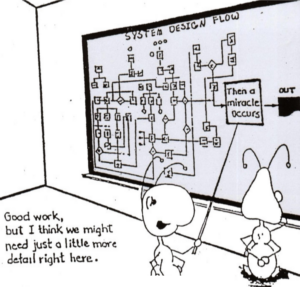

While promoters often shroud the process in exotic names and ‘unique’ structures, the two stages of a Gift and Loan-Back scheme are:

Stage one: the gift

Gift: The high-risk person gifts all their present and future cash assets—including bank accounts, ongoing wages, and borrowings—to a low-risk entity, such as a Discretionary Trust. If the high-risk person lacks available cash, then instead, they issue promissory notes, including IOUs and post-dated cheques, which are cheques written with a future date.

Stage two: the loan back

Loan-Back: The low-risk entity then:

-

-

- lends the money (back) to the high-risk person; and

- registers a security interest over the high-risk person’s assets, such as:

-

The high-risk person does not gift assets like real estate and shares, rather they gift cash. As a result, there is no transfer duty and no triggering of Capital Gains Tax.

If the high-risk individual declares bankruptcy or the high-risk company becomes insolvent, the low-risk entity, as a secured creditor, holds priority over unsecured creditors. Consequently, the low-risk entity recovers the lent funds from the high-risk person. This is in preference to the unsecured creditors.

Example of how a Loan and Gift-back works – ‘asset mortgage scheme’

Sarah, as a director of an engineering business, faces heightened risk due to her roles in both managing a professional service business and serving as a director. She is concerned that a lawsuit could result in a substantial loss of her assets.

Sarah, as a director of an engineering business, faces heightened risk due to her roles in both managing a professional service business and serving as a director. She is concerned that a lawsuit could result in a substantial loss of her assets.

Sarah’s only asset is a $3 million property. Her bank mortgage balance is $800,000. Therefore, her equity in the property is $2.2 million. Sarah wants to protect the equity in her property. This is in case she ever goes bankrupt. The stamp duty to transfer the property to a low-risk entity is $135,000. So, instead, of transferring the property, Sarah enters into a Gift and Loan-Back scheme. She does this to strip out the equity and move that equity into her low-risk entity. She does this in three stages:

- Sarah gifts $2.2 million of cash to a newly formed discretionary family trust (Sarah is the Appointor of the family trust so she keeps control);

- Using a loan agreement, the family trust loans $2.2 million (back) to Sarah; and

- To secure the loan, the family trust registers an equitable mortgage on Sarah’s property for $2.2 million.

Her fears become reality; following a dispute Sarah declares bankruptcy. The bank and Sarah’s family trust are secured creditors. Secured creditors get paid first – in preference to unsecured creditors.

The Bank forces a mortgagee sale of her $3 million property. From the $3 million sale proceeds, the bank takes its $800,000 and walks away. The second secured creditor – Sarah’s family trust – is next in line. The family trust takes the rest of the sale proceeds and walks away with the remaining $2.2 million. There is no money left for the unsecured creditors.

The unsecured creditors are not happy. They start legal proceedings. They argue that the Loan and Gift-Back is a sham. The cases below support this.

Q: Why did Sarah not transfer her property to her family trust? It looks less artificial.

I agree. It would have been better (but again not foolproof – nothing is foolproof, see Wallace v Wallace) for Sarah to have transferred the property from her name into her family trust. However, a transfer of the underlying asset has transaction costs:

- Stamp duty. Sarah pays about 4.5% in stamp duty (transfer duty) on the property’s market value. (If she had used her low-risk stay-at-home husband – rather than her family trust – she might have got half the property into his name stamp duty-free.)

- CGT. Sarah has to pay Capital Gains Tax (CGT) on the transfer. (However, there may be no CGT if the property had been her family home.)

- Loss of Principal Place of Residence Exemption. If the property was her family home and is transferred to a family trust, it begins to accrue a CGT liability. This tax must be paid when the trust eventually sells the property. By transferring the property from her name, Sarah loses the CGT exemption for her principal place of residence. (However, if she had transferred the family home to her low-risk husband, he would typically be able to maintain the CGT-free status of the home.)

- Land Tax Implications. Sarah’s family trust may now be liable for land tax. (However, it’s possible that Sarah was already paying land tax on the property if it had not been her principal place of residence.)

If there were no transaction costs in transferring the asset then people would be less likely to need a Gift and Loan-Back scheme. Accordingly, these transaction costs are considered in more detail below.

Why not just transfer, as a gift, all your assets to the low-risk entity?

Transferring an asset to a low-risk entity, rather than keeping it in your name, is a more straightforward approach to reducing personal and business risks. (It works even better if the asset never gets into your name to begin with, but that is another matter.)

For asset protection, it is better to transfer all your assets to a low-risk entity. (In which case, you would not need the complexity of the Gift and Loan-Back structure.) An outright transfer is also less complex, convoluted and artificial – but nothing is foolproof (see the bankruptcy clawback rules).

When you transfer real estate and shares, you suffer stamp duty and Capital Gains Tax. Stamp duty on real estate is around 4.5% of the value of the property. Further, for your home, from that point on, you also lose the free CGT status.

In contrast to an outright transfer, the Gift and Loan-Back scheme moves the equity in your asset with no need for a transfer. There are fewer transactional costs. For example, you do not have any stamp duty or trigger any Capital Gains tax.

Consider your home (main residence). While your home may suffer no CGT on the transfer, the low-risk entity no longer retains the home as a CGT-free asset. From that moment on your family home starts accumulating CGT. The low-risk entity will have to pay CGT when it eventually sells the property. The CGT exemption for main residences would no longer apply once the property is in the trust. The trust may also now have to pay land tax and higher rates.

If your low-risk entity is your spouse then some of the above costs are reduced.

Case 1: ACCC v Master Wealth Control – Vestey Trust

In the case of ACCC v Master Wealth Control Pty Ltd [2024] FCA 344, the Gift and Loan-Back scheme failed. The promotors gave their ‘unique’ scheme an exciting-sounding name: the “Vestey Trust” or the “Master Wealth Control Package.”

Three regulators attacked the Gift and Loan-Back Vestry scheme

Lawyers, accountants, financial planners and television shows (e.g. A Current Affair, 2022) lampooned this scheme. All to no avail. Not even ASIC or the ATO could shut the Vestry Trust scheme down:

- In 2022, the Australian Securities and Investments Commission (ASIC) valiantly tried to ban the scheme: ASIC Media Release 22-079MR.

- Later in 2022, the ATO exposed the scheme as unnecessarily complex and documented numerous tax and superannuation compliance issues: QC 71175.

- It was not until 2024 that the Australian Competition and Consumer Commission (ACCC) successfully challenged the scheme in the Master Wealth case. The court found the scheme violated the Australian Consumer Laws and was deceptive.

The moral of the story is that you have to look after yourself. Stop relying on regulators to help you. Speak to your accountant and financial planner, immediately, when a promoter presents you with a quick fix scheme.

The ACCC contends that Dominique Grubisa made three misleading representations in her Gift and Loan-Back scheme:

1. Asserting that if a bank repossesses your home, you lose all your equity because ‘banks don’t give change’.

2. Claiming that the Vestey Trust is ‘bulletproof’, ‘impenetrable’, and that students are not ‘pinned down by creditors’.

3. Suggesting that the Sharrment case endorses the Vestey Trust.

Master Wealth Case finds that the ‘impenetrable’ Vestey Trust was penetrable and superficial

The Federal Court criticised the promotion of the so-called ‘impenetrable’ Vestey Trust for asset protection in the Master Wealth case. People were deceived into paying over $9 million to learn the secrets of this ‘flawless’ scheme. More than 3,000 individuals enrolled in these programmes, each paying up to $10,200 to ‘learn’ how to establish a Vestey Trust.

Promoters use exciting names for their Gift and Loan-Back scheme

While a wonderfully exciting expression, the court noted the misuse of the word “Vestey”. The court clarified the legal misunderstandings embedded in the scheme’s name, despite being shrouded in a complex sequence of measures—the discretionary trust, loan agreements, bare trusts, assignment of income, gift deeds and protective financial instruments—the scheme ultimately failed to provide any real asset protection.

The Vestry Trust was not supported by the Sharrment case

Additionally, the Federal court refuted claims that the Vestey Trust approach was validated by precedent. It clearly stated that old cases such as Sharrment Pty Ltd v Official Trustee in Bankruptcy [1988] FCA 179 did not support the Vestry Trust structure.

How does a Vestry Trust work – or rather not work?

The Vestry Sale Back scheme starts with an assignment of wages, rents and income to a discretionary trust. The discretionary trust is not allowed to borrow – but has a loan-back. The loan-back is an open-ended Promissory Note – a form of non-cash consideration. This is similar to a line of credit or IOU. Rather than receiving the full amount of funds immediately, the high-risk person only receives a portion and pays that back over the period agreed to in the promissory note. The Court held that this did not provide full protection from creditors. The Court held that the claim of full protection was false and misleading.

In our above Sarah example, Sarah somehow found some ready cash to gift to her family trust. Often the high-risk person will not have access to cash and that is why they use promissory notes. As the case states:

The equitable mortgage is supported by the execution of a promissory note [but more usually a Loan Agreement] by the SMSF to the Vestey Trust. This recognises a debt is owed by the SMSF to the Vestey Trust

Justice Jackson explained the Vestey Trust scheme:

The effect of the Transaction Documents may thus be summarised at its most basic level as follows:(a) a discretionary trust would be created and controlled by the client;(b) all future income of the client was intended to be assigned to the trustee and paid into the trustee’s bank account, although as a matter of law that was only valid to the extent of existing debts at the time the Notice of Assignment was given;(c) the client would then withdraw money from time to time from the trustee’s bank account to meet personal expenses of the client, thereby borrowing money from the trustee free of interest and with no obligation of repayment for at least 50 years; and(d) that loan would be secured by the Equitable Mortgage, and would also be the subject of a caveat on the title of any real property and could be the subject of PPSR registration in respect of personal property.

What is an ‘equitable mortgage’ in a Loan and Gift-Back scheme

In the above case, Justice Jackson refers to an ‘Equitable Mortgage‘. Legal Consolidated does not prepare ‘legal’ or ‘equitable’ mortgages. But our law firm is one of the biggest sellers of Loan Agreements in Australia which you can build on our law firm’s website. Our Loan Agreements can be used as a basis for both ‘legal’ and ‘equitable’ mortgages. When you lend money to someone you can secure that money against the borrower’s land. Your property lawyer will generally recommend that you register that loan at the title’s office. This brings notice to the world of both your loan and that it is secured over the borrower’s real estate.

However, if the bank already has a mortgage then you have two options. You can lodge the Loan as a second mortgage (legal mortgage) or via a caveat (equitable mortgage). However, if you lodge the loan as a second mortgage then the title’s office tells the first mortgagor (the bank) what you have done. This upsets the bank. So most property lawyers, from what we see, lodge the mortgage via a caveat, instead. This is not usually communicated to the bank. Unless the bank does a title search – which it rarely ever does – the bank never finds out. Legal Consolidated does not practice in property law. We merely sell the Loan Agreement on our law firm’s website.

Why did the Vestry Sale and Gift Back strategy not work?

Justice Jackson explained:

That structure has an obvious flaw as a structure designed to protect the client’s property from creditors, in that it will only afford protection to the extent of the amount of the secured loan by the trustee to the client. In the early stages of the structure, the amount of the loan will be relatively small. The amount of the loan will be limited by the amount of the existing debts which are assigned to the trustee, and will be limited further by the amount of the withdrawals from the trustee’s bank account to meet personal expenses of the client.For example, a person who earns and spends about $2,000 per week (ie about $100,000 per annum) might have a debt to the trustee at the end of the first week of the life of the structure of about $2,000, and at the end of the first year of about $100,000. However, most members of the relevant class would be likely to have net assets worth more than, say, $2,000 or $100,000.For example, if one takes a person with net assets of $500,000, and income and expenses of $100,000 per annum, the amount of the secured loan from the trustee to the client will not equal or exceed the net assets of the client for 5 years, even if one wrongly assumes that the assignment applies to all future income and even if one makes the unrealistic assumption that the value of the client’s net assets would not change at all over that period. However, the MWC program claimed to provide clients with complete and immediate protection from creditors to the extent of all their net worth.

Well done by the ACCC for exposing the Vestry Trust

The ACCC on 9 April 2024 stated:

Students of the MWC program could completely protect all of their assets from creditors by setting up a specific trust DG Institute called a ‘ Vestey Trust’ using transaction documents provided by DG Institute. In fact, the transaction documents provided did not provide the level of protection from creditors promised.

The ‘Vestey Trust’ system promoted by DG Institute had been tested and upheld as effective by the Full Court of the Federal Court of Australia in the ‘Sharrment’ case, when in fact this was not the case.

Case 2: Sharrment Pty Ltd v Official Trustee in Bankruptcy – a ‘sham trust’ to avoid creditors

The Court in Sharrment Pty Ltd v Official Trustee in Bankruptcy [1988] FCA 179 stated:

The complicated series of transactions were “alter egos” of the late Mr. Wynyard and the elaborate juggling of funds and thicket of book entries were all a cloak, artifice or sham intended to create the appearance of a debt due by Mr. Wynyard to one of his family trusts … The transactions were undertaken for the purpose of putting assets in the amount of some $420,000 out of the reach of Mr. Wynyard’s creditors and hiding those assets behind the cloak or mask of a debt. The companies concerned were said to be Mr. Wynyard’s puppets. Mr. Wynyard could control the trusts by his power as appointor of removing the trustee and appointing another trustee in its place.

Case 3: Re Permewan (No 2) – Gift and Loan-Back fails

The Queensland Supreme Court in the case of Re Permewan (No 2) declared a gift and loan-back arrangement invalid. The arrangement in this case was signed using a promissory note, where an individual promised to pay a related entity by document rather than through an actual money transfer. The promissory note in Re Permewan (No 2) failed to meet the technical standards required by the Bills of Exchange Act. Moreover, the court noted that even if these requirements had been met, the arrangement might still have been voided because it could have been unenforceable due to public policy reasons or considered a sham.

The facts of Re Permewan (No. 2)

In the case of Re Permewan (No 2) [2022] QSC 114, Prudence Permewan, dies leaving a Will naming her son Scott as executor and trustee. She assigned Scott the shares in the corporate trustee of her family trust. The company looks after her family’s discretionary trust. In her Will, she then directs that the rest of her estate go into the family trust.

Before her death, Prudence wanted to disinherit her two daughters. To achieve this, she and Scott implemented a Gift and Loan-Back scheme. This involved:

- Gift: Prudence gifted $3 million to her trust via a promissory note.

- Loan-Back: Her family trust then loaned the same amount back to her and secured this loan with a mortgage on her property.

If successful, these transactions would have depleted Prue’s estate, concentrating her wealth in a trust managed by her son, excluding her daughters. Consequently, the estate became valueless, rendering any challenge by Prue’s daughters to her will futile, as the assets were now elsewhere.

The scheme aimed to shift the residual value of Prudence’s assets to her trust. Therefore, upon her death, there would be nothing in her estate for her daughters. This avoids family provision claims under the Succession Act 1981 (Qld) since a family trust does not form part of an individual’s will.

After Prudence dies her daughters start legal action. They argue that the Gift and Loan-Back scheme was invalid as it interfered with their rights to challenge the estate under family provision laws and was an artificial structure.

Decision of Re Permewan (No 2)

The Court described the arrangement as:

an elaborate web of documents [with] no commercial purpose but were designed only to avoid the existence of a fund from which a family provision application could be made (paragraph 43)

The Supreme Court highlighted three critical aspects in ruling the arrangement unenforceable:

- The court concluded that the arrangement likely constituted a ‘sham’. It found that Prudence had no genuine intention of repaying the $3 million loan to the Trust, and similarly, the Trust had no real intention of enforcing the loan repayment.

- The court deemed the transaction as ‘contrary to public policy’ because it was perceived as an attempt by Prudence to sidestep the family provision proceedings under the Succession Act 1981 (Qld).

- It was determined that the promissory note was never actually handed over from the Trust to Prudence, rendering the transaction technically incomplete. So the son loses both in substance and by this technicality.

Case 4: Atia v Nusbaum – the Gift and Loan-Back works!!

One Gift and Loan-Back scheme was successful, though not to conceal assets from creditors. In Atia v Nusbaum [2011] QSC044:

- When you get involved in a Gift and Loan-Back make sure you control the entity you give the money to. This is why you often pick a Discretionary Trust and you are the Appointor. This allows you to continue to control the debt.

- Sadly, Dr Atia did not follow that useful advice. Instead, he decided to trust his mum as the low-risk entity.

- So, Dr Atia (a high-risk person – being a medical doctor) enters into a Gift and Loan-Back with this mother (low-risk entity).

- Dr Atia now has to stay on his mum’s good side. But Dr Atia fails to do so.

- Humorously for us, not so Dr Atia, his mother calls in the debt. In a quick about-face, Dr Atia now argues that the loan and mortgage were just a sham to avoid his creditors. He cries that he never intended the Gift and Loan-Back to be binding. It was just a pretence to protect him if he was sued as a surgeon. The court said that Dr Atia:

contends the 2003 mortgage was a sham, not supported by any underlying debt. The term “sham” is used to connote the transaction being a cloak, giving the appearance of one transaction when it masks a different transaction. [para 58]

- Even more humorously, again for us, not for the good doctor, the Court finds that all aspects of the legal documents, including the deed of gift, loan agreement and registered mortgage had been validly signed. The court confirmed that the legal effect of the documentation was exactly as the parties intended it to be. Therefore, there was no mistake or sham involved.

- It would have been interesting if Dr Atia had been using (what Dr Atia himself called a sham) the gift and loan-back scheme to avoid his creditors. One can only assume that Dr Atia would, in that instance, NOT have said that the loan and gift-back were a sham.

Before you seek the quick fix of a Gift and Loan-Back scheme talk with your accountant and financial planner.

Case 5: Turner v O’Bryan-Turner

In previous cases, we see a desire to stop the unsecured creditor and someone challenging your Will. In Turner v O’Bryan-Turner [2021] NSWSC 5, the purpose of the Loan and Gift-Back is to stop the farmer’s wife from sharing in the farm if they ever divorce. To do that they move all the equity in the farmland to another vehicle. This is how the full court described the Loan and Gift-Back;

- John signed what are described as two promissory notes in favour of the trustee of those trusts, those notes together totalling around $2.5 million (that being said to be around about 90% of the value of the Trundle Properties at the time). John executed statutory declarations at that time to the effect that all payments by him by promissory notes to the trustee were by way of gift.

- John and Allawah Pastoral then entered into loan agreements whereby Allawah Pastoral in effect lent to John the $2.5 million that John had just “gifted” to Allawah Pastoral under the promissory notes; and those two loans were secured by way of unregistered (and unstamped) mortgages over the Trundle Properties. John then purported to cancel those promissory notes.

With disdain, the Court explains the true reason behind the complex set of documents:

- The consequence of the 2010 Transaction was that, unless disturbed, Allawah Pastoral thus had the benefit of security over the Trundle Properties and would, at some point in time, be able to obtain what was then estimated to be approximately 90% of the value of the Trundle Properties. The purpose of the 2010 Transaction was unashamedly to protect John’s farming assets from a potential claim by his then de facto, Wendy, in the event that she should leave him. The concern apparently expressed at the time by John’s father, Ken, was that the “farm” should continue to be held in the Turner family.

The Full Court states that the transactions are not genuine and that the Loan and Gift-Back are ineffective. Further, the promissory note was flawed and without a valid promissory note to make payment, the loan behind the gift and loan-back failed.

Are Loan and Gift-Back schemes artificial? Compare them to Part IVA.

Loans and Gift-Backs schemes appear artificial and contrived. While being artificial and contrived may not necessarily be fatal, bankruptcy courts, family courts, liquidators, Centrelink, the ATO, and inheritance claims can challenge such arrangements as shams. Loan and Gift-Back schemes share characteristics with the kind of arrangements targeted under Part IVA Income Tax Assessment Act 1936 (ITAA 1936), particularly for their artificial and contrived nature. Here is a comparative analysis:

- Legitimate Reason for the Scheme:

- Part IVA: Was there a credible, commercial reason for adopting the scheme, such as facilitating estate planning or ensuring smooth business succession? If the scheme serves a legitimate business or personal purpose, it may not fall foul of Part IVA.

- Gift and Loan-Back Scheme: Struggles to demonstrate a commercial purpose or economic rationale beyond stopping creditors.

- Dominant Purpose of the Transactions:

- Part IVA: What is the dominant purpose of the, often complex, set of transactions? The ATO looks into whether the primary reason for the scheme was to obtain a tax benefit, rather than achieving a commercial or other outcome.

- Gift and Loan-Back Scheme: Oriented only towards creditor protection and often with a complex and opaque web of secrets, understandings and side deals

- Nature of the Transaction:

- Part IVA: The ATO assesses whether the transaction was a genuine commercial transaction or a string of strange artificially contrived arrangements, that often serve no commercial purpose and do not make any sense. If the transaction is marked by unnecessary complexity with no commercial purpose, it suggests that obtaining a tax benefit could be the dominant purpose.

- Gift and Loan-Back Scheme: The scheme’s complex and contrived nature suggests that it serves no real commercial purpose, focusing primarily on creditor avoidance and lacking a genuine commercial transaction.

- Timing of the Scheme’s Implementation:

- Part IVA: The timing of when the scheme was implemented relative to other financial actions. If the scheme coincides strategically with other financial events to maximise tax advantages, it might suggest a tax avoidance purpose.

- Gift and Loan-Back Scheme: If implemented near potential financial distress or creditor action, it could be perceived as strategically timed to sidestep financial responsibilities, rather than legitimate commercial activity.

Loans and Gift-Backs can be potentially attacked using similar criteria. The dominant purpose of the Loan and Gift-Back is to escape creditors. It looks artificial, is often complex (to muddy the waters), seems to have no other purpose and lacks commerciality.

Part IVA strikes down contrived and artificial schemes that, although legally valid, are designed to do one thing: reduce tax. Although Loans and Gift-Backs are employed for asset protection rather than tax avoidance, their ‘artificial’ nature is similar. For example, the Loan and Gift-Back is designed for one purpose: to shield assets from creditors. They lack any other apparent purpose.

(To learn more about Part IVA, read the works of Adjunct Professor, Dr Lex Fullarton, Australia’s leading expert on the topic. Like most academic articles, his publications are available for free.)

Four-year claw-back under the Bankruptcy Act for the Gift

One risk of the strategy is linked to the claw-back rules in the Bankruptcy Act. If the person who gives the gift goes bankrupt within four years, the gift could be taken back under these rules. Therefore, the success of the Gift and Loan-Back strategy depends on the giver staying solvent for at least four years.

There is no time limit for clawing back a Gift if it is intended to hinder creditors.

Consider a gift made by a high-risk person. Under Section 121 of the Bankruptcy Act 1966 (Cth), such a gift is void if the primary intent is to prevent, hinder, or delay creditors. This section does not impose a time limit on how far back the trustee can challenge a transaction. While it is challenging for the Trustee-in-Bankruptcy to prove that an action taken many years ago was intended to defeat creditors, this task becomes easier if there is a scheme that is complex and contrived. Therefore, if the primary reason for the gift is to execute a complex and unexplainable Gift and Loan-Back strategy, it becomes easier to prove that the gift was intended to defeat creditors.

Now, consider a gift that does not involve the complexity of the Loan-Back, such as when a high-risk individual simply gifts some shares and property. This could be due to reasons like pressure from a nagging spouse or a hostile father-in-law, or for estate or succession planning purposes. It is harder to argue that the transfer took place to avoid creditors. In contrast, a Loan-Back of the identical value of the Gift – on the same day – looks to be an obvious intent to defeat creditors.

The courts have acknowledged that individuals are allowed to engage in prudent asset structuring and estate planning to protect their assets in case they become bankrupt in the future or their children divorce. Such actions are permissible and often recommended. However, problems arise if the Trustee-in-Bankruptcy can prove that the structuring was done with the intent to defeat creditors. The Loan and Gift-Back smacks of obvious intent to defeat creditors.

Does anyone own the Loan and Gift-Back strategy?

Given that promoters cloak their versions of the Loan and Gift-Back in great-sounding names with lots of complex transactions you would have thought that the Patents Office would be brimming with promoters eager to protect their unique and intricate schemes. However, the only Patent application we could find is Applicant by Grant (2004) 62 IPR 143. It was unsuccessful.

Legal Consolidated’s view on the Loan and Gift-Back

The Gift and Loan-Back is designed to reduce the net value of the high-risk person’s assets without affecting their use and enjoyment of those assets. However, while commonly used, the Gift and Loan-Back scheme presents a controversial approach to asset protection, characterised by its legal complexity and the inherent risks associated with its implementation. Although initially appealing for its potential to circumvent financial liabilities and creditor claims, case law suggests that such schemes fail to withstand legal challenges, thereby jeopardising both the assets and the individuals involved.

For asset protection, it is better to engage in transparent and legally sound financial planning. Rather than relying on schemes that may appear to offer immediate protection but are fraught with legal ambiguities, individuals should seek the guidance of qualified professionals such as accountants and financial planners. These experts can provide robust strategies that are compliant with the law and tailored to the unique financial circumstances of each individual. Asset protection is a lifelong pursuit best undertaken with your accountant and financial planner.

Therefore, while the allure of quick-fix asset protection schemes is undeniable, the prudent course involves thorough planning and adherence to legal norms to ensure long-term security and peace of mind.

The victim of a failed Gift and Loan-Back is the high-risk person

My articles are often read by fellow lawyers, my students and academics before they are published. From such feedback, it may appear that I am suggesting that high-risk persons are at fault. That is not my intention, quite the opposite.

High-risk individuals, such as business owners and professionals, have the legitimate right to structure their affairs in a way that minimises the risk of litigation and asset loss in the event of bankruptcy. They are also entitled to arrange their finances to reduce tax liabilities and administrative burdens. Useful structures include Unit Trusts with a company trustee; Family Trust with a company trustee, Self-Managed Superannuation Funds which have the protection of a Special Purpose Company, Bankruptcy Trusts in Wills and the 3-Generation Testamentary Trust Will.

Many promoters of Gift and Loan-Back schemes, much like those spruiking Vestey Trusts, often charge substantial fees. They may even exhibit cult-like behaviour, discouraging clients from consulting with their accountants and financial planners. The real victims are the high-risk individuals and their families, who are saddled with expensive and potentially ineffective asset protection strategies.

Free Asset Protection Kit

Clients should begin their asset protection journey by talking with their accountant, financial planner, and lawyer. These free resources are designed to assist these professionals in guiding their clients:

- Asset Protection Strategies – a complete list and how to use them.

- Family Trusts – how to set up a safe house vehicle (free training video).

- Loans

- Loans to children – in case the child divorces or goes bankrupt.

- Loans to parents – a rich child lends money to parents to get into a retirement home.

- Spouse Loan agreement – ‘safe house spouse’ lends to high-risk spouse (man of straw strategy)

- Forgiving a Debt – for ‘love and affection’.

- Stop your Family Trust owing you money when you die – Unpaid Present Entitlements

- Deed of Gift:

- to a Family Trust – to prove the money you put into your Family Trust was a gift (not a loan)

- to a child – forgive the money your child owes you

- to a person overseas – forgive what the person owes you

- 3-Generation Testamentary Trust Wills

- Stop mistresses and disgruntled children challenging your Will.

- Protect disabled and vulnerable children when you die (free training video).

- Setting up a Bankruptcy Trust in your Will.

- How to put a Divorce Protection Trust in your Will.