Spouse lending money to a spouse

Spouse Loan Agreement

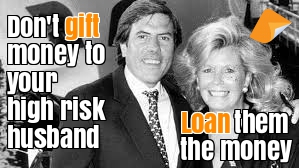

Doctors, Accountants and business owners are at high risk of bankruptcy. They are at risk of being sued and losing everything. In contrast, the stay-at-home parent, teacher or government employee is at low risk. It makes sense to have the family assets in your low-risk spouse’s name. A Legal Consolidated Loan Spouse Agreement works towards that goal. It is another important strategy to protect your family’s wealth.

Husband lends money to Wife – sign the Loan Agreement first

Putting all the family assets into the low-risk spouse is common. This is called the ‘Man of straw and women of substance‘ asset protection strategy. All assets go into your wife’s name. This better protects the family if the husband goes bankrupt.

But what happens if the wife then gifts money to the husband?

Do not gift money to the at-risk partner. That is silly. Instead, the wife lends the husband the money. This is via a legally enforceable Legal Consolidated Loan Agreement between spouses.

What if your husband goes bankrupt? You seek to get back the loan using the Loan Agreement. You at least get some of the money. Also, you can influence, as a creditor, whether your husband goes bankrupt or enters into a compromise.

Do a Spouse Loan Agreement on the back of an envelope?

In the movies, IOUs are often handwritten on a piece of paper. Sometimes instead of a Legal Consolidated Spouse Loan Agreement, someone does a ‘minute’. Both approaches fail. In Rowntree v FCT [2018] FCA 182 shows the additional care required to document even simple related-party transactions, such as loans. In this case, the taxpayer, a practising NSW lawyer, claimed he borrowed over $4m from his group of private companies. The Court said:

‘Mr Rowntree has not deliberately chosen to ignore the law. His evidence presented to the Tribunal suggests that he genuinely believed that there were arguments to support his view that a loan was in existence.

He failed. Only a legally prepared Spouse Loan Agreement satisfies the ATO, Bankruptcy Courts and Family Court.

See a free sample of a Partner Loan Agreement

Press the ‘Start for free‘ button to learn about:

1. Spouse Loan Agreement – ready to sign

2. Legal Consolidated’s letter of advice.

Press the above “Sample” button to see a free sample of the Legal Consolidated Loan Agreement.

Presumption of ‘advancement’ between a husband and wife

Bosanac v FCT

In Bosanac v FCT [2022] HCA 34 the husband and his wife, purchase a property in Dalkeith, Western Australia. This is their matrimonial home.

They pay the deposit for the home with funds from a joint loan. The loan is in both their names. (Joint accounts is poor asset protection, but that is another story.)

However, for asset protection, following the man of straw and woman of substance, the property is solely in the wife’s name.

Following an audit by the ATO, the husband is liable for huge taxation debts. (Luckily they followed asset protection strategies).

The ATO wants to use the WA family home to pay the debt. The ATO argues that the home is owned, at least in part, beneficially by the husband, Mr Bosanac.

But of course, there is an ancient rule called the Presumption of Advancement:

- When dad hands over money to mum or a child it is deemed, on the face of it, to be a ‘gift‘.

- (In contrast, if mum hands over money to dad it is deemed, on the face of it, to be a ‘loan’.)

In what can only be considered sheer arrogance, the ATO contends the 2,000-year-old ‘Presumption’ no longer applies. It is almost ungodly in my view. If the ATO could change the law, which it can not do, then it could be argued that Mr Bosanac intended to retain a 50% beneficial interest in the property.

The ATO argued that the ‘presumption of advancement’ of a wife by her husband, which operates to preclude a resulting trust from arising, has no acceptable rationale and is anomalous, anachronistic and discriminatory.

The ATO asks the High Court to state that the Presumption is no longer part of the law of Australia. At least for the matrimonial home. The High Court, however, refused to do so. Therefore, the husband’s appeal did not depend on the presumption of advancement.

Kiefel CJ and Gleeson J (in a joint judgment) and Gageler J commented that any changes in this area of the law should be left to the legislature. Gordon and Edelman JJ (in a joint judgment) commented that “there may well be scope in the future to extend the ‘presumption’ of advancement to a broader range of relationships”.

To avoid confusion:

- build this Spouse to Spouse Loan Agreement

- build a Loan Agreement from a Parent to a Child

- build a Loan Agreement from a Child to their mum and dad

- expressly make a gift with a Deed of Gift

- or if it is all too late expressly forgive the debt by building a Deed of Debt Forgiveness

Presumption of ‘resulting trust’

Bosanac v FCT

As can be seen above, the High Court unanimously allowed Mr Bosanac’s appeal. It finds that the proper inference drawn from the facts is that:

- the husband and wife objectively intended the wife to be the sole beneficial owner of the home.

- the husband merely facilitating her acquisition of the home.

Three useful quotes from Bosanac v FCT:

“Not only was it acquired in her name and registered in her name, but it was her property”.

The husband is a “sophisticated businessman” who “must be taken to have appreciated that the name in which real property is held is of significant consequence in almost all situations.”

“There was no suggestion that Mrs Bosanac contracted to purchase and did purchase the Dalkeith property in her name to assist her husband to avoid creditors.”

Therefore, to the fury of the ATO, Mr Bosanac does not have a beneficial interest in the home.

But is there a ‘resulting trust’ in Bosanac v FCT

There is yet another ‘presumption’. It is the presumption of resulting trust.

This is where the person:

- who advances purchase monies for an asset

- which is held in the name of another person

- intends to have a beneficial interest in the asset

The law only ‘presumes’ this. The facts can override a ‘presumption’.

A common ‘exception’ is where the person is a husband and purchases the asset in the name of a wife, or a parent (or person who stands in loco parentis) in the name of a child.

This is the above presumption of ‘advancement’. “A presumption that the purchaser intended that the beneficial interest would pass with the legal interest”.

It is held also not to be the case.

Free Asset Protection Kit for clients of lawyers, financial planners and accountants

Clients often start their asset protection journey by speaking with their accountant, financial planner or lawyer. Legal Consolidated has put this kit together to help these professionals on what needs to be done. Enjoy the free resources:- Asset Protection Strategies – a complete list and how to use them.

- Family Trusts – how to set up a safe house vehicle (free training video).

- Loans to children – in case the child divorces or goes bankrupt.

- Loans to parents – a rich child lends money to parents to get into a retirement home.

- Spouse Loan agreement – ‘safe house spouse’ lends to high-risk spouse (man of straw strategy)

- Forgiving a Debt – for ‘love and affection’.

- Deed of Gift:

- to a Family Trust – to prove the money you put into your Family Trust was a gift (not a loan)

- to a child – forgive the money your child owes you

- to a person overseas – forgive what the person owes you

- Stop mistresses and disgruntled children challenging your Will.

- Stop people stealing money from your disabled and vulnerable children when you die (free training video).

- How to set up a Bankruptcy Trust in your Will.

- The value of a Divorce Protection Trust in your Will.

Do Legal Consolidated Loan Agreements work after I die?

A distinct advantage of a Legal Consolidated Loan Deed is that it works after death. This is if any of the parties die.

This is important. You do not want to be making new Loan Agreements for ‘old’ loans. This is called ‘past consideration’ and weakens the enforceability of the loan.

For example ‘I lent my spouse some money yesterday, I now want to document this with a written Loan Agreement’. You can do that. But you should have got the Borrower to sign the Loan Agreement first. And only then lend the money. Could you imagine a bank lending you the money? And then documenting the loan at a later date?

‘Past consideration’ weakens the Loan Agreement. Sure, it is better than nothing. But you should get the Loan Agreement fully signed by all the parties. Only then do the transfer of funds.

Similarly, if a party to a Loan Agreement dies, then under a Legal Consolidated Loan Agreement the ‘executors’ or ‘legal personal representative’ carry out the performance of the Loan agreement. You do not prepare a new Loan Agreement. You should not prepare a new Loan Agreement. To do so damages the loan.

Husband, the Borrower, dies – do I need a new Spouse Loan Agreement?

For example, you lend money to your husband. A few years later he dies. The executor under his Will now has to pay you back the money. You, as the wife/Lender, enforce the Legal Consolidated Loan deed against the estate. (Yes, I know you are probably the executor of his estate. That is fine.)

You should not do a new Loan Agreement. If you do, then the money you lent under the original Loan Agreement may end up as ‘past consideration’.

Who are the parties to a spouse loan agreement

The Lender (Husband) is the entity that is passing the capital (e.g. money) to the Borrower (Wife).

In this Spouse Loan Agreement, the person who is the Lender is lending the money and the person who is the Borrower is the person borrowing the money.

How do I build the Spouse Loan Agreement?

- For free, start building and learning about the Spouse Loan Agreement

- Read the free hints on every page

- Check your answers on the Summary page

- Telephone the law firm with any questions

- Lock and Build your Spouse Loan Agreement

- Type in your Credit Card details

- The Spouse Loan Agreement, our cover letter and Tax Invoice are emailed to you within 60 seconds

- Print and sign the Spouse Loan Agreement

- The next day you can transfer the money

Legally documenting the movement of money from husband to wife to protect from bankruptcy

Establishing a Spouse Loan Agreement not only underscores the seriousness of the transaction but also provides a legal safety net that protects the family’s assets. This is especially true in situations where one spouse may be at higher risk of financial instability due to their professional environment.

The cases of Rowntree and Bosanac underscore the critical need for precise, legally verified documentation in familial financial dealings. These cases highlight how informal or poorly documented transactions can lead to severe legal repercussions and tax complications, emphasising the importance of a meticulously structured Legal Consolidated Spouse Loan agreement.

Utilising a Legal Consolidated Loan Agreement helps safeguard your family’s wealth by ensuring that assets remain in the hands of the spouse less likely to face bankruptcy or litigation risks. The Loan Agreement is a clear declaration that the money transferred is a loan, not a gift, which can be crucial in preventing misunderstandings and potential legal disputes in the event of bankruptcy.

Moreover, in the evolving legal landscape, where the presumption of advancement and resulting trusts are being scrutinised, having a solid, clearly defined loan agreement becomes even more pivotal. Such legal instruments clarify the intentions behind the transfer of funds or assets, helping to rebut presumptions that might otherwise lead to unintended legal outcomes.

Ultimately, a Spouse Loan Agreement is not just a document but a strategic tool for managing family finances and protecting assets against unforeseen legal challenges. It ensures that both parties in a marriage can navigate the financial aspects of their partnership with transparency and mutual respect, thus preserving not only their financial security but also their relationship.

Business Structures that need proper documentation

Family trust

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?