SMSF Custodian Bare Trust Deed

How your Self-Managed Super Fund borrows money

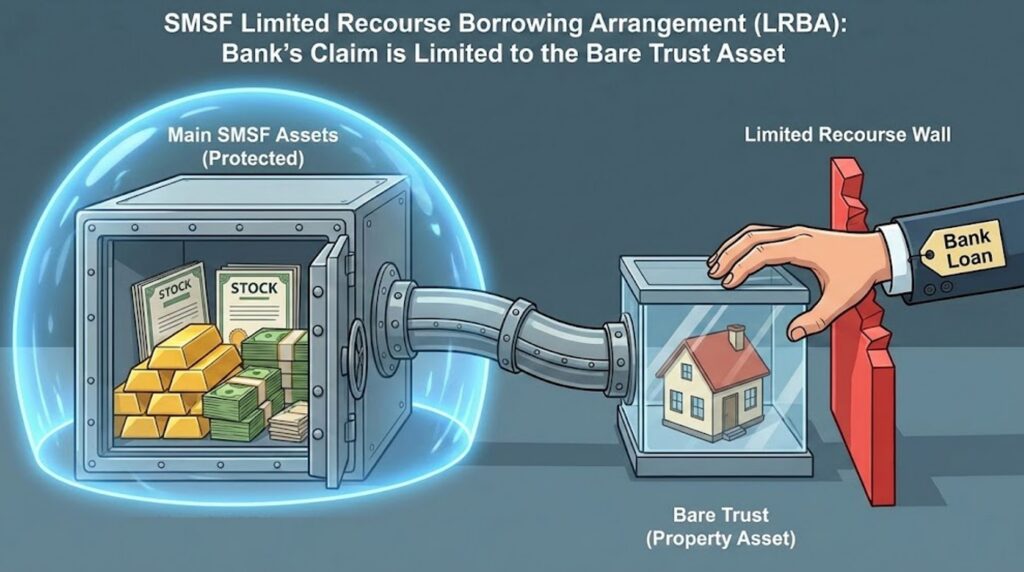

Does your SMSF want to borrow money to buy an asset? You cannot expose your Self-Managed Super Fund, which has many other assets, to this debt. Instead, your SMSF needs to borrow on a limited recourse basis. Therefore, if your SMSF cannot pay the debt or the asset becomes worthless, the SMSF can walk away free of the debt. There is no recourse against the SMSF or its assets by the banker.

This structure is also known as an SMSF Property Trust, Holding Trust, or Bare Trust Deed.

How to gear your SMSF: the 5 Golden Rules

Step 1: Does your SMSF Deed allow borrowing?

Before you look at real estate or the shares you want to buy, check your SMSF Deed. Does it explicitly allow borrowing? Many modern SMSF deeds ban gearing. If your SMSF Deed is silent or outdated, update it.

Step 2: Pre-Approval: finding the money to gear your new SMSF asset

Unless you are self-funding, speak with your financial planner and accountant. You need to know exactly how much your SMSF can borrow.

Speak to your conveyancing lawyer about the timing of when you sign the Bare Trust Deed and Offer to Purchase. Getting it wrong for your home state triggers double stamp duty.

Step 3: Build the “Puppet” Structures (SMSF Bare Custody Trust)

You build two entities on Legal Consolidated’s website:

1. The Corporate Trustee: Build a separate new company to act as the trustee of the SMSF Bare Trust.

2. The SMSF Bare Trust Deed: Press the above Start Building for Free.

Step 4: Contract of Sale to buy the geared SMSF asset

Get your conveyancing lawyer to review your offer to purchase. The SMSF is not the purchaser. The trustee of the bare trust is the purchaser. Each state requires its own special wording. Do not listen to what the bank tells you; speak to your own conveyancing lawyer.

E.g. Mechani Street Pty Ltd ACN 838383838

Step 5: Settlement and Registration of the geared SMSF asset

The loan is drawn down, the property or shares settle, and the title is registered in the name of the Bare Trustee. Your SMSF now “beneficially” owns the asset and collects the rent or dividends. Your SMSF declares the income and expenses (not the geared bare trust).

What is an SMSF Custodian Bare Trust (LRBA)?

To borrow money, the Superannuation Industry (Supervision) Act 1993 (SISA) requires a special bare trust structure. This is called a Limited Recourse Borrowing Arrangement (LRBA).

To enable borrowing, your SMSF borrows and holds the asset within a special type of bare trust. The Legal Consolidated SMSF Custodian Bare Trust Deed complies with ATO requirements, SISA legislation, and lender requirements, such as banks.

The Trustee of the SMSF holds the fund’s main assets, which the bank cannot touch.

Meanwhile, the Custodian Trustee of the Bare Trust holds the geared asset. If the SMSF defaults on the loan, the bank’s only recourse is to take the geared asset – and nothing more.

How do you make the SMSF Bare Trust Bank-Ready?

Lenders are defensive. They look for reasons to reject loan applications. If your Custodian Deed gives the Trustee too much power, the Bank’s legal team rejects it.

Standard bare-trust deeds fail because they are “active” trusts.

Our SMSF Custodian Bare Trust Deed creates a ‘Puppet Trust’ structure. The trustee has zero independent discretion—it must follow the SMSF’s directions. This is exactly what banks require.

This “Puppet” status is required by Lenders (such as La Trobe, BOQ, and Liberty).

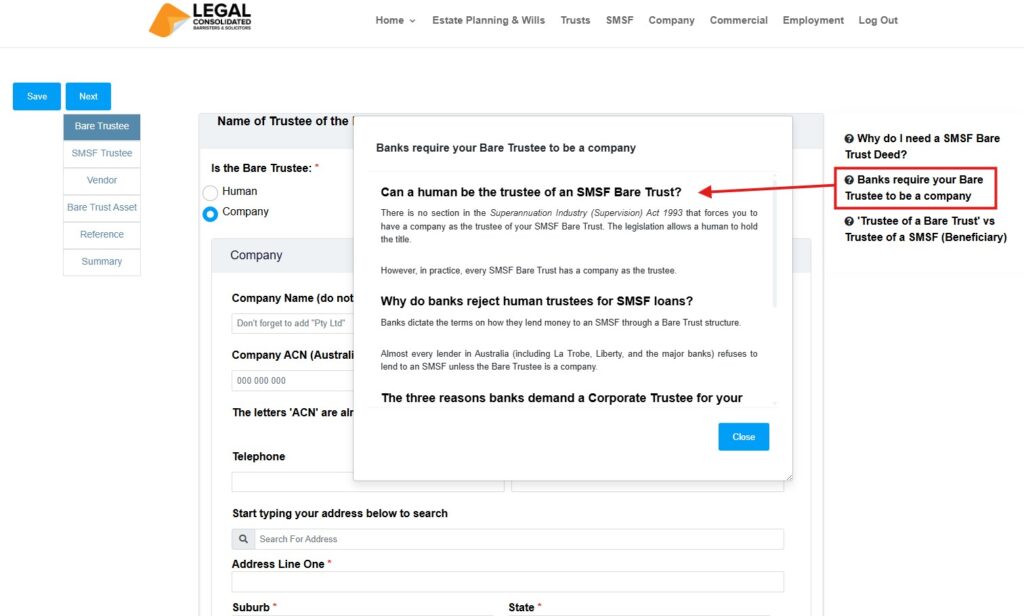

Can a human be the trustee of an SMSF Bare Trust?

There is no section in the Superannuation Industry (Supervision) Act 1993 that forces you to have a company as the trustee of your SMSF Bare Trust. The legislation allows either a human or a company to hold the title.

However, in practice, every SMSF Bare Trust has a company as the trustee.

Why do banks reject human trustees for SMSF loans?

Banks dictate the terms on how they lend money to an SMSF through a Bare Trust structure.

Every lender in Australia (including La Trobe, Liberty, and the major banks) that Legal Consolidated has dealt with refuses to lend to an SMSF unless the Bare Trustee is a company.

The three reasons banks demand a Corporate Trustee for your Bare Trust

Why do Banks demand that a company be the trustee of your bare trust deed?

-

Humans die: If a human trustee dies, the property title must be transferred to a new human. This is expensive. It is messy. Banks hate mess.

-

Companies endure: A company does not die. Directors change, but the legal entity holding the title remains the same. This helps protect the Bank’s security.

-

Asset Protection: To protect the members in their personal capacity, a company as trustee creates a clean “firewall” between the asset and the individual. Often, when trust goes bankrupt, the trustee goes down with the sinking ship.

Do I need a Corporate Trustee for my SMSF Bare Trust?

Yes. While the law does not demand it, the banks do. Without a Corporate Trustee, you cannot get the loan. You must comply with the lender’s requirements to obtain a loan.

Can I amend my Self-Managed Superannuation Fund Bare Trust Deed for free?

Circumstances often change. You may decide to purchase a different property. You may find that the trustee of the Bare Trust needs to be a different company.

If you need to update your SMSF Bare Trust Deed, then email us. We will prepare and email you a voucher. This allows you to update your Bare Trust deed for free. You can update the Bare Trust as many times as needed.

But it may be too late to update the Self-Managed Superannuation Fund Bare Trust

However, you must be careful. Once you sign the Contract of Sale to purchase the asset, it is generally too late to update the Bare Trust Deed.

This is because the name on the Bare Trust Deed must generally match the purchaser on the Contract of Sale. This is to avoid paying stamp duty twice.

Therefore, you must have your accountant and conveyancing lawyer check the Bare Trust Deed before you sign the Contract of Sale.

Do I get a full refund if the Self-Managed Superannuation Fund borrowing does not proceed?

If, for any reason, you do not proceed with the transaction, then let us know. We issue a full refund to your credit card.

As with all our documents, if you do not need the document, then we issue a refund. (The only exception is when you build a company.)

Standard bare trust deeds often allow the Trustee (the trustee of the bare trust) to be indemnified against any assets held by the Beneficiary (the SMSF). This is dangerous for an SMSF.

If a loan goes bad, the Bank seeks to recover from the Custodian Trustee. If the Custodian has a standard indemnity, it seizes your SMSF’s other assets (such as your share portfolio and cash).

Legal Consolidated protects you. We hard-wire a “Limited Recourse Indemnity” into the Deed.

-

The Custodian Trustee can only claim against the single asset in the Bare Trust.

-

Your SMSF’s other assets remain safe and untouchable.

-

This ensures you remain compliant with SISA Section 67A.

The “Single Acquirable Asset” Protection in the Custodian Trust Deed

The legislation strictly prohibits a Limited Recourse Borrowing Arrangement (LRBA) from holding more than one asset. If a deed allows for “multiple assets,” the borrowing arrangement is void. The ATO may force you to sell the property.

Our Deed is drafted to hold a Single Acquirable Asset.

-

It “locks down” the bare trust structure.

-

It prevents accidental breaches of the Superannuation Industry (Supervision) Act.

-

It ensures the arrangement remains a valid “Bare Trust” for tax purposes.

Avoiding the “Development” Trap when gearing a SMSF

Property development in an SMSF is a minefield. It often breaches the “Sole Purpose Test” and “Replacement Asset” rules.

Our Bare Custodian Deed is engineered explicitly for passive investment. By restricting the Trustee to holding the asset, we protect the SMSF from being deemed a “business.” This helps ensure your fund remains compliant and continues to enjoy the concessional 15% tax rate.

Residential vs Commercial Property SMSF Custody Trust Deeds

Legal Consolidated’s Bare Trust Deed is fully compliant for both residential homes and commercial premises (such as offices, factories, or warehouses), provided the ‘Single Acquirable Asset’ rule is met. If you want to gear a second property, build a separate SMSF Bare Trust.

How to escape double stamp duty on an SMSF Bare Trust Deed

Timing of the Custodian Bare Trust is everything to avoid double stamp duty:

-

NSW, ACT, TAS: Sign the Contract of Sale FIRST, then the Bare Trust Deed.

-

QLD, WA, NT: Sign the Bare Trust Deed FIRST, then the Contract of Sale.

-

VIC: Sign the Contract of Sale first (but potentially can be done simultaneously).

The above is general information only. Your conveyancing lawyer will give you legal advice on how to write up the offer to purchase and when to sign it. Legal Consolidated does not provide that advice.

The Risk: ATO Audits on “Active” SMSF Custody Trusts

We are seeing increased ATO scrutiny of “off-the-shelf” Bare Trust deeds available on non-law firm websites.

The problem lies with what the ATO calls “active” bare trusts. The ATO is concerned that many Custodian Trustees are granted too much power. Under Section 67A of the Superannuation Industry (Supervision) Act (SISA), the Custodian’s role must be “passive”.

From what we are seeing, if the Custodian has duties beyond simply “holding” the title, such as:

- a discretion;

- a requirement to preserve;

- the power to manage property; or

- allowing bank accounts;

then the gearing rules are breached.

If an SMSF Bare Trust Deed is faulty:

- The borrowing arrangement is non-compliant.

- You risk paying double Stamp Duty—either immediately or when you eventually transfer the asset from the Bare Trust to the SMSF.

- The property or share must be immediately sold

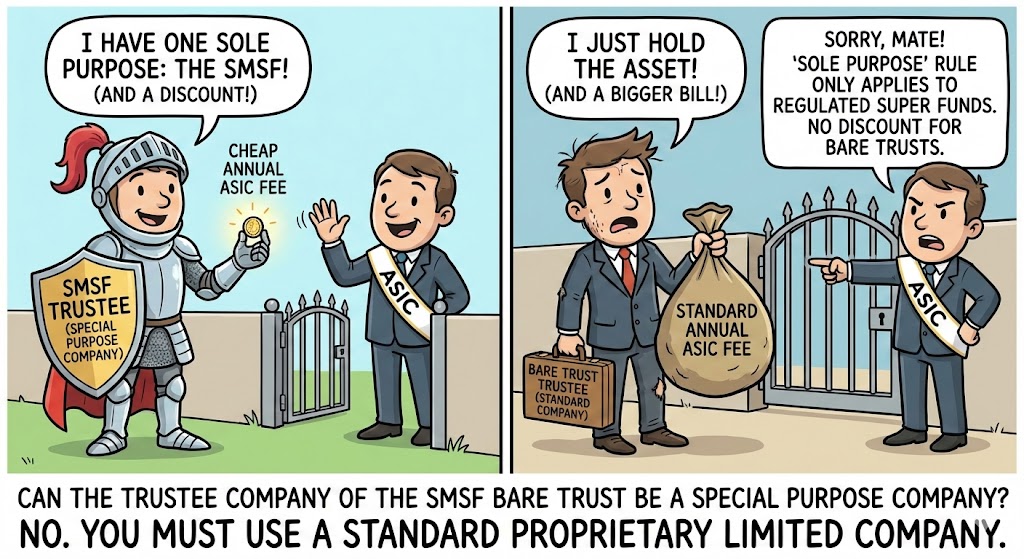

Can the trustee company of the SMSF Bare Trust be a Special Purpose Company?

No. You must use a standard proprietary limited company. You cannot use a Special Purpose Company.

To qualify as a “Special Purpose Company” (and access the reduced annual ASIC fee), a company must meet a strict legal definition. The Special Purpose Company’s sole purpose must be to act as the trustee of a regulated superannuation fund. (And hold no other jobs.)

An SMSF Bare Trust is not a regulated superannuation fund. It is a separate trust. It exists solely to hold a specific asset for the Self-Managed Superannuation Fund. Therefore, the trustee of a Bare Trust fails the “sole purpose” test. It does not qualify as a Special Purpose Company and thus does not receive the benefit of the reduced annual ASIC fee.

How to draft a contract to purchase a geared property for your Self-Managed Superannuation Fund

The purchaser is the trustee of the Bare Trust. The purchaser is not the trustee of the Self-Managed Superannuation Fund.

How the purchaser appears on the contract of purchase is critical. If you get it wrong, you pay double stamp duty (transfer duty). You may also breach the Superannuation Industry (Supervision) Regulations.

Who is the purchaser on the Contract of Sale?

Often, banks and State Revenue Offices prefer the purchaser to be described simply as the corporate trustee of the Bare Trust. They generally do not want to see the words “as trustee for…” on the Contract of Sale.

Example:

-

Often correct: Jenolan Caves Pty Ltd ACN 123 456 789

-

Usually incorrect: Jenolan Caves Pty Ltd as trustee for the Smith Bare Trust

However, this is not a universal rule. It varies depending on:

-

Your State: For example, Western Australia and the Northern Territory often require the trust to be mentioned on the Contract of Sale.

-

Timing: In New South Wales, signing the Bare Trust Deed before the Contract of Sale triggers double stamp duty. In Queensland, the opposite is true.

-

Your Lender: Lenders have their own specific requirements on how the purchaser appears on the offer to purchase and the loan agreement.

Do not rely on the Bank for legal advice regarding the Contract of Sale

You must seek advice from your own conveyancing lawyer. Do not merely sign what the bank puts in front of you. The bank is not your friend. The bank looks after itself. You must look after yourself.

Legal Consolidated only provides you with a Superannuation Industry (Supervision) Act-compliant Bare Trust Deed. We do not provide legal advice on drafting the offer to purchase the asset. We do not provide advice on the loan.

You need to instruct your accountant and conveyancing lawyer on these matters.

Checklist to see if your SMSF Property Trust is ATO compliant

If you have an existing Bare Trust or are about to build one, contact the provider or law firm that prepared it to confirm the following three points:

1. Is it a “Puppet” Trust? The Custodian Trustee must be stripped of all discretion. It must act only on the SMSF Trustee’s direction. If the Deed allows the Custodian to make decisions, open bank accounts, or manage the property independently, this ambiguity breaches SIS Regulations.

2. Does it strictly prohibit “Improvements”? The legislation allows repairs but bans improvements when borrowed money is used. A compliant Bare Trust Deed should expressly restrict the Trustee from carrying out improvements that create a “Replacement Asset”. (You can usually improve the asset using the SMSF’s own cash, but the Bare Trust Deed must forbid using the loan money for this.)

3. Was the signing order correct for your State? Has the conveyancing lawyer signed off and given legal advice on whether to sign the Bare Trust Deed or the Contract of Sale first?

-

Example: In NSW, signing the Deed before the Contract can trigger double duty. In QLD, the reverse is often true.

Legal Consolidated does not provide any legal advice.

Can an SMSF borrow money for repairs with an SMSF Property Trust?

Yes. Our Deed expressly empowers the Trustee to use borrowed funds for repairs (restoring the asset to its original condition).

However, we draft the Deed to protect you from the “Improvement” trap. You cannot use borrowed money to improve an asset (e.g., by adding a new bedroom). This creates a “Replacement Asset” which breaches the borrowing rules. Our Bare Trust ensures your borrowing remains compliant with SMSFR 2012/1.

Can I improve or renovate the SMSF geared property?

Generally, no. Under the “Single Acquirable Asset” rule, you can repair a broken window, but you cannot build a new room or a granny flat using borrowed money. Doing so breaches the Limited Recourse Borrowing Arrangement (LRBA) and forces the immediate sale of the property.

Can I buy a residential property by myself or with my spouse?”

No. Section 66 of the SISA prohibits acquiring assets from related parties. You generally cannot sell your own house to your SMSF. However, you can usually transfer Business Real Property (commercial property) from yourself to your SMSF at market value.

Why use a Legal Consolidated SMSF Holding Trust?

You are building a wealth vehicle for retirement. We are a law firm specialising in superannuation.

-

Lawyer-Drafted: Prepared by specialist superannuation lawyers.

-

We are a law firm: We are not a website that uses a law firm’s template: We are the law firm. We are responsible for our documents.

-

Audit-Ready: Our documents are drafted to meet the requirements of your SMSF Auditors and the ATO’s best-practice guides.

Start building your SMSF Custodian Bare Trust Deed now. Telephone us for free legal advice, but start the free building process first, as it answers most questions. The free building process is highly educational.

The Exit Strategy: Unwinding the Bare Trust and transferring the SMSF geared asset

Once your SMSF pays off the loan, the “Limited Recourse” requirement ends. You no longer need the SMSF Custody Bare Trust structure.

At this point, talk with your accountant and financial planner about these two choices:

1. Keep the structure: You can leave the title in the name of the Custodian/Bare Trustee. The SMSF continues to receive rent and pay expenses beneficially.

2. Transfer title: You can transfer the legal title from the Custodian Company to the SMSF Trustee.

Does transferring the title from a Legal Consolidated Bare Geared Trust trigger Stamp Duty?

Generally, no. Because you paid the full stamp duty when the Bare Trust originally acquired the property (and the deed was correctly stamped at that time), the transfer to the SMSF is usually subject to only nominal stamp duty (e.g., $50–$200, depending on the State).

Our cover letter outlines instructions for handling the eventual transfer to the SMSF once the SMSF has paid off the mortgage or loan.

What is the legal name of a Custodian Bare Trust?

There is no definitive expression or name for a Custodian Bare Trust under the SIS Regulations.

While not defined in the SIS Act, a bare trust has the following (see Herdegen v FCT [1988] FCA 419):

- the trustee holds property without any interest, other than that existing by reason of the office and the legal title as trustee; and

- the trustee has no discretion and no active duties, other than to convey the trust property on demand to the beneficiary or beneficiaries or as directed by them.

Other names for an SMSF Property Trust

An SMSF Custodian Bare Trust is also commonly known by other names, such as:

-

SMSF Bare Trust Deed

-

SMSF Custodian Trust

-

SMSF Property Trust

-

Limited Recourse Borrowing Arrangement (LRBA) Trust

-

Holding Trust

-

Custodian Deed

-

Bare Trust Declaration

-

Debt Instalment Trust

-

Instalment Warrant Trust

-

SMSF Security Trust

Should the Custodian Bare Trust have a name or title?

We do not give your SMSF Bare Trust a name. It is not a pet. It is not a child. It is a legal device.

Family Trusts, Unit Trusts and Self Managed Superannuation Funds have a name, but an SMSF Bare Trust is different. Family, Unit and SMSF Trusts are active business vehicles. They can operate, trade and invest. Each one can:

- get its own Tax File Number (TFN).

- get its own Australian Business Number (ABN).

- file its own trust return with the ATO.

- have a bank account.

An SMSF Bare Trust cannot have any of these.

In contrast to a Family, Unit and SMSF trusts, an SMSF Bare Trust is not a “trust” in the ordinary sense. It is a statutory holding mechanism. It is passive, temporary, and asset-specific. Naming it implies substance, discretion, or continuity that does not exist.

Therefore, you give a Family Trust a name (e.g., The Smith Family Trust). The name helps the ATO and the Bank identify the trading entity. A Bare Trust is the opposite. A Bare Trust must be a “puppet”. It must be passive. It does not trade. It does not file a tax return. It does not have an ABN. It has no income or expenses.

Giving a Bare Trust a name implies it has a life of its own. It implies it is an “active” trust. If you give the Bare Trust a name, the ATO may argue it is an active trust. This breaches the Superannuation Industry (Supervision) Act 1993.

Also, a Bare Trust can only hold one asset. When you sell that asset, the Bare Trust dies (vests). You cannot use it again. A specific name suggests longevity. A Bare Trust has no longevity. It exists only for the single asset.

Refer to the bare trust descriptively only, for example:

“the bare trust constituted by the deed dated [date]”

Never give it a proper noun.

Can I do the opposite: can my SMSF lend money?

So instead of borrowing money, your SMSF wants to lend it out. For example, an SMSF holds some cash and wants to earn a return by lending it to a borrower. You can do that here.

Authors: Adjunct Professor Dr Brett Davies and Hamada Elkotb.

Hamada Elkotb is a Legal Consolidated intern and undertook the IOLT PLT course. He provided significant research and analysis for this article, drawing on his dual qualifications in Egyptian Civil Law (LLB, Tanta University) and Australian Common Law (LLB, Edith Cowan University).

Self-Managed Super Fund, Deeds, PDS and Minutes – build on a law firm’s website

| Build these SMSF documents on our law firm’s website: | |

|---|---|

| SMSF Deed – built over 18,000 times | |

| Special Purpose Company – to be the trustee of SMSF | |

| Convert the old Company into a Special Purpose Company – to be the trustee of SMSF | |

| Investment Strategy – ATO audit-friendly | |

| Vest and Wind up SMSF – wind up, end and close down old SMSFs – get rid of your SMSF | |

| SMSF Loan to Third Party | |

| Commercial lease for SMSF – where the SMSF owns the commercial property | |

| Reversionary Pension Kit – keep your dead spouse’s super in the Super Fund | |

| Power of Attorney for SMSF Corporate Trustee – if the director dies or has dementia, compliant with Fund Manager release forms | |

| SMSF Training Course – includes the SMSF Deed | |

| SMSF asset owner rectification deed – purchased the SMSF asset in the wrong name |

|

| SMSF Custodian Bare Trust Deed – SMSF borrows through a bare trust |

| Update your SMSF Deed for: | |

|---|---|

| 1. Everything – Update Trustee, Upgrade Deed, Binding Nomination and PDS (Recommended) | |

| 2. Trustee only | |

| 3. Upgrade Deed only | |

| 4. Binding Nomination only – updates SMSF Deed as well | |

| 5. Product Disclosure Statement only – fully compliant with the Commonsealth budget | |

| Other SMSF updates | |

| Change SMSF name – no CGT or stamp duty issues |