Self Managed Super Fund deed – fully updated for the Budget

Our Self Managed Super Fund deed complies with the 19 main changes to SMSF Deeds. This is under the Budget:

- Binding death benefit nominations (BDBNs) given the High Court’s landmark decision in Hill v Zuda [2022] HCA 21

- Contributions given the removal of the ‘Work Test’ for those between 67 and 75 years old from 1 July 2022

- Corporate collective investment vehicles (CCIVs), cryptocurrency, non-fungible tokens (NFTs) and blockchain technology, given the expanding investment markets available to SMSFs.

- Internally ‘rollback’ pensions to accumulation for up to 6 members

- Segregate assets between accumulation and pension phases

- Reject contributions

- Refund contributions;

- Deal with excess transfer balance tax and excess non-concessional contributions

- Allow income streams and Account-Based Pension (grandfathered)

- Specify guardians for incapacity and death

- Identify the Power of Attorney when living overseas for more than 2 years

- Resettle pensions with flexible timing without mingling with an accumulation account

- Allow reversionary beneficiary nominations

- Provide for CGT relief

- Deal with segregated and unsegregated assets

- Cease or keep the Transition to Retirement Income Streams

- Calculate member balances, across different funds

- Calculate internal pension rollbacks to accumulation

- Allows for an unlimited number of members (currently the law allows 6 members)

SMSF Deed updated for the Budget

These are all required to give maximum flexibility to your accountant and adviser.

What is a Self-Managed Super Fund deed?

A Self Managed Super Fund Deed holds your retirement money. This is called superannuation. The SMSF gives you greater control.

The Australian government provides generous tax concessions for operating a ‘compliant’ self-managed superannuation fund. You comply if:

- your fund has a maximum of 6 members. You can have 1, 2, 3, 4, 5 and 6 members.

- each member is a trustee. Each trustee is a member.

- Instead of having all the members, as trustees, you can have a company. This is called an SMSF corporate trustee. Each member must be a director of the company. And only members are directors.

- You can not have someone you employ as a member with you. This is unless they are related to you.

- The trustee is a volunteer. You can’t take fees for performing the job of trustee.

- All members and trustees should be Australian residents, otherwise, you face complexity.

Is a Self-Managed Superannuation Fund a ‘trust’

An SMSF fund is a ‘trust’. The ‘trustee’ of the super fund holds the ‘member’s balance’ on trust. This is on trust for the ‘member’. Because the super fund is a trust, it’s governed by the rules of equity. So as well as the Superannuation laws the SMSF and the SMSF Deed must also abide by the laws of trusts and equity.

Can an SMSF only have one member?

Yes, an SMSF can have 1 to 6 members.

- The members must also be the trustees; or

- the members appoint an SMSF Corporate Trustee company to be the SMSF trustees. In this case, all the members (and only those members) are the directors of that special-purpose company.

The trustee or trustees run the SMSF. This is for the benefit of the members. The trustee is one company or humans.

But if you only have one member of your SMSF then:

- the member must find another person to be a co-trustee. So the Trustee of the SMSF is the member and this second person; or

- the sole member builds an SMSF Corporate Trustee Company. And the member is the only director of that company

Most people opt for number 2. A Corporate Trustee Company is also most common for all SMSFs. This is whether you have 1 or more members.

Therefore, in a single-member SMSF, the member must either be the sole director or have two directors. The other director is either:

- related to the member; or

- not an employer of the member.

If you do not opt for an SMSF Trustee company, then for a single-member SMSF, there are two individual trustees. The other human trustee is either related to the member or, if not related, has no employment relationship with the member.

Self-Managed Superannuation Fund Guide

Written by Barbara Smith AM, Dr Brett Davies, Dr Ed Koken I am honoured to have joined forces with well-known and award-winning authors Barbara Smith AM and Dr Ed Koken to produce the fully revised book: Self Managed Superannuation Fund Guide.

This practical, plain English guide is a valuable tool for everyone involved in SMSFs. This includes trustees, members, lawyers, accountants and advisers. It is tax deductible when the book is used for looking after your SMSF.

You can purchase your own copy directly from the publisher and get it updated continually online here.

ORDER TODAY, it helps you complete your individual and SMSF tax returns.

Why is it important to read the book: SMSF Guide?

The Australian book Self Managed Superannuation Fund Guide is important for individuals who are interested in managing their superannuation funds. It is important to digest the advice in this book:

Understanding the rules and regulations:

Self-managed superannuation funds are subject to specific laws and regulations in Australia. The book provides detailed information on these rules. These include contributions, investments, taxation, compliance, and reporting requirements. Understanding these regulations is crucial to ensure compliance and avoid penalties.

Why must a single-member SMSF require two human trustees or an SMSF Company Trustee?

The Superannuation laws require for a single member fund that you have two human Trustees. (Or you can have a Corporate Trustee for an SMSF.)

It is silly and wrong to argue that the requirement for a second human trustee is because of trust law. A trust requires that the trustee and the beneficiary be different. A trust cannot exist when the trustee and the member are the same person. That is a correct statement of trust law. But the SMSF holds the assets for not just the member but for other purposes such as dependants when the member dies.

Rather, there is a better reason as to why the government forces you to have a second human trustee in a single-member SMSF fund. When the member dies there is still a trustee that continues to look after and administer the SMSF. This also works if the member loses mental capacity or leaves Australia.

Want to learn about ‘trusts? Start your journey by watching this free training course and reading this article.

Complies with new TRIS rules

The treatment of transition to retirement income streams and limited recourse borrowing arrangements.

TRIS is no longer able to benefit from the exempt current pension income status. This is on the earnings supporting a TRIS.

If a pension started as a TRIS, the ECPI exemption never applies. This is even where the pensioner subsequently satisfied a condition of release with no cashing restrictions.

Our Self Managed Super Fund deed fully complies with the new rules.

Self-Managed Super Fund complies with the latest Auditing Standards

Self-Managed Super Funds are audited every financial year. The auditor relies on the Auditing and Assurance Standards Board’s (AUASB) Standards.

The new Standard identifies, clarifies and summarises the existing responsibilities that approved self-managed superannuation fund (SMSF) auditors use when conducting SMSF audit engagements. It also provides guidance to the auditor on matters that the auditor considers when planning, conducting and reporting on the financial and compliance engagement of an SMSF audit.

The appendices to GS 009 include an example engagement and representation letter, illustrative trust deed checklists and financial audit procedures, and illustrative examples of threats to the auditor’s independence.

Legal Consolidated’s Self-Managed Superannuation Deed is updated to fully comply with the Standard. Because you are building your SMSF at our website you also receive a signed letter on our law firm’s letterhead to confirm compliance with the Standard.

How do I register a Self-Managed Superannuation Fund?

Firstly, build the SMSF Deed on our website, print it out and have the trustee sign it. Secondly, within 60 days register the SMSF with the ATO. You do this by applying, for free, for an Australian business number (ABN). Our cover letter, which comes with the SMSF Deed, gives you the link to the ATO website. It is free to get an ABN from the ATO. You also apply for a Tax File Number (TFN) from the ATO (as well).

Does my SMSF need an ABN?

Currently, about half of the Self-Managed Super Fund deeds built on our website are for the pension phase. These funds may have just passive investments. And there may only be investments via platforms. Nevertheless, all Australian-compliant SMSF Deeds must have an ABN, at all times.

My company is a trustee of my SMSF. Does my company also need an ABN and TFN?

Most SMSFs have a company as the trustee. If your company is only doing that one job – acting as trustee of the SMSF – then the company has neither an ABN nor a TFN. The trust needs the ABN and TFN, not the corporate trustee.

Must all members be trustees/directors? Really?

When I lecture superannuation to my students I tell them that:

1. all members must also be the only trustees; or

2. if there is a company as trustee then all the members must be the only directors

But that is not always the case.

What if a member loses capacity or has gone overseas? Or the person cannot be bothered running the SMSF?

Section 17A(1) requires all members to be trustees or directors. That draconian rule is tempered by section 17A(3)(b)(ii) SIS Act 1993. It gives discretion. The member can give someone an Enduring POA. Let’s say you have two members: a mum and dad. Both mum and dad can give a POA to their son, or their accountant or anyone they trust.

The ATO sets out the POA rules in SMSFR 2010/2.

In SMSFR 2010/2 an example is given where two members are replaced by their friend who is not a member of the fund as trustee.

However, a POA does not work when you have a corporate trustee. And, these days, 94% of all SMSFs built on our website have a company as trustee.

SMSF member is frail or of unsound mind – enduring power of attorney

The government wants the members of the SMSF to stay hands-on. This is achieved by forcing all members to be the trustees of the SMSF. Or making all members directors of the corporate trustee of the SMSF.

But there are exemptions to this ‘control’ rule. One exemption is the member having a legally prepared POA by your lawyer is critical. (POAs built on government websites often do not work. And the relevant state government has no duty of care or responsibility.)

Therefore, if the member gets too frail or loses mental capacity, the SMSF remains compliant.

The POA helps where the member:

- loses mental capacity so that the member can no longer make decisions as trustee or director of the SMSF

- becomes reluctant to act as trustee or director for any reason including stress or frailty

- going overseas for a long period

Are you sure a ‘non’ member of the SMSF can still replace the trustee/member?

Well the ATO believes you can. In SMSFR 2010/2:

Andrew works for a large international group of companies. He and his wife, Jane, are trustees and members of their SMSF. From 1 February 2009 Andrew is transferred to an overseas company for an indefinite period of time. In accordance with the relevant State legislation, Andrew and his wife each execute an enduring power of attorney in favour of their friend and retired accountant, Trevor. In addition, Andrew and Jane both resigned as trustees of their SMSF and appointed Trevor as the trustee. The appointment of Trevor as trustee is in accordance with the terms of the trust deed. Other than the fact that Andrew and Jane are not trustees of the SMSF, the superannuation fund satisfies the other requirements of the definition of an SMSF in subsection 17A(1).

Trevor is a legal personal representative of both of the members, Andrew and Jane, by virtue of holding an enduring power of attorney in respect of each of them. In addition, Trevor is now the trustee of the SMSF in place of both Andrew and Jane. Once appointed as trustee, Trevor is subject to civil and criminal penalties in the event that he breaches his duties. Provided that the enduring power of attorney remains valid during the period Trevor is the trustee and given that the other requirements of subparagraph 17A(3)(b)(ii) are satisfied, the superannuation fund continues to satisfy the definition of an SMSF in subsection 17A(1), notwithstanding that Andrew and Jane are no longer trustees.

Obviously, Trevor cannot take a fee as remuneration for acting as the Trustee. Taking a fee breaches section 17A(1) SIS Act 1993.

Can a person under 18 be a member of an SMSF?

A person cannot be a trustee of an SMSF. But with a Legal Consolidated SMSF deed, one can be a member if a parent or guardian acts as a trustee on their behalf.

Contribution restrictions also apply to the child’s ability to make personal concessional contributions. A person under 18 can only make personal concessional contributions if they have income derived from work activities. If they do not, the only concessional contributions they can receive will be from a legitimate employer.

As a minor, they are entitled to receive a death benefit pension from the superannuation of either of their parents and be treated like a dependant for tax purposes on any superannuation lump sum death benefit.

What happens when a member of the SMSF turns 18 years old?

Your child is a member of the SMSF? And they now turn 18 years of age?

If a person is in an SMSF, they now must be appointed as a trustee in their own right. This means that they take on all the legal responsibilities of being a trustee of an SMSF.

They can also make personal concessional contributions, irrespective of their work status, providing they have enough taxable income to claim the deduction.

They no longer automatically meet the tax definition of dependant for death benefit purposes and, as such, any death benefit they might receive cannot necessarily be in the form of a pension and lump-sum tax could be payable.

Does the SMSF Deed mention AASB15 “Revenue from Contracts with Customers”?

As of 1 July 2021, non-listed companies are no longer allowed to prepare Special Purpose Financial Statements (SPFs). Instead, they prepare the arduous General Purpose Financial Statements (GPFS). Small proprietary companies where 5% of their shareholders request GPFS to be prepared are included in the definition of companies that comply with this requirement.

This requirement also applies to SMSF, Trusts and Partnerships, but only where the founding Deed makes mention of AASB15 in its definition of income.

Happily, Legal Consolidated documents do not mention AASB15 in the definition of income.

Further, no Legal Consolidated documents require compliance with the arduous AASB15.

Investing in Cryptocurrency using SMSF

Legal Consolidated SMSF deeds are fully compliant with the new Cryptocurrency rules see here.

Superannuation guarantee rate

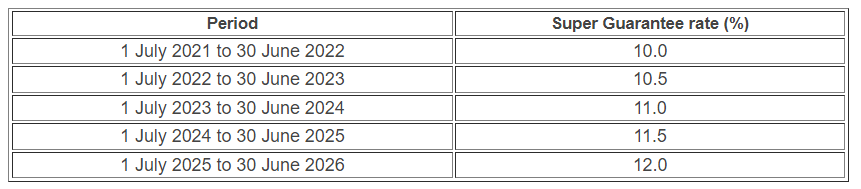

The superannuation guarantee rates are as per the table below.

Employers pay the relevant minimum superannuation rate as per the table.

This is on an employee’s ordinary time earnings in each quarter. The amount contributed cannot include any employee salary sacrifice contributions. And it is based on an employee’s ordinary time earnings before any salary sacrifice superannuation amounts are deducted.

The superannuation guarantee rate is legislated:

To update your SMSF Deed see here.

Any stamp duty on Legal Consolidated SMSF Deeds and variations?

Legal Consolidated SMSF Deeds are not dutiable. We draft them so that they do not need to be lodged for stamp duty. However, if the SMSF Deed is in the Northern Territory then you have to lodge the SMSF deed for stamping.

Stamp duty in the Northern Territory for Legal Consolidated SMSF Deeds

A Legal Consolidated SMSF deed that relates to property in the NT (even if signed outside the NT) must be lodged with the:

- NT Territory Revenue Office, GPO Box 1974, Darwin NT 0801

In the NT there is usually a ‘nominal’ fee of $20 (plus $5 for each duplicate deed). This is under section 2 of Schedule 1 and section 9B Stamp Duty Act 1978 (NT)). Upon signing you only have 60 days to complete and lodge the Stamp Duty Lodgement Form. The form is freely available from the NT Department of Treasury and Finance website.

Stamp Duty requirements for SMSF Deeds in New South Wales

Legal Consolidated SMSF Deeds and our deeds that amend SMSFs are not dutiable for stamp duty in NSW. See 65(10)(a) Duties Act 1997 (NSW). You do not need to lodge our deeds for stamping.

No stamp duty in Victoria for Legal Consolidated SMSF Deeds

No duty assessment is required for Legal Consolidated SMSF deeds that establish or amend the SMSF. See section 39 Duties Act 2000 (Vic). You do not need to lodge our deeds for stamping.

How much stamp duty is payable on a Queensland SMSF Deed and variations?

When you build on Legal Consolidated’s website SMSF Deeds and SMSF Deed Updates there is no stamp duty. And you do not need to lodge such Legal Consolidated deeds for duty. See sections 9 and 10 Duties Act 2001 (QLD). If you are moving cash or stamp dutiable property into or out of the SMSF then you will need to pay stamp duty. But, as to the Legal Consolidated SMSF deeds themselves, they are not dutiable.

The stamping of Western Australian SMSF deeds and variations

No duty assessment is necessary for Legal Consolidated SMSF Deeds and deeds that amend an SMSF deed. See the Duties Act 2008 (WA). You do not need to lodge our deeds for stamping.

Dealing with South Australian stamp duty for SMSF Deeds and variations

The good news here is that Legal Consolidated SMSF Deeds and SMSF Deeds of Variation are not dutiable. They do not need to be lodged. See Schedule 2, Part 2, Item 30 Stamp Duties Act 1923 (SA). However, such deeds need to be lodged if the deed moves assets or changes the interest in the underlying assets in the SMSF. For example, you move the $4m vineyard in the Barossa Valley from Mum’s account in the SMSF to Dad’s account in the SMSF.

Legal Consolidated SMSF deeds and variations are designed to not move or change any rights to the assets in the SMSF.

If your accountant is concerned, then out of an abundance of caution, lodge the Legal Consolidated SMSF Deed or variation at RevenueSA, GPO Box 1353, Adelaide SA 5001 and ask for the deed to be stamped ‘exempt’.

No stamp duty on Legal Consolidated ACT SMSF Deeds

Legal Consolidated SMSF Deeds and deeds of variation are drafted so that they have no stamp duty and are, also, not required to be lodged for stamping. See Duties Amendment Act 2008 (ACT). You do not need to lodge our deeds for stamping.

Tasmanian stamp duty on Legal Consolidated SMSF deeds and variations

Happily, Legal Consolidated drafts its SMSF Deeds and variations so that they neither suffer any stamp duty nor need to be lodged. You do not need to lodge our deeds for stamping.

Advantages of using Legal Consolidated to build your SMSF Deed

Because we are a law firm, you retain Legal Professional Privilege, we are responsible for the document and you receive legal advice. Most websites ‘appear’ to have a lawyer prepared the SMSF Deed, but, scratch the surface and you will find that this is not correct. Such websites merely ‘re-sell’ a law firm’s template. That has no law firm professional insurance attached to it. And the accountant that goes on such websites is breaking the law.

Business Structures vs Self-Managed Superannuation

Family trust vs SMSF

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs SMSF

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and SMSF

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case