Update SMSF Name online

Why change the name of your SMSF?

If the SMSF name does not do anything, why change it?

Is an SMSF Name just a ‘nickname’?

The SMSF name is just a nickname to help the Accountant, who may be looking after 100s of other SMSFs, identify yours a bit quicker. Why change the SMSF Name?

Seven reasons to update the SMSF name:

1. correcting spelling errors (e.g. Smitth Super Fund)

2. your husband has died (e.g. Coral & Ted Smith Superannuation Fund)

3. your spouse has divorced you (e.g. Joanne and John Lee Super Fund)

4. the SMSF name is not as clever as you first thought (e.g. Scrooge McDuck Super Fund)

5. your name may upset the ATO (e.g. Get out of Tax Superannuation Fund)

6. your parents are dead, and you now want to remove their names from the Superannuation fund

7.theSMSFnamefailstoincludetheword’Fund’

I cannot find the ‘name’ of my SMSF. Where is the SMSF name?

The super fund’s name is in the trust deed, which is often on the front page (dust cover). It may also be recorded on bank accounts, share registries, the ATO, and ASIC.

Can I change the name of the SMSF to any name I want?

Yes, you can call your SMSF anything you wish. (In contrast, a company must always have a unique name.)

There are no restrictions on what name you use for your SMSF. However, avoid misleading SMSF names, which are deceptively similar to another fund’s name or identical to an existing company or business name.

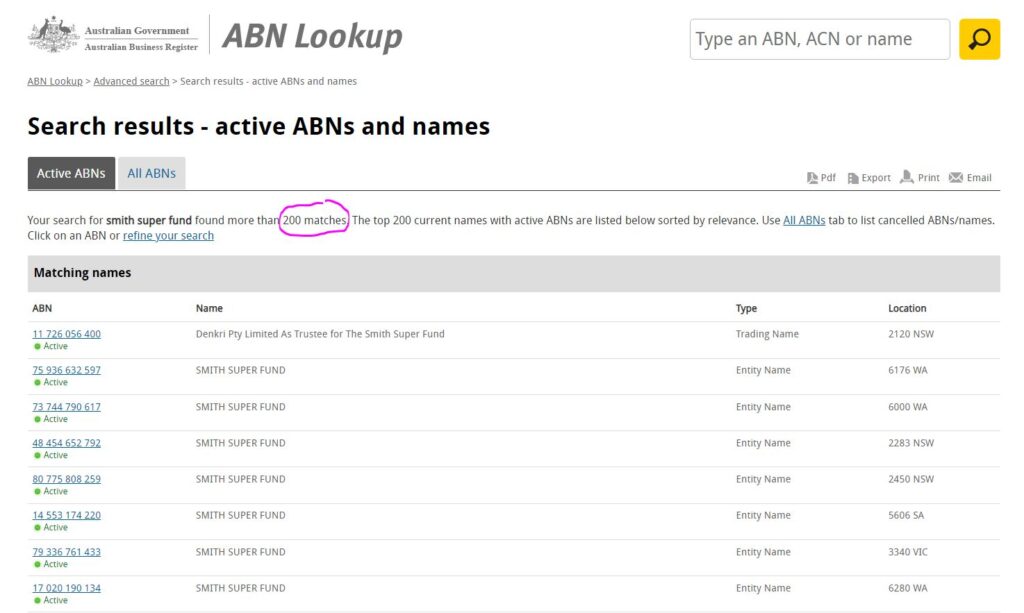

Having said that, there are many SMSFs called the “Smith Super Fund”. Many businesses and company names have “Smith” in them.

Best practice of SMSF naming conventions – do not upset the bank, ASIC or the ATO

Keep an SMSF name simple and short

An SMSF is often identified with a string of information on share registers and the government. For example, consider:

Cosmic Nominees Pty Ltd ACN 839383839 as trustee for the Mary and John Cartrict Super Fund ABN 838373837383

Here, the SMSF name is Mary and John Cartrict Super Fund

As you can see, it makes sense to keep the SMSF name short and simple.

Banks often have limited space for describing your super fund. They may shorten it in their system. This confuses your auditor and the ATO. And you do not want to confuse such people. It aggravates your auditor and the ATO.

Keep your surname out of the SMSF name

At Legal Consolidated, not all of us agree with this: The SMSF Name becomes public information. It is on publicly searchable databases. However, it is no one’s business who is ‘behind’ the SMSF. Why give out your name for no reason? The matter is compounded if you are rich, famous, or your surname is distinctive.

Using your name is also bad for asset protection.

On the other hand, your accountant may have 500 SMSF clients. In this case, the accountant can identify your SMSF quicker if it has your surname on it.

Do not use SMSF names that go out of date

We set up an SMSF in the 1980s. The SMSF name is the name of the building and street where they purchased a block of flats in Double Bay. Well, our clients are dead. Their children now want to change the name because the block of flats was sold years ago. The auditor has also, in a passing comment, stated that the SMSF name is ‘misleading’.

Any stamp duty or taxation issues when updating the name of the Self-Managed Superannuation Fund?

Legal Consolidated does not advise on taxation or stamp duty. However, in most states, there are generally no taxation issues when you only update the SMSF name.

What are the dangers of not having ‘Fund’ in the name?

While the Australian Taxation Office does not have a strict legal rule that your Self-Managed Superannuation Fund name must contain the word ‘Fund’ or ‘Superannuation’, omitting it is impractical and invites serious administrative problems.

The name of your Self-Managed Superannuation Fund is its primary legal identifier for all third parties. An ambiguous name creates confusion for banks, share registries, and investment platforms, leading to costly delays.

Real-World Example: Bank Refuses to Open an Account where the name did not include ‘Fund’

We see this issue most commonly when trustees attempt to open the fund’s bank account.

An accountant came to Legal Consolidated for assistance after the Self-Managed Superannuation Fund, which was built by a website pretending to be a law firm, was rejected by a major bank. The non-law firm had allowed them to name the SMSF “John and Mary Smith Investments”. When the SMSF trustees tried to open a bank account, the bank’s compliance department refused, stating the name did not clearly identify the entity as a superannuation fund.

The accountant built a Deed of Variation to change the name to “John and Mary Smith Superannuation Fund”. This unnecessary corrective process cost the client additional legal fees and delayed their fund’s operations by several weeks, during which time they could not accept contributions or rollovers.

We have also been advised by several lawyers, accountants and financial planners who have built legal documents on our law firm’s website that an ambiguous name has presented audit problems with the Australian Taxation Office. The ATO auditor questioned why the name was chosen, creating an unnecessary suspicion that the fund was attempting to “get away with things” by not clearly identifying itself as a superannuation entity.

This is why Legal Consolidated’s building process enforces the inclusion of ‘Fund’.

Is the name of your Self-Managed Superannuation Fund registered?

An SMSF name is not registered anywhere.

Do I need to let the ATO know that I have updated the name of my Self-Managed Super Fund?

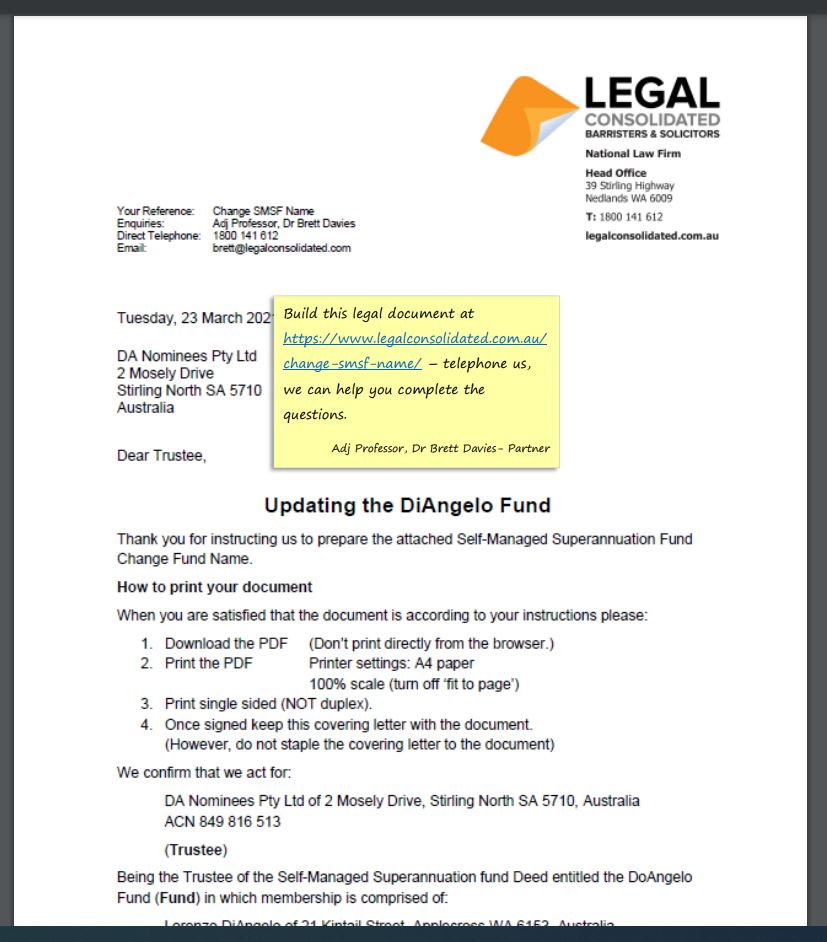

The Australian Taxation Office (ATO) regulates Self-Managed Superannuation Funds. You must inform the ATO within 28 days of changing your Superannuation Fund’s name. Our cover letter that you get with the Deed to update your SMSF Name has a link to the form that the ATO requires you to complete.

Do I have to inform the share registries and banks of the SMSF Name change?

Yes. While you are not changing the SMSF Trustee or Members, let everyone know you have changed the SMSF’s name.

Some public registers do not have your SMSF Fund’s name recorded. They generally do not need to be advised when the fund’s name changes. Private or public registers that use your SMSF’s name must be advised.

Do I need to let ASIC know that I have changed the name of my SMSF?

Yes. While your ABN and other registrations do not change, let all government departments know that you updated your SMSF name.

Can I change the name of my SMSF by just ‘minutes’ or a ‘resolution’?

No. Your SMSF Deed is a deed. The only way to change a deed is by signing another deed. Only law firms can prepare deeds. We are a law firm. We provide the deed as part of the SMSF Change Name Deed kit.

Minutes and resolutions merely record what you did. Minutes and resolutions do not change the name of your Self-Managed Superannuation Fund.

In years to come, you, your children or grandchildren may be tasked with providing evidence of the SMSF name change. Only a deed achieves this.

We have seen the ATO, ASIC, share registries, and the title office reject minutes. They ask to see the Deed of Variation of the SMSF Deed that changed the name, which is included in the document you are about to start building.

What is included in the Legal Consolidated SMSF Change Name Deed kit?

You can see a full free sample and the law firm’s cover letter with every Legal Consolidated document.

The Legal Consolidated Change SMSF Name Kit includes:

- Legal Consolidated letter of advice, including the links to the ATO form

- Trustee resolutions (legal minutes) – for your accountant’s and SMSF auditor’s due diligence file

- Deed of change of SMSF name

- Notification of change of SMSF name

We are an Australian law firm providing the SMSF Change Name Deed online.

We are a law firm. Many websites appear to be law firms. But they merely resell a lawyer’s template. You, your accountant and your financial planner are not protected.

If you are unsure, then telephone that website. And ask the person giving you advice: ‘are you a lawyer?’. All these years, you thought you were dealing with a law firm. Now, only to find every document you have done with these ‘non-law’ firms is unprotected.

The process to update the name of an SMSF

To change the name of your SMSF with a Legal Consolidated Change the SMSF Name kit:

1. Trustee Resolution:

Legal Consolidated includes a resolution to change the fund’s name in the kit. This resolution formally records the minutes of the meeting.

2. Sign the Deed:

Legal Consolidated provides the Deed to Amend the SMSF Name. This is now signed.

3. Notify the ATO:

Once the name is changed, notify the Australian Taxation Office (ATO) so that it can update its records.

4. Update Bank Accounts and Investments:

Update the Self-Managed Super Fund’s name with the banks, investment platforms, and other financial institutions where the fund has accounts and investments.

5. Inform Relevant Parties:

Notify all relevant parties about the change of name. This includes investment managers, insurance providers, and anyone who needs to know the new fund name.

6. Legal and Compliance Documentation:

Follow the Legal Consolidated letter of advice that comes with the Kit to ensure that the new fund name is reflected in legal and compliance documents.

Free legal advice on updating your SMSF Trust Deed name

Telephone us, and we can help you answer the questions about changing the name of your SMSF. But start the free building process first. Just press the green button at the top of this page. The free building process answers most of your questions. We empower our clients. Enjoy the free hints and free education.

Business Structures v Self-Managed Superannuation Fund

Family trust v SMSF

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust v SMSF

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate Structures v SMSF

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?