Why change the name of the Family Trust?

QUESTION: If the Family Trust name doesn’t do anything why change it? It is not registered anywhere. It is just a nickname to help the Accountant, who may look after 100s of other Family Trusts, identify mine quicker. Why change the Family Trust Name?

ANSWER: Nineteen reasons to update the name of a Family Trust

We have been preparing Family Trust updates to change the name since 1988. Here are the 19 most common reasons to change your Family Trust Name:

- correct spelling errors (e.g. Smitth Family Trust)

- husband has died (e.g. Coral & Ted Smith Family Trust)

- wife has divorced you (e.g. Joanne and John Lee Family Trust)

- your family name is distinctive and for privacy, you want it removed from your family trust (e.g. Barlowe Family Trust)

- name is not as clever as you first thought (e.g. Scrooge McDuck Family Trust)

- name may upset the ATO (e.g. Get out of Tax Family Trust)

- the name of the trust scares banks (e.g. the 38 Warren Street Development Trust, suggests that you are a property developer)

- your parents died

- you may NOT want it to be so obvious that the Family Trust is also a ‘Service Trust‘ for your main business (e.g. Williams Service Trust)

- the Family Trust name is too long (long Family Trust names do not fit on bank mortgage statements, ATO and ASIC forms)

- the Family Trust name identified its purpose but that purpose has changed (e.g. Ramsay Road Clear Mountain Trust)

- the Family Trust name has symbols in it, and banks, ASIC and the ATO forms cannot cope (e.g. ‘The Regus’ 27/34, 42 – 48 George Street, NSW – Holding Trust)

- you have been numbering your trusts, e.g. Smith Family Trust No. 2; Smith Family Trust No. 4. The banks and the ATO now want to see all the other trusts as well

- your trust name contains words that are illegal or suggest that you hold a licence or are related to other businesses (e.g. Bank, Building Society, BHP, Incorporated, Royal, Commonwealth)

- your accountant is sick and tired of so many trusts in his filing cabinet having the same name. E.g. Rossi Family Trust

- Legal Clarity and Estate Planning: Changing the name of a Family Trust can also be a strategic step in estate planning, particularly if the trust’s structure or intended beneficiaries have evolved over time. Updating the name can clarify the trust’s purpose and alignment with current estate goals

- Avoiding Confusion: If a trust’s name is too similar to another entity, it can lead to confusion in financial and legal documents. Renaming the trust can prevent such issues, especially in large families or businesses where multiple trusts exist

- Adapting to Business Growth: If the trust is associated with a business, changes in the business—such as expansion into new areas or restructuring—might necessitate a trust name change to better represent its current usage

- Modernisation: Over time, some trust names may become outdated or no longer reflect the modern values or dynamics of the beneficiaries—updating the name can keep the trust relevant and aligned with contemporary contexts

This Deed of Variation does two things. It formally records the decision to change the Family Trust Name and effects the name change.

Does the new name of my Discretionary Family Trust have to be unique?

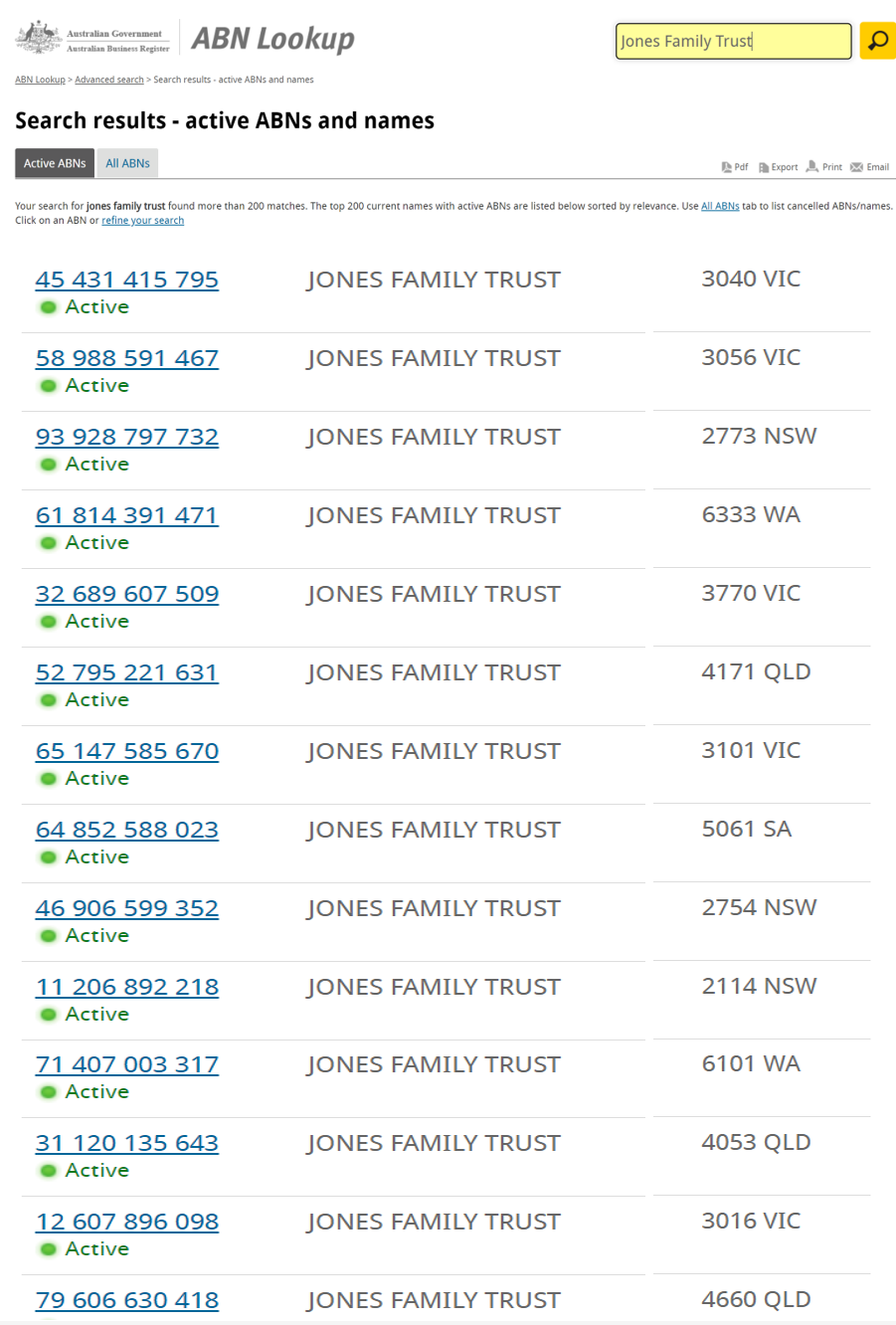

A trust name is similar to the name of a human being. Just as many people have the same name, so too, many trusts have the same name. E.g. Jones Family Trust.

Your Family Trust does not need a unique name. Family Trust (Discretionary trusts) like unit trust names are not registered with a governing body. In contrast, company names are registered with ASIC.

To overcome this problem the government stamps every human and every Family Trust with a number. For example, a human may have a Tax File Number. A Family Trust may have a unique Australian Business Number (ABN) identifier.

Any taxation or CGT issues when you change the name of your Family Trust?

There are generally no taxation issues when you only update the Family Trust name.

However, Legal Consolidated is not giving legal advice. We are not advising you on any taxation or other issues with updating your Family Trust. If you are unsure speak with your accountant and lawyer.

Any stamp duty when I update the name of my Family Trust?

Your local stamp duty office may require that the Deed of Variation of Change the Family Trust Name (and all copies) be lodged after signing. However:

- there is no need to get the Legal Consolidated Change of Family Trust Deed stamped in Western Australia, Queensland, South Australia and the Australian Capital Territory; but

- in all other States and Territories, Deeds of Variation must be lodged for stamping, and nominal lodging fees usual apply.

If another law firm prepared your Deed of Update for the Family Trust Name, then check with that law firm. Each law firm drafts the legal document differently.

Let the ATO know that I have changed the name of the Family Trust?

When you update the name of your Family Trust your accountant will let the ATO know.

The trust name should be consistent from year to year, except in the year of a name change when you lodge your trust accounts.

Let everyone know that the Family Trust name has changed

Whoever the Family Trust is dealing with should also be advised of the change of the name of your Family Trust. This includes people doing business with the Family Trust. E.g. Banks, creditors etc…

When you distribute income to a beneficiary then that beneficiary should also be told of the change of name.

Can I change the name of the Family Trust via a minute or resolution?

That would be silly. A Family Trust is a Deed. A deed can only be changed by another Deed. Press the “Start for Free” button above and start building the Family Trust Deed to Change a Family Trust name. This Deed is a formal recording of the decision to change the Family Trust Name and also changes the name.

A minute also does not do anything – it merely records something.

The foundation of a Family Trust is its deed, and modifications to the deed necessitate the creation of another deed. If you are considering changing the name of your Family Trust, you need to build a deed of variation that formally records the decision to change the name and actually implements the change. Begin this process by clicking the “Start for Free” button above to build the Family Trust Deed of Variation.

Keep your original Discretionary Trust Deeds and all variations

We make special mention of the Minute that is included in the Family Trust Change Name Kit. You need to hold and retain, forever, original deeds. If you do not retain original signed deeds, you will not be able to open bank accounts or borrow money. Copies are not good enough. Even certified copies of Family Trust deeds and variations are not good enough.

You need to show the bank all original trust deeds.

Ensure that both you and your accountant retain original deeds. They are precious and usually impossible to replace.

To labour the point, if your Family Trust Deed has been updated 8 times, over the last 30 years, then you need to give the bank 9 ORIGINAL Family Trust deeds. If you are unable to decide if a deed is original lick your finger and rub it over a signature. Please do not get involved in the silliness of electronic signatures.

Telephone us. We can help you answer the questions to correct or change the Family Trust name.

Family Trust and other business structures in Australia

Family trust

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees (this changes the Trustee of the Family Trust)

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

Service trust and Independent Contractors Agreements

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case