SMSF Acknowledgement of Trust – fixes Assets Purchased in the Wrong Name

Has your Self-Managed Superannuation Fund purchased an asset in the wrong name, such as a property?

Or did it purchase the asset in the trustee’s name, but without disclosing that the true (equitable) owner is the SMSF? For example, the asset is in an individual trustee’s name or a company, but without a clear disclosure of the SMSF trust relationship.

These failures cause issues with your accountant, auditor, and the Australian Taxation Office. Our Acknowledgement of Trust—After the Trustee Buys helps document that the asset is held in trust for your SMSF, supporting (but not guaranteeing) compliance and rectification efforts.

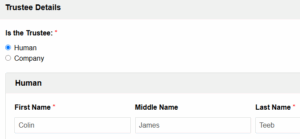

Colin is temporarily holding the SMSF property for the Trustee of the SMSF

Colin purchased the SMSF asset in the wrong name

Colin James Teeb’s SMSF is called the Teebs SMSF. The trustee of the Teebs SMSF is Audacity Pty Ltd. Colin has been told many times that when his SMSF buys an asset, it must have in the agreement the purchaser being:

Audacity Pty Ltd ACN 837738394 atf Teebs SMSF ABN 3838373930398.

The abbreviation ‘atf’ stands for ‘as trustee for.

At the spur of the moment, Colin purchases a house for his SMSF at an auction. It is a very exciting day. The real estate agent floods him with paperwork, and in the hurly-burly, the purchaser ends up being put on the paperwork as Colin himself. The SMSF pays for the property and settles a month later.

Colin mistakenly registered the SMSF asset in his name.

This Deed corrects that error by declaring:

(1) the SMSF Trustee is the true owner, and

(2) the Trustee holds the asset for the SMSF’s benefit.

After the settlement, Colin realises his mistake. He immediately goes to his accountant, who:

- Builds a Legal Consolidated SMSF Asset Ownership Rectification Deed.

- Collects all the evidence that the true (equitable) owner is the Teebs SMSF (not Colin).

- Has the conveyancer prepared a deed of transfer from Colin to Audacity Pty Ltd ACN 837738394 atf Teebs SMSF ABN 3838373930398

- Lodges the deed of transfer, the Asset Ownership Rectification Deed, and all the receipts with the local stamp duty office (in this instance, the stamps office is happy not to inflict additional stamp duty, but that is not always the case).

- The lawyer or conveyancer now transfers the property to the correct owner, Audacity Pty Ltd, the trustee of the SMSF.

- Under the Australian Torrens land titles system, you cannot record trust relationships on the front page of the land certificate of title. So the accountant lodges the Deed of Rectification by way of a caveat.

- The auditor is not happy (nothing unusual there!). Still, he is pleased that the Asset Ownership Recification Deed has been completed and duly stamped, so he will not qualify his audit “in this instance,” he sternly tells the accountant and Colin.

- “Has a caveat been lodged?” barks the auditor. The accountant informs the auditor that the caveat has been lodged. One can never tell, but the auditor looks almost happy.

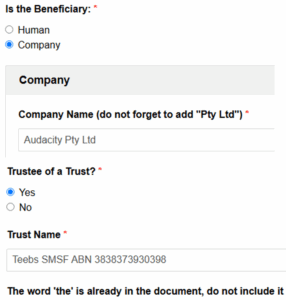

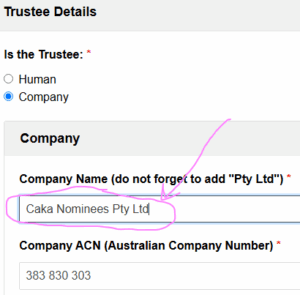

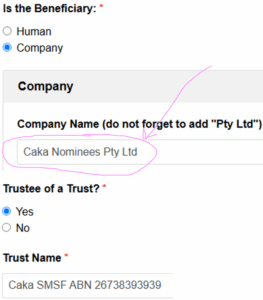

Joanne purchases the SMSF asset in the correct SMSF trust name, but there is no disclosure of the trust relationship

Unlike the mess Colin left above, this mistake is less severe.

At least Caka Nominees Pty Ltd, as the trustee of the Caka SMSF, holds the SMSF asset, so it is half right.

Joanne Raylene Smith has an SMSF called the Caka SMSF. The trustee of the SMSF is Caka Nominees Pty Ltd. (Caka is her dog’s name, in case you were wondering.) Caka Nominees Pty Ltd buys an asset for the SMSF.

Caka Nominees Pty Ltd is a Special Purpose Company, so Joanne mistakenly believes she does not need to disclose the true (equitable) owner on the purchase documents.

At the end of the financial year, the accountant is preparing the SMSF’s tax returns. As a good accountant, he pre-empts what the auditor will ask for:

“Show me evidence that the company purchased the asset for the benefit of the Caka SMSF. I want to see the purchaser named Caka Nominees Pty Ltd 383830303 as trustee for the Caka SMSF ABN 26738393939.”

Joanne tells the accountant he is being a bit anal because a Special Purpose Company can carry out only one job—to be the trustee of the SMSF. The accountant corrects her. That is not the case; the Special Purpose Company should only own assets for the SMSF, but it could break its own rules and purchase assets for itself absolutely.

The trustee of the SMSF is repeated here, and the SMSF is clearly identified.

More importantly, neither the SMSF auditor nor the ATO will be happy. So the accountant:

- On Legal Consolidated’s website, builds an Acknowledgement of Trust to declare under deed that the SMSF is the true (equitable) owner of the asset. This clearly states that the company merely holds the SMSF’s assets in trust.

- The accountant takes the Acknowledgement of Trust to the stamps office for stamping. The stamp office does not want to be bothered with this and declines to stamp the document. The accountant explains that SMSFs require exacting standards over and above a Family Trust or Unit Trust. Besides, the land title office will not accept the Deed of Rectification unless it is stamped. The stamps office stamps the Deed of Rectification for only a nominal duty (usually).

- Under the Australian Torrens land titles system, you cannot disclose trust relationships on the front page of the title deeds. So the accountant lodges the duly stamped Deed of Rectification under a caveat.

- The auditor is usually happy with the stamped Acknowledgement of Trust, especially as it has been registered on the title to give ‘notice to the world’. It would be a harsh auditor to qualify the SMSF audit.

Example of the wrong person owning the SMSF’s bank account

To prepare your Bare Trust, you must describe the asset and the parties involved. As you build the Bare Trust we will ask:

1. The Holder of the Asset (Bare Trustee): The full legal name of the person or company incorrectly holding the asset. In this example, Colin put the money into his personal name.

-

-

-

-

-

e.g., Colin James Teeb

-

-

-

-

2. The True Owner (Beneficiary): The name of the SMSF’s trustee. Colin’s SMSF has a corporate trustee.

-

-

-

-

-

e.g., Audacity Pty Ltd

-

-

-

-

3. The True owner holds the bank account in trust for the SMSF. Select yes as the asset is held by the corporate trustee on behalf of the SMSF:

-

-

-

-

- Teebs SMSF ABN 3838373930398

-

-

-

4. The Asset: A clear legal description of the asset.

-

-

-

-

-

For Bank Accounts: E.g., Commonwealth Bank Savings Account, BSB: 000-111, Account: 12345678.

-

For Real Estate: E.g., the property at 94 Melrose Street, North Melbourne, VIC 3051, being all the land in Certificate of Title Volume 1234 Folio 567.

-

For Shares: E.g., 5,000 ordinary shares in BHP Group Limited (ASX:BHP).

-

-

-

-

SMSF acquires property in the wrong name or without full disclosure of the SMSF

Sometimes, because of urgency or innocence, a person incorrectly purchases an asset for their Self-Managed Superannuation Fund. For example:

- the person buying the property is not a trustee of the SMSF (this is the Colin example above);

- the person buying the asset is only one of the trustees of the SMSF; or

- most commonly, the person buying the asset is the trustee of the SMSF, but there is nothing on any documents to clearly show that the super fund is the true beneficial owner (the Joanne example above).

Why Your SMSF Asset Title must be Perfect

An imperfectly held asset is a direct challenge to your SMSF’s compliance. Regulation 4.09A of the SIS Regulations and section 52(2)(d) of the SIS Act are clear: your fund’s assets must be held separately and in a way that unequivocally identifies them as belonging to the SMSF.

When an asset is in a personal name (the ‘Colin’ example) or in the trustee company’s name without the trust relationship being disclosed (the ‘Joanne’ example), you fail this test. Your auditor is potentially legally required to flag this failure and report it to the ATO. This is not a minor administrative error; it constitutes a breach of a core trustee covenant, resulting in penalties. The purpose of a perfect title is to give ‘notice to the world’—and specifically to the ATO—that the asset is held for the sole purpose of providing retirement benefits.

The SMSF rules state that the trustee of the SMSF must hold the SMSF assets (there are some minor exemptions). As soon as the breach is discovered, you must:

- transfer the property into the correct trustee name

- with notice that the trustee holds it in trust for the the SMSF.

Good luck with getting that through the stamp office and CGT rules, even with the SMSF Asset Ownership Rectification Deed.

The SIS Act requires that (1) the SMSF Trustee hold SMSF assets and (2) the trust relationship be notified to the world

Section 52(2)(d) of the SIS Act: This section imposes a covenant on SMSF trustees to ensure that the fund’s money and assets are kept separate from those held personally by the trustee or an employer-sponsor. While it does not explicitly state that assets must be held in the trustee’s name, it implies that assets must be clearly identified as belonging to the SMSF to avoid commingling. See the Superannuation Industry (Supervision) Act 1993 (SIS Act) and Superannuation Industry (Supervision) Regulations 1994 (SIS Regulations).

Regulation 4.09A of the SIS Regulations empowers the Australian Taxation Office (ATO) to force the SMSF trustees to keep fund assets separate from personal or business assets. The ATO interprets this to mean that assets should be recorded in the name of the trustee(s), noting their capacity as trustees for the SMSF (e.g., “Caka Nominees Pty Ltd as trustee for the Caka SMSF”). See also Section 35B(1) of the SIS Act.

Colin’s Error: As discussed above, as Colin registered an asset (e.g., 94 Melrose Street, North Melbourne, VIC 3051) in his personal name, this contravenes section 52(2)(d) and Regulation 4.09A, as the asset is not held in the trustee’s name (Caka Nominees Pty Ltd). The Legal Consolidated Declaration of Trust corrects this by declaring Caka Nominees Pty Ltd as the trustee holding the asset for the Caka SMSF.

Section 124 of the SIS Act: Allows trustees to appoint external investment managers, but the legal ownership of SMSF assets remains with the trustee. This reinforces that assets must be held in the trustee’s name, even if managed externally.

The ATO advises that SMSF assets should be recorded in a way that “clearly shows legal ownership by the fund” (e.g., on property titles, share registries, or bank accounts). This acts as notice to third parties (e.g., banks, land registries, or creditors) that the asset is held for the SMSF’s benefit.

What does the stamps office want to see when I say the true owner is the SMSF?

You must show evidence of who the true beneficial owner was and still is. You and your accountant will also need to fight the good fight with the SMSF auditor as to how serious the breach of the Superannuation Laws has been in this instance. Legal Consolidated is not advising you on stamp duty or Superannuation compliance rules.

How does an Acknowledgement of Trust fix incorrect ownership?

An Acknowledgement of Trust is a legal document that records a bare trust relationship after an asset purchase. In a bare trust, the trustee (for example, an individual or company) holds the asset solely for the beneficiary (your Self-Managed Superannuation Fund), with no discretion. For Self-Managed Superannuation Funds, this document clarifies that the asset, though titled incorrectly, is beneficially owned by the Self-Managed Superannuation Fund. It is a “better late than never” solution.

The Bare Deed’s Legal Power: It Confirms, It Doesn’t ‘Transfer’

A critical legal distinction to understand is that the SMSF Asset Ownership Rectification Deed does not create a new arrangement or transfer the asset. Rather, it formally documents and clarifies the truth of the situation from the moment the asset was acquired.

The Deed is a legal statement that declares the person or entity holding the asset (e.g. Colin Smith) has only ever done so as a ‘bare trustee’ for the SMSF. This means the SMSF was always the ‘equitable owner’, and the person on the title was merely a placeholder with no rights to the asset themselves.

Think of it as the missing legal ‘label’ for the asset. This provides the crucial evidence trail for your auditor and the ATO, confirming the fund’s uninterrupted ownership from the date of purchase. It is this act of confirming a pre-existing trust that may help you avoid double stamp duty and Capital Gains Tax, as you are not transacting, but merely correcting the record.

Why Use an Acknowledgement of Trust for Your Self-Managed Superannuation Fund?

Creating an Acknowledgement of Trust offers several benefits:

-

Supports Accountants and Auditors: Provides written evidence that the asset is held for the Self-Managed Superannuation Fund, helping your accountant update records and satisfy auditor queries.

-

Prepares for Australian Taxation Office Audits: Helps demonstrate the trust relationship, reducing the risk of penalties for non-compliance with Superannuation Industry (Supervision) rules, though additional supporting evidence, such as bank transfers, will be needed.

-

Facilitates Asset Transfer: Assists in transferring the asset into the Self-Managed Superannuation Fund’s name (or rather the trustee of the SMSF atf the SMSF). However, stamp duty offices may require additional proof of beneficial ownership.

-

Document’s Intent: Records what happened at the time of purchase, showing the trustee acted for the Self-Managed Superannuation Fund.

The Acknowledgment of Trust does not change the past or guarantee full compliance. For example, stamp duty relief or auditor approval may depend on other factors. Always consult your accountant and financial advisor for compliance with Self-Managed Superannuation Fund regulations.

What does the SMSF Ownership Retification NOT do

Legal Consolidated does not advise on these matters, and the Acknowledgment of Trust does not:

- Guarantee that you can escape the auditor and ATO inflicting punishment on you and your SMSF – this includes penalties

- Transfer the asset to the correct name. For example, if Joseph Smith purchased the SMSF asset in his name but the trustee of the SMSF is Kelly Nominees Pty Ltd, then you need to transfer the asset from Joseph Smith to Kelly Nominees Pty Ltd. This Acknowledgement of Trust does not do the transfer. You need to attend to the physical transfer through your lawyer or conveyancer.

- Escape double stamp duty and trigger capital gains tax. Sure, an Acknowledgement of Trust may help with that, together with your records of payment, but it may not be enough.

At the end of the day, the Acknowledgement of Trust is the best you can do, but it may not be enough to escape the wounds that the above regulators and tax collectors can inflict upon you and your SMSF.

Other risks of holding the SMSF asset in the wrong name – or not fully explaining that the beneficial owner is the SMSF

All the Acknowledgment of Trust is doing is recording, by way of a Deed, the existing trust relationship – that you claim exists. However, there is a real risk that the:

- State stamp duty office

- ATO for Capital Gains Tax and the regulator of SMSF

- Bankruptcy Court

- Family Court

may not believe your story. They may impose stamp duty and CGT on the Acknowledgement of Trust Deed. Be careful. Make sure you have plenty of evidence that at all times the beneficial owner was and remains the beneficiary (bank transfers, bank statements, emails etc…)

You need to prove that this Acknowledgement of Trust changes nothing. Your Self-Managed Superannuation fund was always the true beneficial owner of the asset. You need evidence that it has always been the case.

Start fixing your self-managed superannuation fund’s incorrect ownership as soon as you can

Do not let an asset ownership error jeopardise your Self-Managed Superannuation Fund’s compliance even further. The sooner you right the wrong, the better. Click “Start for Free” to learn how the documents works. The building process is free and educational.

Benidorm Pty Ltd v Chief Comr of State Revenue

You will enjoy the case Benidorm Pty Ltd v Chief Comr of State Revenue [2020] NSWSC 471. It shows how an Acknowledgement of Trust after you buy is hard to prove. In Benidorm v State Revenue, an executor of a Will declares he holds a penthouse on trust for a new beneficiary. This is following the death of the original beneficiary. It is an acknowledgment of trust after the asset comes into your hands.

After you get the asset, the Acknowledgement of Trust merely acknowledges that which has already come to exist. (Well, you say it was always the case.)

The facts of the case Benidorm v State Revenue

Benidorm Pty Ltd was formed in 2007. [This is how you build a new company.]

- The company is a vehicle formed with one purpose. This is to purchase a Sydney penthouse for $12.5m.

- The sole director and shareholder of Benidorm is a lawyer.

- The lawyer is acting for his client, Rolf.

- Rolf is a resident of a very beautiful tax haven called Guernsey. (Sorry, Guernsey no longer likes the expression ‘tax haven’. It prefers the expression ‘low tax’ jurisdiction, so let us go with that.)

- Rolf, the client, gives the funds to the company to purchase the penthouse.

The facts of the above case are: immediately before the purchase contract is signed, the lawyer and Benidorm sign a Declaration of Trust before you buy. The lawyer says he holds his shares in Benidorm as a mere nominee for Rolf. If you build this document on our website then: Bare Trustee: lawyer Beneficiary: Rolf Asset: shares in Benidorm Pty Ltd

Then Benidorm and Rolf sign another Declaration of Trust BEFORE you buy. The bare trust deed declares that Benidorm holds the title to the penthouse as a bare trustee for Rolf. To build that document on our website: Bare Trustee: Benidorm Pty Ltd Beneficiary: Rolf Asset: penthouse

Rolf died in 2013. Sam (Rolf’s friend) is Rolf’s estate’s executor and sole beneficiary. In January 2015, the lawyer signed a document declaring that he now holds the shares in Benidorm in trust for Sam. The lawyer’s support for Acknowledgment of Trust is that Sam is the sole beneficiary and the executor of Rolf’s estate. This is the First Acknowledgement of Trust. Benidorm and Sam sign the Second Acknowledgement of Trust on the same day. The company Benidorm acknowledges that it “will hold” the penthouse on trust as a nominee for the “New Beneficiary” (Sam). This is on the same terms as the First Declaration of Trust.

The NSW State Revenue Office is not happy with the Second Declaration of Trust after you have the asset

- State Revenue has no issue regarding the two Declaration of Trusts BEFORE you buy.

- State Revenue does not care about the First Acknowledgement of Trust regarding the shares. (Why would it anyway. At that point, the shares had no value.)

- But State Revenue does not like the Second Acknowledgement of Trust after you buy the penthouse ownership. State Revenue charges Benidorm full stamp duty. It charges full ad valorem duty of $710k on the Second Declaration of Trust AFTER you have the asset.

- In effect, as is often the case, where the regulator does not believe your story, it treats the Declaration of Trust AFTER you have the asset as a transfer. The lawyer argued that ‘it was always the case that the asset belonged beneficially to the beneficiary’. The regulator disagrees. The regulator treats the Declaration of Trust AFTER you have the asset as a beneficial transfer from one person to another.

Sam disagrees. So off to the NSW Supreme Court, they go.

What did the court in Benidorm v State Revenue consider?

The Court is asked: is the “acknowledgement of trust AFTER you acquire” subject to stamp duty?

Rolf wins. There is no stamp duty on the Acknowledgement of Trust AFTER you purchase:

- The NSW Supreme Court states that the definition in s 8(3) Duties Act 1997 (NSW) of:

- “declaration of trust” does not include mere acknowledgements of existing trusts. Instead, to come within the definition, “the impugned declaration must do something more than, in the sense of having a legal effect beyond, merely acknowledging the position subsisting at the time of the impugned declaration”.

- The Court states that the Second Acknowledgement of Trust had no effect beyond merely acknowledging that which had already come to exist.

- On the death of Rolf (under section 44 Probate and Administration Act) the beneficial interest in the penthouse vests in Sam as executor. In the words of the Court, that

- “had the consequence of effecting a change in the beneficiary and, in effect, created a new and different trust”. The Second Acknowledgement of Trust did no more than acknowledge that fact. The Second Acknowledgement of Trust, therefore, did not constitute a “declaration of trust” within the meaning of the definition of that term in s 8(3) Duties Act. As a result, the Court set aside the ad valorem stamp duty assessment.

- The Court states that the Second Acknowledgement of Trust after the acquisition was not subject to stamp duty.

This case highlights the fact that an Acknowledgement of Trust after you acquire the asset:

- is only part of the process. You also need supporting documentation.

- if you have, the important, supporting documents then there is unlikely to be stamp duty.

- is not as good as signing a Declaration of Trust BEFORE your trustee acquires the asset.

Legal Consolidated provides no advice on this document. We do not provide advice on tax and stamp duty issues. You need to speak with your accountant.

Deputy Commissioner of Taxation (Superannuation) v Ryan [2015] FCA 1037

The court criticised undocumented transactions that obscured SMSF asset ownership, emphasising the need for clear records to demonstrate compliance. While not about public notice, it supports the principle that ownership must be evident to regulators and auditors.

Shail Superannuation Fund v Commissioner of Taxation [2011] AATA 940

This case involved a dispute over whether a property was an SMSF asset. The Administrative Appeals Tribunal emphasised the importance of proper documentation (e.g., trust deeds or title records) to prove the SMSF’s beneficial interest, indirectly supporting the need for clear ownership records as a form of notice.

Business Structures that can use Bare Trusts – before and after

Family Trust and Bare Trusts

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust and Bare Trusts

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures that can use bare trusts

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case