Using Trusts for Property Loans

Trusts are often used to protect assets, reduce taxes, and for succession planning. The main types of trusts for loans are:

- 3-Generation Testamentary Trusts in Wills

- discretionary trusts (family trusts)

- unit trusts

- self-managed super fund trusts, and

- Bare Trusts.

At times, you may want to borrow money through your trust.

How does my trust borrow money from a bank?

Because of the changes to banking rules, we have received feedback from lawyers, accountants, and financial planners who use our website to build documents. These are the six disturbing trends:

- Lenders in Australia now perceive dealing with trusts as a cumbersome process that offers them no additional benefits.

- The new processes of applying for loans through trusts are typically complex, involving intricate legal considerations and a heavier burden of documentation before approval.

- Most bank managers and credit staff lack a comprehensive understanding of how trusts operate, which can lead to trust-related loan applications being shuffled between various bank departments, causing delays and mistakes. In contrast, mortgage brokers are more up to speed with the new rules on lending to companies and trusts.

- Many bank managers are unsure whether their institutions even lend to trusts, as the new credit policies are vague.

- Remarkably, one of Australia’s leading banks is unable to process residential loans for trusts due to limitations in its IT systems.

- Banks often refer trust loans to their business banking departments, where experienced staff can better manage them. However, this results in higher costs, increased fees, and slower processing times. Additionally, business banking may limit borrowing capacity and exclude low-documentation loan options compared to residential loans.

Why lawyers no longer use ‘Schedules’ in their legal documents

Q: As a banker, I found Schedules (some of the old boys at the bank still call them ‘extracts’) useful just to copy that particular page of the SMSF, Trust deed, Loan or Lease agreement. But law firms no longer use them. Why?

A: “Schedules” are a sheet of paper attached to the legal document. They carry some, but not all of the variables. Schedules have no terms of the agreement. For example:

- For a 3-Generation Testamentary Trust Will, it is a list of ‘Executors’ and ‘Primary Beneficiaries’.

- For a Lease, it lists “Leasee”, “Lessor”. “Lease Fee” and “Term”.

- For a Family Trust, it lists “Appointor”, “Back-up Appointor”, “Trustee”.

- For a Loan Agreement, it lists “Lender”, Borrower”, “Amount Lent”, “Interest Rate”.

- For a Division 7A Loan Deed, it is a list of the “Lenders”, “Borrowers” and “Addresses”

- In an Employment Contract “Employer”, “Employee”, “Salary”.

- For an SMSF they state the date of the deed, members and trustees, but it contains none of the rules of binding nominations and SIS Requirements.

- For a Partnership Deed, it is a list of the “Partners” and their “percentage interest”.

Lawyers rarely use Schedules in their legal documents these days. They are considered old-fashioned and lazy drafting.

Schedules in legal documents were popular before word processors. Until the 1970s, the lawyer (a man in those days) went to a printing shop. He prints out the substantive part of the legal document. A big stack of them. His secretary (a woman in those days) merely types in the agreement’s main variables- the Schedule or Extract. E.g. Lender, Borrower, Amount Lent and Interest Rate.

The schedules look terrible. No self-respecting lawyer is caught dead with them these days. A sure-fire way to find out that the legal document is being ‘resold’ by a non-law firm website is to see a “Schedule”.

Since the 1980s, law firms have incorporated all parties and terms into the substantive part of the legal document. It looks better. It tells the whole story.

Further, you cannot expect to just copy the Schedule and think you know the entire legal document.

Prudent banks and lenders review the entire legal document

Now, let us turn our minds to the banker. A careless banker just copies the Schedule containing the parties’ details. That is a useless amount of misinformation. Proper due diligence involves reviewing the entire legal document.

A banker who merely reviews the schedule of an old legal document (or something prepared by a non-law firm website) only gets part of the story.

Careless bankers are duped. For example, the client merely puts misleading information in the Schedule. And then puts the full story in the legal document. The careless banker is none the wiser. I doubt a banker is silly enough to just look at a Schedule and believe that the bank’s due diligence is complete!

That would be akin to the banker getting married to someone on the strength of just their Facebook page. The careful banker reviews the entire deed.

Adams on Contract Drafting expresses concerns with Schedules.

To appease the bank and their ‘due diligence’, copy the entire document and email it to them.

Banker wants a ‘certified’ copy of the document – not extracts

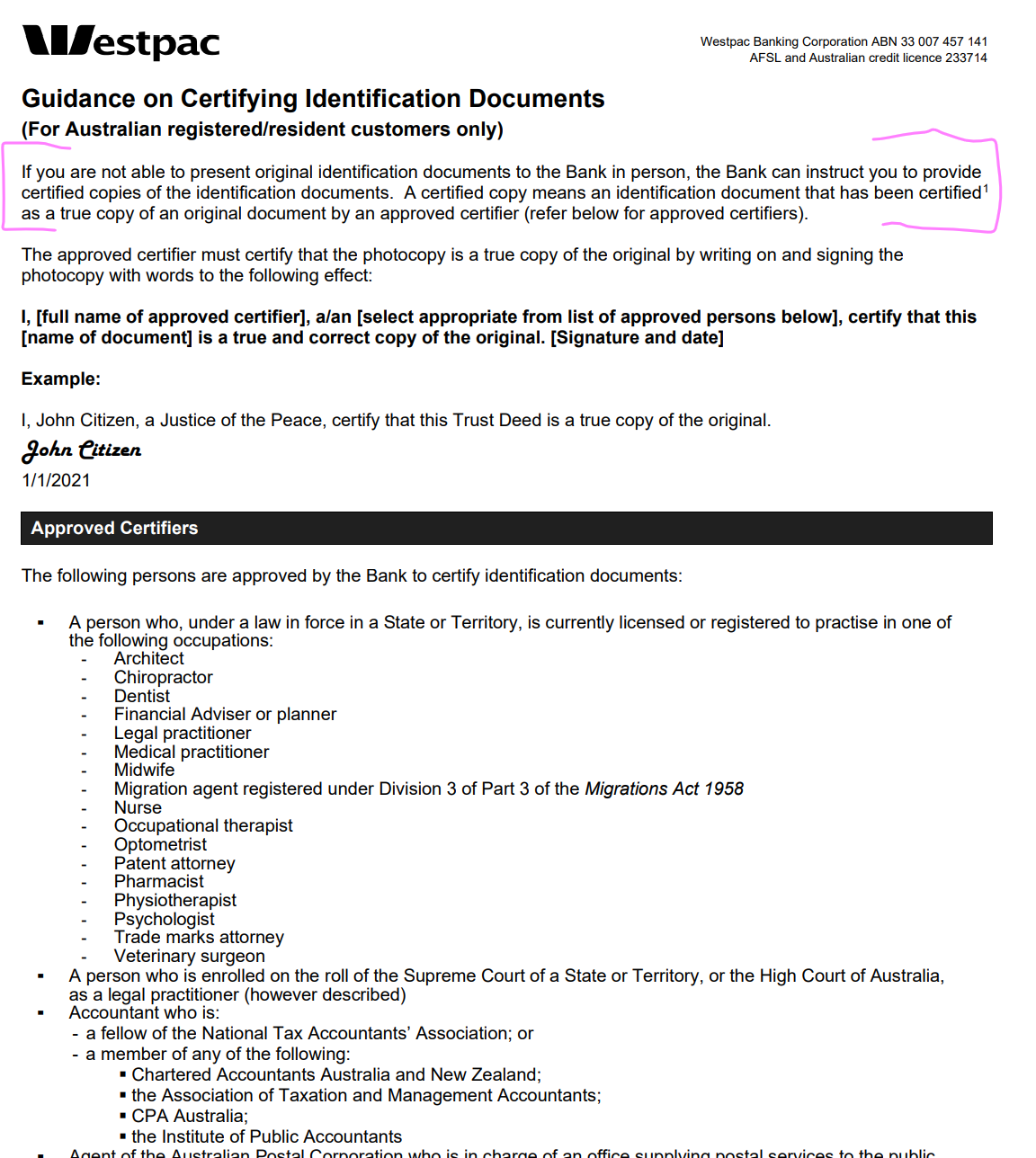

A bank asks for a certified copy of your document. Not realising the dance to be performed to satisfy the bank, you innocently go to the local chemist, photocopy the deed and get the pharmacist to certify the deed as a ‘true copy of the original’. You then post the certified copy to the bank. The bank manager telephones you and states that, while pharmacists and many other professionals can certify documents as true and original, it is never good enough for the bank.

The bank manager forgot to tell you that the bank wants to certify the trust deed itself. But you are reluctant to courier the original deed to the bank in case it goes missing. So you get in your boat, car, aeroplane or bicycle and go off to the bank offices, if there are any branches left in your neck of the woods.

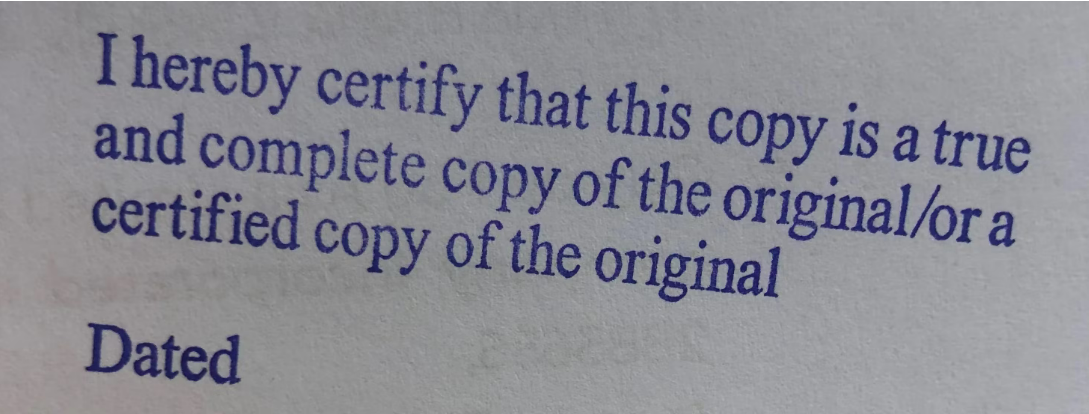

You take the original trust deed and two photocopies. (Copy the deed yourself, as the bank manager often damages your original trust deed when they try to put it through their copier.) Take all three to the bank, and the bank certifies both copies. With a pretty stamp, it will say:

‘Certified by the Commonwealth Bank of Australia by Manager John Smith on 13 March year‘

Take one of the certified copies back home with you.

In twenty years, when CBA has lost the certified copy, you can post the second certified copy to CBA. They often accept that. Other banks will not, but the bank that certified it twenty years ago may. If not, take the original trust deed back to the bank and start the dance again. Let’s hope you have not lost your original deed.

Banker wants a list of the beneficiaries of the Family Trust

Q: We are building our client’s Family Trust deed on your website. I specify the Default Beneficiaries. These are ‘the children of Colin Jones and Muriel Jones’. This shows on the Family Trust deed. However, the client’s banker is asking for a list of all the Family Trust’s beneficiaries.

A: I suggest that you read the above information again. We are an Australian-wide tax law firm. We know little about banking. It may be the case that the banker knows little about Family Trusts, Unit Trusts, Bare Trusts, Partnership of Family Trusts, and companies. And that is fine.

Bankers ask for the Beneficiaries of Unit Trusts, Bare Trusts, and Self-Managed Superannuation Funds. And the banker asks for the shareholders of the company. These are usually finite and ascertainable.

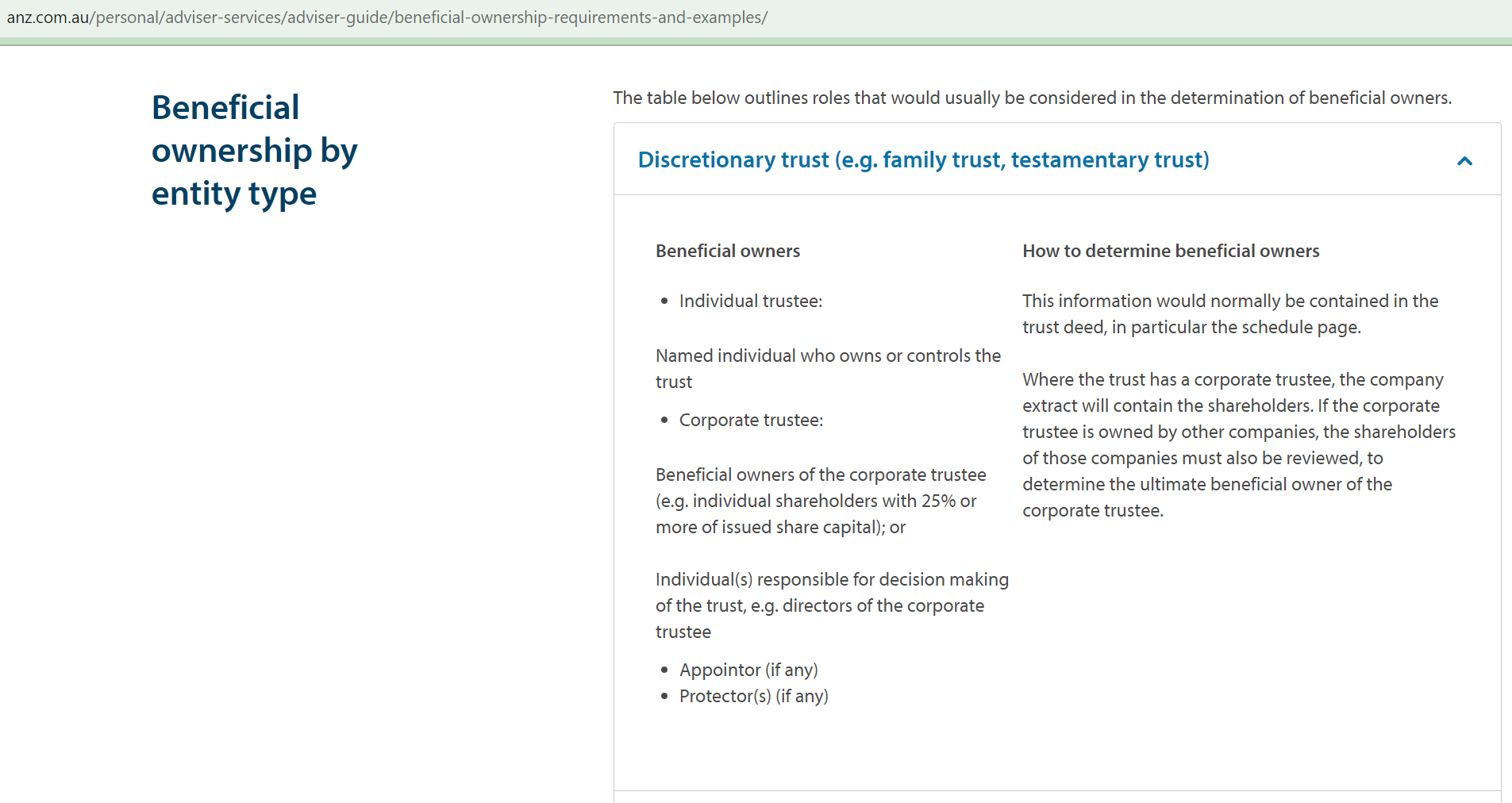

The list of beneficiaries of a Family Trust is in the 1,000s. So a banker does not ask for a list of beneficiaries in a Family Trust. Instead, the banker, for a Family Trust, wants:

- Appointors – this is the person who controls the Trustee of the Family Trust

- Back-up Appointors – these are the lucky people who control the Family Trust after the Appointor dies

- Trustee or Corporate Trustee of the Family Trust

- Default Beneficiaries (also called Takers in Default, Specified Beneficiaries and Named Beneficiaries)

Show the banker this article. The banker defers to his or her superior. Their superior helps the banker read the Family Trust deed to get the information required.

Banker wants to know about classes of beneficiaries in a Family Trust

These are the questions that ANZ asks as to who the beneficial owners are of a Family Trust. As you can see, banks will not ask for a list of Beneficiaries for a family trust. It is a silly question given the nature of Family Trusts.

Q: The banker is asking if any of the beneficiaries are a member of a ‘class’. Do the terms of the trust identify the beneficiaries as members of a beneficiary class (eg unit holders, family members of a named person, charitable organisation, or cause)?

A: Again, as stated above, these are not questions for a Family Trust. Almost all beneficiaries in a Family Trust, of which there are 1,000s, are referenced by the ‘class’ they are in.

For example, ‘the children of the Appointor’ is a class. So are all religious groups and educational organisations. Most Family Trusts in Australia are structured that way. So, to answer the two questions is always yes. This is for all Australian Family Trusts. But as I said, it is a silly question to ask. This is because the answer is always yes.

Banker wants a Specified Beneficiary removed from a Discretionary Trust

There may be Capital Gains Tax and stamp duty issues when changing a Default Beneficiary. Build this document to exclude a Beneficiary of a Family Trust. (On another topic, sometimes you have to do things to reduce a foreign beneficiary for state land tax and stamp duty surcharges. But that is another matter.)

A default beneficiary does have a contingent interest in the Family Trust property. But the interest is contingent upon the trustee not exercising its discretion otherwise. This rarely happens. See Chief Commissioner of Stamp Duties (NSW) v Buckle (1998) HCA 4; 192 CLR 226.

The ATO believes that neither an ordinary nor a default beneficiary has an ‘interest’ in a discretionary trust of the type referred to in section 104-70. See ATO TD 2003/28.

Banker wants to add a Beneficiary to the Discretionary Trust

Above, the banker wanted you to remove a beneficiary from your Family Trust. Here, the banker wants your spouse or another family member added as a Primary Beneficiary or General Beneficiary.

This may be because you are now married or due to a miscommunication with the bank manager. There are stamp duty and capital gains tax (CGT) on doing this, and there is generally no compelling reason why this needs to be done—other than the local bank manager thinking it is a good idea or misinterpreting directions from head office. Before agreeing to such a change, understand the legal and tax implications. This is not a simple administrative tweak to your Family Trust deed.

Why is there CGT and stamp duty if I add a person as my Primary Beneficiary?

Adding to the class of primary beneficiaries or general beneficiaries in a discretionary trust triggers stamp duty and CGT because it is treated as creating a new trust. This variation results in a resettlement of the trust, creating a new trust for taxation purposes. Resettlement occurs when the trust’s terms fundamentally change, altering the beneficiaries’ interests or the trust’s core purpose. The Australian Taxation Office (ATO) and state revenue offices closely scrutinise such changes.

- Stamp Duty: When resettlement occurs, state laws impose stamp duty as if the Family Trust assets have been transferred to the new trust. Adding a primary beneficiary is rarely exempt, as it expands the class of persons entitled to trust property, for example

- Under the Duties Act 2000 (Vic), Section 36, a change in beneficial interests in a trust can be deemed a transfer of dutiable property, attracting stamp duty.

- Similarly, in New South Wales, the Duties Act 1997 (NSW), Section 54, imposes duty on transactions that alter trust interests unless a specific exemption applies (e.g., for minor administrative changes). Adding a primary beneficiary is rarely exempt, as it expands the class of persons entitled to trust property.

- Chief Commissioner of Stamp Duties (NSW) v Buckle (1998) HCA 4; 192 CLR 226: The High Court confirmed that a default beneficiary in a discretionary trust has only a contingent interest, dependent on the trustee’s discretion not being exercised elsewhere. However, adding a new primary beneficiary expands the pool of potential recipients, which may shift the trust’s purpose or structure enough to trigger a resettlement under state stamp duty laws.

- Capital Gains Tax: A resettlement is a ‘disposal’ event for CGT purposes under the Income Tax Assessment Act 1997 (Cth) (ITAA 1997), Section 104-60. The trust is deemed to have disposed of its assets at market value to the “new” trust, triggering CGT liability. The ATO’s view, as outlined in Taxation Ruling TR 2006/7, is that a significant variation—such as adding a beneficiary—causes a trust to lose its continuity, resulting in a CGT event E1 (creation of a new trust). This is a costly outcome that banks often overlook when making such strange requests.

-

- Federal Commissioner of Taxation v Clark [2011] FCAFC 5: This case clarified that not all changes to a trust deed result in a resettlement for CGT purposes. The Full Federal Court held that minor administrative amendments (e.g., updating trustee powers) do not trigger CGT event E1, but substantive changes—like altering the class of beneficiaries—can. Adding a primary beneficiary typically falls into the latter category, as it reshapes the trust’s beneficial ownership structure.

- ATO TD 2003/28: The ATO’s determination reinforces that neither ordinary nor default beneficiaries have a fixed “interest” in a discretionary trust for CGT purposes under Section 104-70 of the ITAA 1997. However, adding a primary beneficiary can still trigger a CGT event if it amounts to a resettlement, as it fundamentally alters the trust relationship.

Other words for Primary Beneficiary, Taker in Default, Specified Beneficiary

Because Family Trust deeds are unregulated, different law firms use different expressions for the Primary Beneficiaries.

Here is a list of alternative names used for a primary beneficiary in a family trust. We explain where the expressions derive from:

- Taker in Default – I like this term because it shows what happens when the Appointment fails to tell the Trustee who will distribute the family trust’s tax income for the financial year. It is often used in cases where the beneficiary receives assets if no other conditions are met.

- Default Beneficiary – Indicates the individual or group who receives assets by default if no other allocation is made at the end of the life of the trust. (The above de

- Specified Beneficiary – Denotes beneficiaries explicitly named in the trust deed.

- Named Beneficiary – Refers to a beneficiary directly identified in the trust documentation.

- Principal Beneficiary – Highlights the main beneficiary for whom the trust is primarily intended.

- Major Beneficiary – Suggests the beneficiary receiving the majority or a significant portion of trust assets.

- Primary Taker – Used to describe the main recipient of the trust benefits.

- Designated Beneficiary – Refers to those explicitly designated to receive trust benefits.

- Key Beneficiary – A term emphasising the importance of this beneficiary in the trust arrangement.

- Main Beneficiary – Another term underscoring the primary recipient’s role.

- First Beneficiary – Indicates priority in receiving trust benefits.

- Specified Taker – Focuses on those specified to benefit from the trust assets.

These expressions generally all mean the same thing.

Business Structures used when borrowing money from a bank or lending institution

Family trusts borrowing money

- Family Trust Deed – watch the free training course, you will have this vehicle for decades so get to know it

- Family Trust Updates – family trusts, like your car need servicing every 6 – 7 years, otherwise they go out of date:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for the latest taxation rules, the bank will require an up-to-date deed or it will not lend you the money

- Guardian and Appointor – only update the Guardian & Appointor for succession planning – when the Appointor dies, then your Backup-Appointors take over

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – what are the tax advantages of a corporate beneficiary

Unit trusts borrowing money

- Unit Trust – a Family Trust is for a Mum and Dad. A Unit Trust is for two or more separate families.

- Unit Trust Vesting Deed – wind up your Unit Trust, often used to satisfy the bank, Centrelink and the ATO

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures that can borrow money from banks

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – most banks will not lend to companies with no Constitution. If you have an old Memo & Articles or out of date Constitution then update it.

- Replace lost Company Constitution – don’t waste the banks time telling them you lost the Constitution. It will count against you when they are assessing you.

Legal Consolidated Service trusts and Independent Contractor Agreements can also borrow money

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case