Welcome to Legal Consolidated Barristers & Solicitors

- Legal Consolidated is responsible for the documents.

- Your client becomes our client.

- There is a direct client relationship between us and your client.

- Every document comes with a letter confirming we authored the document built on our website.

Legal Consolidated website vs non-law firm website

- Over 6,400 Australian accountants, law firms and advisers build legal documents on our website.

- This is for their clients.

- Because we are a law firm, your client becomes a client of the law firm.

- Therefore, our law firm is responsible for the documents built on our website.

- Every document comes with a letter addressed to your client confirming that we authored the legal document.

In contrast, a non-law firm website:

- merely resells a lawyer’s template; and

- therefore, there is no law firm responsible for the documents you built for your clients

Non-law firm’s websites merely re-sell a lawyer’s template – dangerous

Non-law firm websites buy, beg, borrow or steal a law firm’s template.

Often the templates are never updated or monitored by a law firm. In Australia, a law firm is not responsible for ‘re-sold’ templates. You, as the accountant and your client, are on your own.

Worse still the adviser and accountant are providing ‘legal advice’. This is because the template is resold by non-lawyers. There is no direct relationship between the lawyer that first provided the template and the end-user being the accountant’s client. ‘Tax agent services’ does not extend to giving legal advice: s90-5(1) TASA 2009. Tax agents are not protected by non-law firm websites.

ACT and South Australian tax agents using non-law firm websites breach:

- s16(1) & 21(2)(b) Legal Profession Act 2006 (ACT); and

- Legal Practitioners Act 1981 (SA)

Using a non-law firm website breaches ‘preparing documents that create or regulate legal rights’.

In Western Australia, a non-law firm website breaches the ‘preparing of any deed, instrument or writing dealing with real or personal estate’.

Even the supply of Trust deeds and Employment Contracts breach the law. A tax agent building trust deeds on a non-law firm website breaches the law: sections 21(2)(d) and 21(2)(b) Legal Practitioners Act 1981 (SA).

Incorporating a company on a non-law firm website breaches the law because a company needs (or should have) a constitution. A constitution is a ‘deed’. Only lawyers can legally prepare deeds. Similarly, a POA is a deed. So an accountant or adviser building a POA on a non-law firm website, including a website provided by a State government, breaches the law.

We do not re-sell a lawyer’s template. We are the law firm.

Before using a non-law website consider:

- Who is drafting the legal document? The Family Trust Deeds, Power of Attorneys, 3-Generation Testamentary Trust Wills, Loan Agreements, Leases and the 100s of other documents are drafted by the Australian law firm Legal Consolidated Barristers & Solicitors.

While accountants and clients may type in answers to the questions, the law firm controls the logic flow, questions, hints, training videos and systems. We retain the copyright of our documents and we are responsible for the legal document. The law firm is drafting the online document.

- Who is responsible for the drafting and its legal correctness? The law firm developed and controls the system. The law firm provides locked PDF documents of the finished document together with a covering letter on law firm letterhead confirming that we prepared and drafted the legal document.

- Where are the client’s ‘personal information’ and data stored? All information is stored on the law firm’s website. Your client retains legal professional privilege. However, Legal Consolidated does not see or retain any person’s credit card details.

- Can non-lawyers charge to prepare legal documents? No, they cannot. However, a professional person such as a financial adviser or accountant can charge for the time in giving the relevant financial planning and accounting advice.

For example, much of the work in Estate Planning is understanding the client’s tax position, financial planning, superannuation, insurance and business structures. Just as you cannot give legal advice. We are not able to give financial planning advice. For example, we can not give advice on reversionary pensions. And we are not licenced tax agents.

All documents built on Legal Consolidated’s website are signed off by us – the law firm

Non-qualified suppliers of legal documents claim that their Deeds are ‘signed off’ by an Australian lawyer.

This suggests that a lawyer has approved the legal document you are building online.

However, there can only be a ‘lawyer sign off’ when the legal document is prepared directly on a law firm’s website, such as Legal Consolidated Barristers & Solicitors’ website.

This is not the case with non-law firm websites.

Be careful with websites that are not law firms. Ask these non-law firm websites three questions:

- Who is responsible for the legal document?

- May I please have the above answer on a law firm’s letterhead?

- Where is the covering letter, on law firm letterhead, confirming that the law firm authored and is responsible for the Deed?

A re-sold lawyer template is:

- different from purchasing a legal document directly from the law firm’s website

- not ‘signed off‘ by a lawyer.

With all Legal Consolidated Deeds, you get a cover letter. It is signed by a lawyer from our law firm. It confirms that Legal Consolidated authored the legal document.

Are accountants and advisers giving legal advice when building legal documents on our website?

Our law firm’s website empowers accountants and financial advisers to build legal documents for their clients. Documents include Trust Deeds, Self-Managed Super Deeds, Companies and 3-Generation Testamentary Trust Wills.

Legal Consolidated Barristers & Solicitors is the only law firm in Australia providing online legal documents. On our website, you deal directly with a law firm. We provide:

a. Legal Professional Privilege

b. legal advice and help to answer online questions – telephone, email or chat with us

c. letter confirming that Legal Consolidated Barristers & Solicitors authored and is responsible for the document

d. the law firm is responsible for the legal document including:

-

-

-

- the questions, hints and training videos

- dynamic logic flows – the next question changes depending on the previous answer

- the answers you type in (e.g. if the accountant or adviser incorrectly misspells the client’s name we are responsible)

- legal documents, minutes and cover letter

- the signing of the documents

-

-

Am I giving legal advice when I build a document on a law firm’s website?

You are not giving legal advice when you build documents on our law firm’s website. You are a ‘mere scribe’. See:

- Attorney-General v Quill Wills Ltd (1990) 3 WAR 500

- Legal Practice Board v Computer Accounting and Tax Pty Ltd [2007] WASC 184

- Cornall v Nagle [1995] 2 VR 188 at 210

- Tax Agent Services Act 2009 (Cth)

- Sinclair v C of T [2010] AATA 902

- Andre Agassi v Robinson & Bar Council & Law Society [2005] EWCA 1507

The Tax Institute’s Estate & Business Succession Planning, 7th edition, states on page 9:

‘Work that is undertaken in association with the law or legal practice will not necessarily constitute engaging in legal practice. Examples include:

* clerical or administration tasks

* selling legal documents; and

* advising of incidental legal requirements by a person in the pursuit of an occupation other than law, eg tax agents advising on the requirements of tax legislation.’

For Estate Planning what do the accountant and adviser put on the Tax Invoice?

Q: We have just completed our first Estate Planning bundle for our client.

I am grateful that Legal Consolidated Barristers & Solicitors provides a written letter on its letterhead. The letter is addressed directly to the client. It clearly confirms that Legal Consolidated is the sole author, and owner and is responsible for the legal document.

Your online building process for Estate Planning allows me to generate a new revenue stream from work that I am largely already doing. Your website gives me the confidence to advise on the benefits of estate planning. It is a complete service model for my practice.

We are about to invoice the client for our time as a scribe. This is for typing in the answers to the questions.

What do you consider is appropriate wording, to have on our invoice, for being a scribe?

A: I don’t think you are looking at it from the correct perspective. On the back of many accountants’ and financial planners’ business cards, you see a list of services. One of them is often ‘Estate Planning’.

Estate Planning is much more than a Will and POAs. In fact, a Will and POAs are, with respect, only a minor part of a lifetime Estate Planning process that accountants and advisers embark upon for each of their clients. For example, is it not the job of the adviser to 1. create wealth 2. preserve wealth and 3. transfer wealth at the correct time, such as divorce, death and succession planning?

Further, many aspects of Estate Planning are the sole province of the financial planner. This includes Reversionary Pensions, superannuation and the like. Similarly, only accountants can give advice on the taxation implications and preparations.

I would have thought that on your Tax Invoice, you would put “Estate Planning $6,500” or whatever fee you charge as a financial planner or accountant. And then add incidental costs such as the costs of the insurance broker, finance broker fees, estate planning lawyer fees, valuers fees and the like.

Can the adviser’s client pay for the documents with their own credit card?

Yes, irrespective of whose account it is in, any credit card can be used to pay for the document. And that credit card can be different each time.

So the client can pay directly with their credit card.

This is the case even though the account is in the name of the accounting practice, financial planning or law firm.

Who is better at Estate Planning – lawyer or adviser?

I had a call from an adviser in Sydney. His client died. His children rang up the adviser. They claim that Dad’s estate is worth $100k. But the death tax is $32k.

I found that hard to believe.

The adviser tells me that the only asset of the dead father’s estate is $100k. This is life insurance in the Superannuation fund. Because the children are over 18 there is a 32% non-dependency tax.

I asked why there is no Superannuation Testamentary Trust in the Will. This reduces the non-dependency tax on the super. In fact, I telephoned the lawyer that put the Will together. He is a well-respected family lawyer that I know. To protect him I call him Robert. This is how the call goes:

Brett: Robert how come you didn’t put a Superannuation Testamentary Trust in his Will?

Robert: Brett as you know I only practice in family law. I didn’t know that there is a tax on super at death. I did put a note in the cover letter. It states that I don’t do tax. In future when I get another Will to do, which is not that often, I will add to the note to say that I don’t give advice on tax and superannuation.

Brett: But Robert did you speak with the client’s accountant and financial planner?

Robert: I didn’t see much need to do so. I am the lawyer, not them.

The financial planner and accountant are the centre of the universe. Those professionals get the team together. They source the best risk adviser, family lawyer, tax lawyer, share broker, actuary, finance broker etc…

Estate Planning is best controlled by the accountant and the financial planner. They know the client. They are the best professionals to be the project manager of the estate planning process.

Can I buy a template over the Internet and change it in MS Word?

It is illegal for you to update or manipulate a legal document in MS Word.

See Legal Practice Board v Computer Accounting and Tax Pty Ltd [2007] WASC 184.

In this case, the accountant purchased a trust deed template. The trust deed came from a law firm. However, the accountant, in MS Word, populated the template. This is with the client’s name and address.

The court held that the accounting firm was breaching the relevant legislation. It is not a law firm and is not allowed to prepare legal documents.

Further, neither the accountant nor the client had legal professional indemnity insurance. This is for any issues that arise out of the legal document.

This is why all Legal Consolidated documents are delivered to you as a locked PDF. If they need updating we give you a voucher to update the document on our website. We control the questions, hints, logic flow and the finished legal document. We provide a letter addressed to your client to confirm that Legal Consolidated prepared the document. Legal Consolidated is responsible for the document.

Even when the non-lawyer states that they are not lawyers that is not good enough: Legal Services Commissioner v Raghoobar [2023] QSC 41. Only a law firm can provide legal advice and prepare deeds.

I ‘found’ a Division 7A Loan Agreement in MS Word. Can I put in the client’s details and email it to them?

Division 7A is the third highest area of negligence claims against accountants.

I am gobsmacked as to why an accounting house takes the risk of providing legal documents to clients.

If an accountant populates a Word document then the accountant is liable for the legal document. That is breaking the law. And the accounting house has no insurance to cover problems with that legal document. See Legal Practice Board v Computer Accounting and Tax Pty Ltd [2007] WASC 184.

Instead, build a Division 7A Loan Deed on our website. Legal Consolidated is then responsible for the deed. All our documents are provided:

- As a locked PDF

- With a cover letter addressed to your client. It confirms that Legal Consolidated prepared the legal document.

Why do lawyers no longer use ‘Schedules’ in their legal documents?

Q: As a banker, I found Schedules useful just to copy that particular page of the Trust deed, Loan or Lease agreement. But law firms no longer use them. Why?

A: “Schedules” are a sheet of paper attached to the legal document. They carry some, but not all of the variables. Schedules have no terms of the agreement. For example:

- For a Lease, it lists “Leasee”, “Lessor”. “Lease Fee” and “Term”.

- For a Family Trust, it lists “Appointor”, “Back-up Appointor”, “Trustee”.

- For a Loan Agreement, it lists “Lender”, Borrower”, “Amount Lent”, “Interest Rate”.

- In an Employment Contract “Employer”, “Employee”, “Salary”.

Lawyers rarely use Schedules in their legal documents, these days. They are considered old fashion and lazy drafting.

Schedules in legal documents were popular before word processors. Up until the 1970s, the lawyer (a man in those days) goes to a printing shop. He prints out the substantive part of the legal document. A big stack of them. His secretary (a woman in those days) merely types in the main variables of the agreement. E.g. Lender, Borrower, Amount Lent and Interest Rate.

The schedules look terrible. No self-respecting lawyer is caught dead with them these days. In fact, a sure-fire way to find out that the legal document is being ‘resold’ by a non-law firm website is to see a “Schedule”.

Since the 1980s law firms incorporate all parties and terms into the substantive part of the legal document. It looks better. It tells the whole story.

And most importantly, you cannot expect to just copy the Schedule and think you know the entire legal document.

The careful banker reviews the entire legal document

Now let us turn our minds to the banker. A careless banker just copies the Schedule containing the parties’ details. That is a useless amount of misinformation. Proper due diligence is reviewing the entire legal document.

A banker that merely reviews the schedule of an old legal document (or something prepared by a non-law firm website) only gets part of the story.

Careless bankers are duped. For example, the client merely puts misleading information in the Schedule. And then puts the full story in the legal document. The careless banker is none the wiser. I doubt a banker is silly enough to just look at a Schedule and believe that the bank’s due diligence is complete!

That would be akin to the banker getting married to someone on the strength of just their Facebook page. The careful banker reviews the entire deed.

Adams on Contract drafting expresses concerns with Schedules.

To appease the bank and their ‘due diligence’ copy the entire document and email it to them.

Who owns the Legal Consolidated login details?

The person or practice who owns the domain name for the username or email address owns the account. When an employee or co-owner leaves the person who continues to control the domain name controls the Legal Consolidated account.

What about a financial planner’s Dealer Group?

The Australian Financial Licensee (AFS) provides a list of ‘financial products’ financial advisers offer your clients. Legal services, such as our law firm’s online legal documents, are not investment products. They are legal documents.

Your practice can build legal documents online for clients. Each document comes with our letter confirming we authored the document.

Some dealer groups and accounting houses require that a lawyer speaks to your client. Just tick the box, as you build the document if you want this service. A lawyer contacts your client directly regarding the document.

Build your own Estate Planning Standard Policy for your practice.

Lawyers building legal documents on Legal Consolidated’s website

Q: I think you are the only law firm in Australia that provides all 16 POAs. This is right across Australia.

- Can I change the POAs to suit my client’s requirements?

- I am a lawyer. I am concerned as to your comment that “your client becomes our client and there is a direct relationship” etc. What does this mean? I would not want you to contact my client.

A: The three biggest builders of legal documents on our law firm’s website are lawyers, accountants and financial planners.

We are honoured that fellow lawyers build legal documents on our website. Thank you.

As I write this answer to your question, a lawyer in Port Macquarie telephoned me. This is about updating a Family Trust deed for his client. This is on our law firm’s website. He is a commercial/family lawyer. Just as Legal Consolidated has no skill or knowledge of those areas of practice, so too, that lawyer does not want to engage in trust law. It is hardly worth his effort. He only needs a Family Trust deed and updates a couple of times a month.

Now, as a lawyer, I know, because we are anal retentive, and we have to be, that lawyers like to continually change their documents. Let me say two things:

-

-

-

- The online building process has two purposes:

- Firstly, to educate. There are many hints and training videos for each question.

- Secondly, to craft a document suitable for the client’s needs. This is based on how the questions are answered. Legal Consolidated remains responsible for that document.

You press the Lock and Build button and pay for the document with your credit card. The document then comes out as a locked PDF. We do not want you to change the document. If the document is not suitable just email us for a voucher to update it. This is using the same question-and-answer routine.

Thank you for your kind comments about Legal Consolidated being the only law firm in Australia to provide POAs, online, in all 8 Australian jurisdictions. Now remember, each POA is peculiar. In Tasmania both the enduring and medical have to be registered to be effective. That is not the case in NSW. In Western Australia, an enduring POA cannot be lodged at the title’s office, unless it is printed back to back (duplex). You are paying Legal Consolidated because of its expertise and knowledge. It is best not to change anything, other than the changes in the question-and-answer building process.

Try the free building process. It is educational. If the document is still not what you want, we provide a full refund. This is back to the credit card you used.

- As to our promise to be responsible for the document, that can only be achieved if we are acting directly for your client. As you can read above when a document is provided by a law firm to a marketing company that provides legal documents on a website the lawyer providing the template is no longer responsible for the document.

An Australian law firm is not responsible for templates that are resold by these ‘marketing companies’. Even though these ‘marketing companies’ give the impression they are law firms themselves.

I cannot understand why lawyers, accountants and financial planners would build legal documents on ‘marketing’ (non-law firm) websites. They and their clients are not protected.

- The online building process has two purposes:

-

-

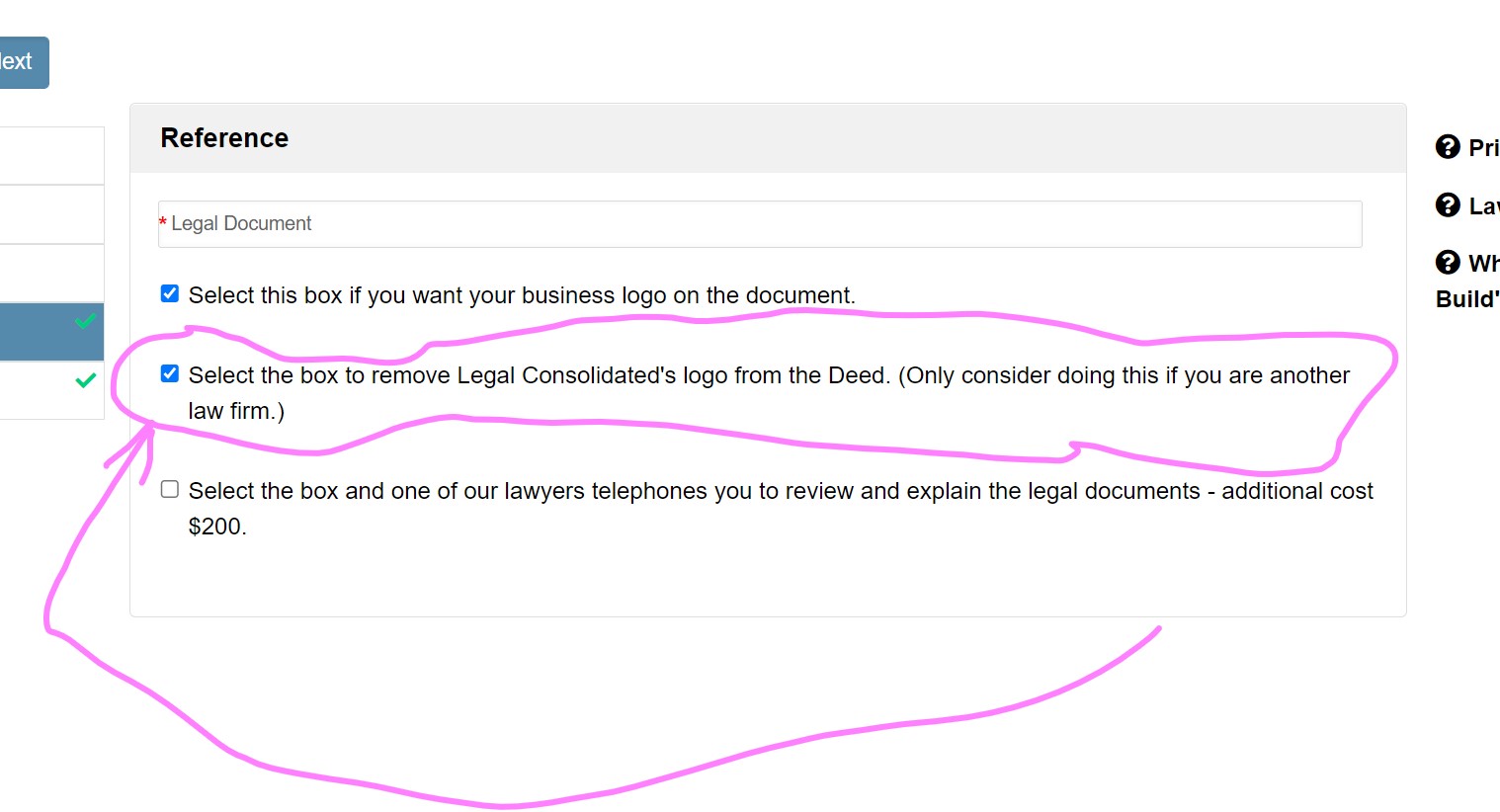

Anyway, on the last page of the building process, you can tick a box to remove the “Legal Consolidated” logos etc… Only do this if you are a lawyer. We have no contact with your client.

While you can build over 380 different documents with us, the most commonly built documents by advisers and accountants are:

3-Generation Testamentary Trust Wills

SMSF special purpose companies

Our law firm’s retainer

Click this link to view our Retainer

Our law firm’s Privacy Policy

Click this link to view our Privacy Policy

Our duty is to the court first

As an Australian law firm, we are officers of the court. Our first and foremost duty is to the court. It outweighs any obligation that we have to our clients. While we have an ethical responsibility to act in the best interests of our clients, acting in the best interests of our clients does not mean ever putting our ethical duty to the court second.

Legal Consolidated’s first duty is to the court and justice system

Our most important duty is to the court and the administration of justice. This means that if acting in your best interests conflicts with our duty to the court, we must and will always put the court before you. We are respectful to other people involved in any court case, such as court staff, the person with whom you are in dispute, the other side’s lawyer, and any witnesses in the case.

We can not act for you if there is a conflict of interest. We only have one master.

Lawyers have a duty of care to look after their clients’ interests. The Legal Profession (Solicitors’ Conduct) Rules 2020 include rules about how conflicts of this duty must be managed. We cannot act for you or the other person if there is a conflict of interest. We can only serve one interest. If those interests are not aligned we no longer act for you. An example of a conflict of interest is when you tell us a secret and you tell us not to tell the other person who we act for.

Legal Consolidated may form the view that we have a potential rather than an actual conflict of interest. In that event, we will stop acting for you. You may believe that we do not have a conflict. But this is a decision that Legal Consolidated will make. We are a conservative law firm and we take our higher duties to the court very seriously.

When do we stop acting for a client?

We will not act for you if you fail to give us instructions or your actions may break the law. Our duty is to the courts and judicial system first.

Use of the Service Law firm providing legal documents online

1. All legal documents you build on our law firm’s website are subject to the Terms of Service.

2. Legal Consolidated Barristers & Solicitors is an Australian law firm. We can and do give legal advice. Seek advice if you are unsure about the legal document you need.

3. You may incorrectly interpret or misunderstand a question and therefore end up with a document that is wrong or won’t work. So contact us as required.

4. The legal, commercial and taxation effects of a document varies based on your personal situation. Have your accountant or financial planner contact us.

5. Only you know the purpose for which you intend to use a document you build: Our law firm is not responsible for your choice of the document. If in doubt, telephone us on the document’s suitability.

6. Legal Consolidated operates in Australia. We only operate in Australia. We do not give advice on matters that do not relate to Australia and are outside the Australian jurisdiction.

By using Legal Consolidated you agree to these terms of service.

General Permissions & Restrictions

You agree not to distribute any of our information or documents.

You agree not to alter any part of the documents. If you do then we are no longer responsible for the document.

Legal Consolidated 100% Full Refund Policy

You get a full refund, upon request, for any documents you do not wish to use.

Indemnity

To the extent permitted by applicable law, you agree to defend, indemnify and hold harmless Legal Consolidated, any parent corporation, officers, directors, employees and agents, from and against any and all claims, damages, obligations, losses, liabilities, costs or debt, and expenses arising from your use of and access to the services.

Please telephone for help building our legal documents