Do overseas Australian Expats need a tax-effective Will and POA? I completed my doctorate in succession with my wife while living in London, I have firsthand experience of the allure and complexities of living overseas.

Today’s globalised world tempts many of us with opportunities overseas, drawing us with the promise of professional and personal growth. Whether immersing in European culture or navigating Asia’s business hubs, the benefits are significant.

However, how does your overseas adventure impact Australian death taxes and estate planning? Do you need a tax-effective Australian Will?

Do overseas Australian Expats need a tax effective Will and POA?

While living overseas we leave assets such as bank accounts, shares, superannuation, life insurance, and real estate in Australia. We also inherit our parent’s assets.

We intend to manage our assets upon returning home. However, that may be too late. Life’s unpredictability leads to extra defacto death taxes for your Australian assets.

How Australia’s de facto death taxes affect expats’ estates

All Australians suffer from four de facto death taxes on their assets in Australia. These include Capital Gains Tax, Stamp (transfer) Duty, income tax, and a 32% tax on superannuation payouts.

Further, your estate suffers three additional death taxes if all your executors live overseas.

These death taxes are reduced by a 3-Generation Testametnaty Trust Will. They come with:

- Divorce Protection Trusts

- Bankruptcy Trusts

- Protects your right to sell your Australian home up to 3 years after their death – tax-free

- Special Disability Trust – and still get Australian Centrelink benefits

- Reducing the 32% tax on the dead person’s superannuation

- Considered Person Clause – to stop people from Australia and overseas from challenging your Will

- Succession planning for an Australian company

Protect global assets with Legal Consolidated’s 3-Generation Testamentary Trust Wills

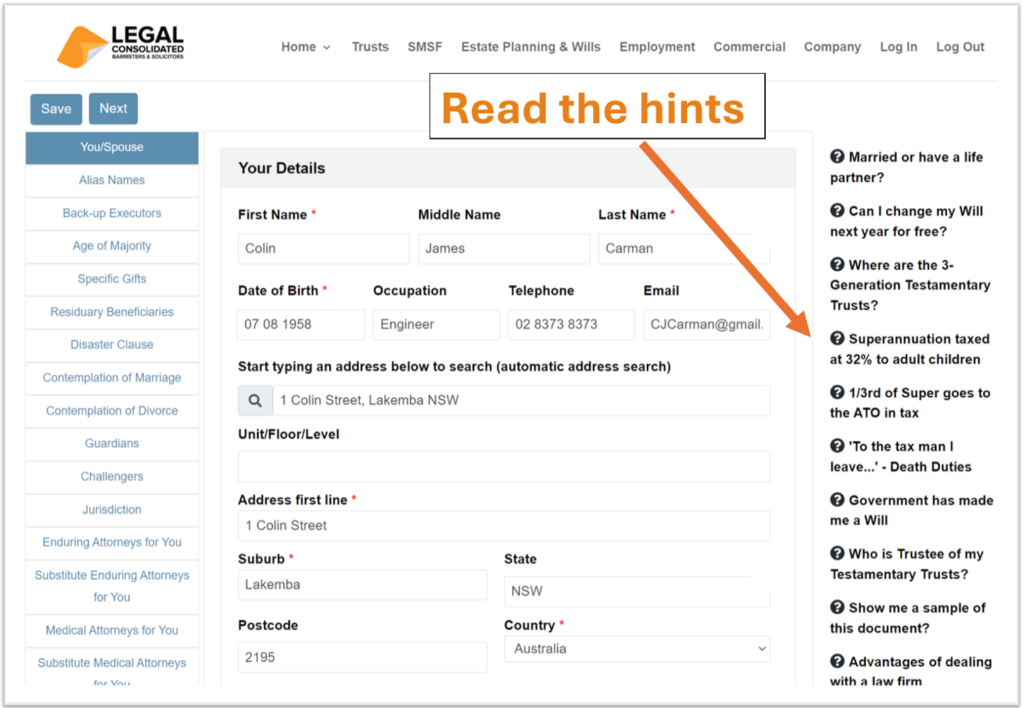

On Legal Consolidated’s website build the 3-Generation Testamentary Trust Wills.

Our Wills comply with the Hague Convention. Therefore, they work in over 99% of countries – not just for Australian assets. The 3-Generation Testamentary Trust Will protects and deals with both Australian and non-Australian assets.

This is a list of countries where Legal Consolidated’s 3-Generation Testamentary Trusts operate.

Three-generation Testamentary Trust Wills also include Australian Divorce Protection Trusts and Bankruptcy Trusts. These protect your beneficiaries and are not commonly found in overseas Wills.

Challenges in international estate administration for Australian expats

What happens when an Australian expatriate dies overseas without a valid Australian Will? The process of managing or repatriating these assets becomes a complex legal and taxation challenge.

Executors struggle to secure a Grant of Probate in Australia, facing costly and time-consuming procedures due to non-compliance with Australian legal standards and the different state and federal government taxes.

The risks of dying overseas without a Will: intestacy laws for expats

Dying intestate (without a Will) means your assets are distributed according to predefined rules, likely not reflecting your wishes or saving tax. This is particularly complex for expatriates with assets and familial ties across multiple countries, possibly leading to disputes and unintended claims. Also, there is no tax planning.

Key benefits of an Australian 3-Generation Testamentary Trust Will for expatriates

An Australian 3-Generation Testamentary Trust Will ensure your assets are managed according to your wishes, regardless of where you live. A 3-Generation Testamentary Trust Will from Legal Consolidated aligns with international norms and provides a comprehensive taxation strategy for managing your global assets efficiently.

Managing legal and financial affairs from abroad: power of attorney explained

While living overseas, build Australian POAs. Appoint a Power of Attorney (POA) in Australia to handle your financial and legal matters. Each state and territory in Australia has its own rules for Enduring POA (money) and Medical/Lifestyle POA.

- Money Enduring POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- Medical, Lifestyle, Guardianships, and Care Directives:

- Work in every state Company POA – when directors go missing, insane or die

For example, if you own assets, like real estate, in multiple states—for example, in both Melbourne and Brisbane—you need separate Enduring POAs for each Australian state, one for Victoria and the another for Queensland.

How do Australian expats protect their estates both in Australia and overseas?

Because of the additional taxes, getting an Australian tax-effect estate plan is important. Australian expatriates should ensure their assets and loved ones are protected by establishing appropriate legal documents, including an Australian 3-Generation Testamentary Trust Will to reduce the de facto death duties.

This simplifies the legal process and ensures that your global lifestyle does not complicate your estate’s future with Australian taxes. Robust estate planning with a Legal Consolidated 3-Generation Testamentary Trust Will is essential for navigating the complexities of international living.

Expats get free updates on their WIlls and POAs – for life

The 3-Generation Testamentary Trust Wills and POAs can be updated for free. You can update your Wills and POAs as often as you wish. This can be done whether you are living in Australia or overseas.

Expats and their families get free advice on how to use Wills and POAs

Included in the cost of the Legal Consolidated Wills and POAs is free advice. This is for both you and your family. For example, if the person you appointed in your POA needs help we will help them at no charge.

Does Legal Consolidated help if my children’s guardians live overseas?

For Expats with assets both in Australia and overseas protection from death duties, divorcing and bankrupt children and a 32% tax on super. Build online, from anywhere in the world, with free lifetime updates:

Couples Bundle build from anywhere in the world

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle built from anywhere in the world

includes 3-Generation Testamentary Trust Will and 2 POAs

For expats these are the extra Australian Death Taxes

- When living overseas Australia’s four death duties

- 32% tax on superannuation to adult children

- Selling a dead person’s home tax-free from outside of Australia

- HECs debt at death if you die overseas

- CGT on dead wife’s wedding ring

- Extra tax on foreigners and Charities

Vulnerable children living in Australia or overseas

- Build online your 3-Generation Testamentary Trust Will for Australian and overseas assets to include:

- Divorce Protection Trust if children divorce anywhere in the world

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Overseas Guardians for under-18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Wills when overseas

- Contractual Will Agreement for second marriages

- Across all countries Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my overseas lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in an overseas hospital or isolating?

- lose my Will or my overseas home burns down?

- have addresses changed or are addresses not in Australia in my Will?

- have foreign nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills for foreign assets

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements when overseas

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Australian Family Court looks at dead Dad’s Will