1. Address changes after I sign my Will and POAs?

An advantage of Legal Consolidated Wills, POAs and all our legal documents is that if:

- your address changes in your Wills, POAs or any other legal documents or

- the addresses change for your executors, beneficiaries, attorneys in your POAs, attorneys and other parties in any contract

then you do not need to update your Wills, 3-Generation Testamentary Trust Wills, Enduring POA or Medical Lifestyle POAs. Your estate planning documents remain valid even if addresses change.

Example of someone changing their address AFTER their Will is signed:

Patrick O’Connor lives at 12 Greenfield Drive, Bondi, NSW 2026, when he builds his Will and Power of Attorney (POA) on Legal Consolidated’s website. In his Will, Patrick names his sister, Siobhán Murphy, who resides at 45 Bluegum Street, Footscray, VIC 3011, as his executor and beneficiary.

A year later, Patrick moves to 98 Banksia Avenue, Fremantle, WA 6160, and Siobhán moves to 22 Jacaranda Crescent, Toowoomba, QLD 4350.

-

-

-

-

-

-

-

- Patrick’s Will and POA remain valid despite these address changes.

- He does not need to update his legal documents.

- Legal Consolidated ensures the documents stay valid, even if addresses for Patrick, Siobhán, or anyone else involved change.

-

-

-

-

-

-

This saves Patrick time and money while maintaining the integrity of his estate planning documents.

2. Address changes before I sign my Will and POAs?

If addresses change after signing your Will or Power of Attorney, there is no need to update the document — it remains valid.

However, if an address changes before signing, update the address before signing.

Your address and the addresses of attorneys, beneficiaries, and executors must be correct at the date of signing.

If addresses change AFTER you sign the legal document, that is fine. You do not need to update your document.

What if an address changes before you get a chance to sign the Estate Planning document? Do not sign out-of-date Wills and POAs. Update the Will or POA before you sign. You can update your Wills and POAs as often as you wish. This is for any reason for the rest of your life. Just email us your Tax Invoice. We email you a voucher to update your Wills and POAs.

An example of a person changing their address before they sign their Will and POAs:

Maria Elisabetta Rossi lives at 20 Bellavista Road, Carlton, VIC 3053, when she built her Will and Power of Attorney (POA) on Legal Consolidated’s website. She names her brother, Giovanni Luca Bianchi, who resides at 15 Olive Tree Lane, Norwood, SA 5067, as her executor and beneficiary.

Before Maria signs her Will and POA, she moves to 45 Sunset Drive, Newtown, NSW 2042, and Giovanni moves to 32 Cypress Grove, Hamilton Hill, WA 6163.

-

-

-

-

-

-

-

- Maria cannot sign the documents with the old addresses. Her Will and POA must be updated to reflect the correct address.

- Legal Consolidated Wills and POAs can be updated for free as often as you wish.

- She emails Legal Consolidated her Tax Invoice, and the law firm prepares and emails her a voucher to update her Will and POA.

- Maria updates her documents and signs them with the correct addresses, ensuring their validity.

-

-

-

-

-

-

This simple process ensures that Maria’s legal documents are up-to-date and accurate before she signs them. Legal Consolidated allows free updates as often as needed, free of charge.

Why Addresses Must Be Correct on the Day of Signing a legal document

Addresses in legal documents serve a practical and legal purpose. When signing a Will or Power of Attorney (POA), the addresses must be accurate for the following reasons:

- Clear Identification:

Including addresses helps identify the individuals mentioned in the document. This is especially important if the names are common. For example, distinguishing between “John Smith” at 12 Green Street and “John Smith” at 45 Ocean Avenue clarifies who is referred to in the Will or POA. - Legal Certainty:

Correct addresses reduce ambiguity. If an executor, attorney, or beneficiary cannot be identified due to incorrect or incomplete information, it could lead to delays or disputes during the administration of an estate. - Practicality for Communication:

Executors, attorneys, and beneficiaries are often contacted by post or through legal representatives. Accurate addresses at the time of signing ensure smooth communication without delays or misdirection. - Court and Probate Processes:

Probate courts often rely on the addresses in the Will to validate and locate the individuals involved. Incorrect information can complicate these processes, requiring additional verification steps.

Why does Legal Consolidated include Addresses in Wills?

- Identification and Differentiation:

Addresses help differentiate between individuals with similar names. This is crucial for avoiding disputes and identifying the right person in legal proceedings. - Locating Beneficiaries and Executors:

Including addresses ensures that executors, attorneys, and beneficiaries can be located efficiently when the Will is signed. This is vital for the timely estate distribution and fulfilment of the deceased’s wishes. - Legal Requirement or Custom:

While not always legally required, including addresses is common in estate planning. It aligns with best practices to avoid challenges during probate. - Preventing Misinterpretation:

Legal Consolidated 3-Generation Testamentary Trust Wills and POAs can be updated for free.

Update them as often as you like.

Log back in and email us the Tax Invoice.

Call us if you need help locating your Tax Invoice.A Will may be open to legal challenge if it does not clearly identify its beneficiaries, executors, or attorneys. Addresses provide an additional layer of specificity to prevent this.

- Practical Implementation:

Executors and solicitors may need to contact all parties involved. Including addresses makes it easier to carry out the practicalities of the Will.

It is free to update Legal Consolidated Wills and POAs

Wills and POAs you build on Legal Consolidated’s website can be updated for free. This is as often as you wish. So, if, for any reason, you want to update your Wills or POAs, then you are welcome to do so.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

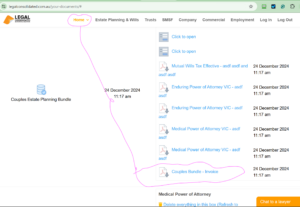

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians of under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in a hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will