Since 2018, thanks to significant advocacy efforts by the Financial Advice Association Australia and Legal Consolidated, financial planners have been empowered to act as authorised witnesses for Commonwealth statutory declarations and Powers of Attorney (POAs) across various Australian states.

This advancement enhances financial planners’ ability to assist in estate planning, ensuring that essential services are more accessible and efficiently managed. These guidelines and state-specific information will help you navigate these responsibilities with confidence and compliance.

Free advice on POAs – for life

Legal Consolidated POAs come with free legal advice for the client, adviser and accountant – for life. If your client has a Legal Consolidated POA or lifestyle POA ring us with any questions. Also, Legal Consolidated Wills and POAs can be updated for free, as often as the client wishes.

Legal Consolidated does not provide advice on POAs prepared by other law firms.

Can accountants and financial planners witness Statutory Declarations?

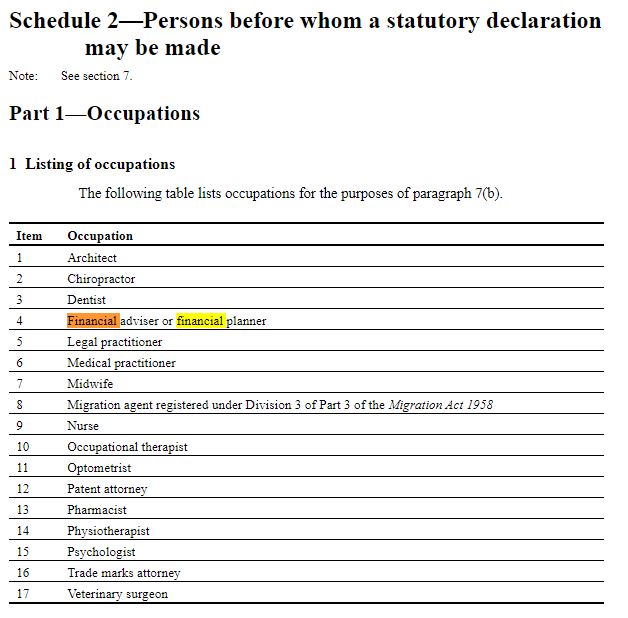

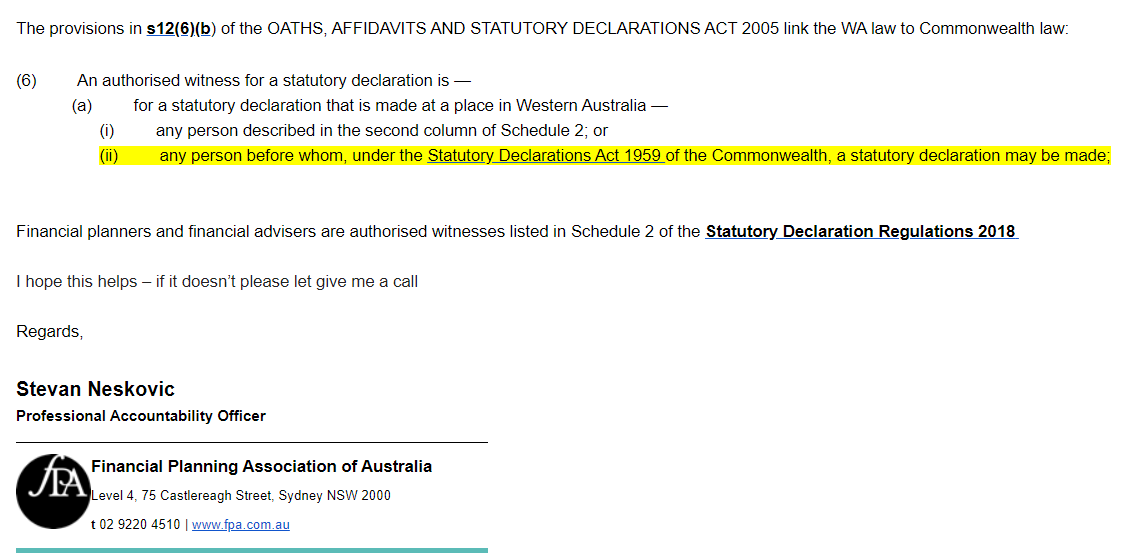

The Statutory Regulations 2018 (Cth) allows financial planners and advisers to witness Commonwealth statutory declarations. This has been the case since 18 September 2018.

This means that financial planners are in the group of ‘authorised witnesses’. This is long overdue and I applaud the FPA and many other groups, including Legal Consolidated in lobbying for this.

As an authorised witness, you ensure that the Statutory Declaration meets the form and content requirements that are set out in Schedule 1 of the Regulations.

Help for financial planners witnessing POAs

When you build POAs on Legal Consolidated’s website the building process answers these questions:

- What address to use?

- Non-English speaking?

- Cannot put pen to paper?

- What information should be included in my POA?

- Should a POA be typed or handwritten?

- How do I amend a POA? Are there time limits?

- What information is included in my POA?

Each State has its own rules on who can witness a POA

Different Australian States and Territories have different requirements for witnessing a Power of Attorney (POA).

As a national Australian law firm, Legal Consolidated provides, on our website, both enduring and lifestyle POAs for:

- New South Wales

- Enduring/Money –

- Lifestyle/Medical – Enduring Power of Guardianship

- Victoria

- Enduring/Money –

- Lifestyle/Medical – Appointing Medical Treatment Decision Maker

- Queensland

- Enduring/Money –

- Lifestyle/Medical – Enduring Power of Attorney

- Western Australia

- Enduring/Money –

- Lifestyle/Medical – Enduring Power of Guardianship

- South Australia

- Enduring

- Lifestyle/Medical – Advanced Care Directive

- Tasmania

- Enduring

- Lifestyle/Medical – Enduring Power of Guardianship

- Australian Capital Territory (ACT)

- Enduring

- Lifestyle/Medical – Enduring Power of Attorney

- Northern Territory

- Enduring

- Lifestyle/Medical – Advance Personal Plan

Over 30% of POAs prepared on a government website are wrong. About 12% of lawyer-prepared POAs also do not work.

If you prepared a POA for a client on a government website or non-law firm website, then you are the adviser and are liable for that document.

You should not take the risk. You should build your POAs for your clients on the Legal Consolidated Barristers & Solicitors’ website. Our law firm is then responsible for the document. Not you the adviser.

Because a financial planner can witness a Commonwealth Statutory Declaration for many States that is one of the classes of people that can also witness POAs.

Nearly one-third of POAs from a government website do not work. Only witness a POA built by Legal Consolidated or another law firm. If you witness a POA that is not prepared by us or another law firm then you may be held responsible for that document if it ends up not working.

In all States, only lawyers can prepare ‘Deeds’. A POA is a ‘deed’. So don’t build the POA on the government website. Instead, build it on a law firm’s website and be protected by our law firm’s Professional Indemnity insurance.

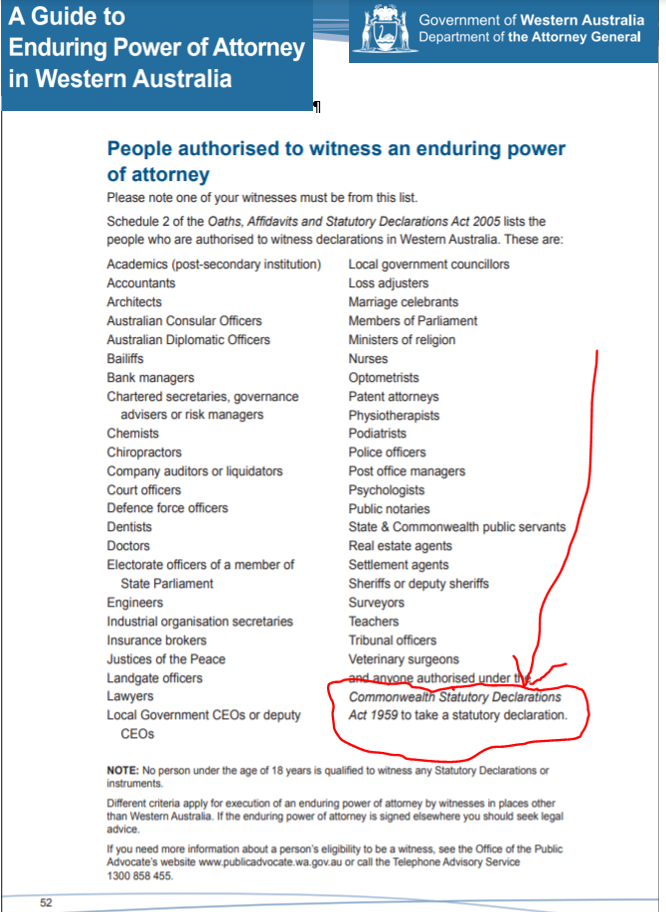

Financial Advisers Witnessing Western Australian POAs

- A person can witness a WA POA if they can witness Commonwealth Statutory Declarations.

- As stated above financial planners can witness Commonwealth Statutory Declarations.

- Therefore, a Financial Planner (anywhere in Australia) can witness WA Enduring POAs and Lifestyle/Medical POAs (Power of Guardianship) that are built on our law firm’s website.

See Appendix B of the WA Attorney General’s A Guide to Enduring Power of Attorney in Western Australia dated December 2013 (page 52):

Advisers and Accountants cannot witness NSW POAs

Sadly in NSW only Court officials and lawyers can witness a NSW POA. At the time this seemed a good idea to make money for lawyers. But it has proved a hindrance to both lawyers and the Court. Legal Consolidated continues to lobby the NSW government to free up this draconian and time-wasting restriction.

Advisers cannot be an ‘authorised witness’ for a Victorian Enduring POA

Financial advisors are not authorised witnesses for a Victorian Enduring POA. The Victorian POA Act requires the person to be authorised to witness affidavits in Victoria. Under section 19(1) Oaths and Affirmations Act 2018 (Vic). Sadly, financial advisors are not listed as authorised.

Each state has its own Medical POA. It is called a Medical Treatment Decision Maker. They are regulated by the Medical Treatment Planning and Decisions Act 2016 (VIC). Advisers, for the reasons set out above, can NOT be the ‘authorised’ witness for this document.

Legal Consolidated congratulates the Financial Advice Association Australia (FAAA) for its successful advocacy to allow financial planners to witness powers of attorney in several Australian states. This achievement enhances the financial planner’s vital role in estate planning, making POAs more accessible to the Australian community.

Financial planner Certifying documents (certifier)

In Victoria, Section 39 Oaths and Affirmations Act 2018 (Vic) allows the “Financial adviser or financial planner” to certify a document as a true copy of the original. This has been the case since 1 March 2019.

Accountant certifying documents as original

Also, these accountants may certify documents as original in Victoria:

- Fellow of the National Tax Accountants’ Association (NTAA)

- Member of Chartered Accountants Australia and New Zealand

- Member of the Association of Taxation and Management Accountants

- Member of CPA Australia

- Member of the Institute of Public Accountants

When you build a POA on our law firm website we stand by that document for the life of your client.

But every lawyer builds their POAs differently

This advice only relates to POAs prepared by Legal Consolidated. If you are using another law firm to prepare your POAs then speak to that law firm. Each law firm has its own way of preparing POAs.

And if you are building a POA from a government webpage, then good luck. Nearly one-third of POAs prepared on government websites do not work. (This figure is lower in Tasmania.)

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will