Lost tax benefits when leaving Gifts to Charities

Specific Gifts are problematic more so when you include charities in your Will.

Rather than making a Specific Gift in your Will, consider making the charity a Residuary Beneficiary:

- leaving the rental property to a non-charitable beneficiary, such as a human, transfers both dormant CGT burden together with the property. The human takes over the dead person’s potential CGT liability. However, the CGT is not payable until the property is sold – if ever. Death does not ‘trigger’ the payment of CGT, in this instance. However, if your Executor is forced to sell the asset and distribute the income to the charity then the charity gets all the money and the Residuary Beneficiaries pay the CGT.

A gift to a charity in your Will does not provide a tax deduction. Alternatively, you can request a separate Wish List that the beneficiary donates, allowing them to claim the deduction.

- conversely, leaving the charity a percentage of your estate allows the accountant, financial planner and lawyer to distribute the assets in the best after-tax position. This is for all Residuary Beneficiaries. For example:

-

- the charity may take in species (directly) the appreciating asset and pay no CGT, and

-

- the other Residuary Beneficiaries may take the cash.

-

In both of the above examples, the 3-Generation Testamentary Trusts in your Wills:

- often reduce that pregnant CGT liability down to zero; and

- allows the assets to be moved to the best after-tax position

Q: Can I give cash to the charity instead?

A: You are correct. There is generally no Capital Gains Tax on money. CGT is normally on appreciating assets like shares and property.

However, we have a new problem. It is the same problem with a Specific gift of cash to anyone: this is whether the beneficiary is a charity or not.

Gifts to charities in Wills do not get a tax deduction. It is a lost tax benefit.

Example of leaving cash to a charity in your Will

For example, on the day you build your Will, you are worth $4m: $2m in cash and $2m in property. You leave $2m to the charity as a Specific Gift. So the charity gets 50% of your estate and the Residuary Beneficiaries get the other 50%. That is all fair. Well done.

However, unbeknown to you (because you got dementia) your family spends $2m on your medical needs. So you eventually die with only $2m in assets. It makes no difference if that $2m came from the cash or the property.

If your estate only has the $2m in property then the property must be sold to satisfy the Specific Gift of $2m cash. This is because Specific Gifts are paid out first – before the Residuary Beneficiaries get anything.

The Residuary Beneficiaries in this example get nothing.

Examples of leaving Specific Gifts to an Australian Charity:

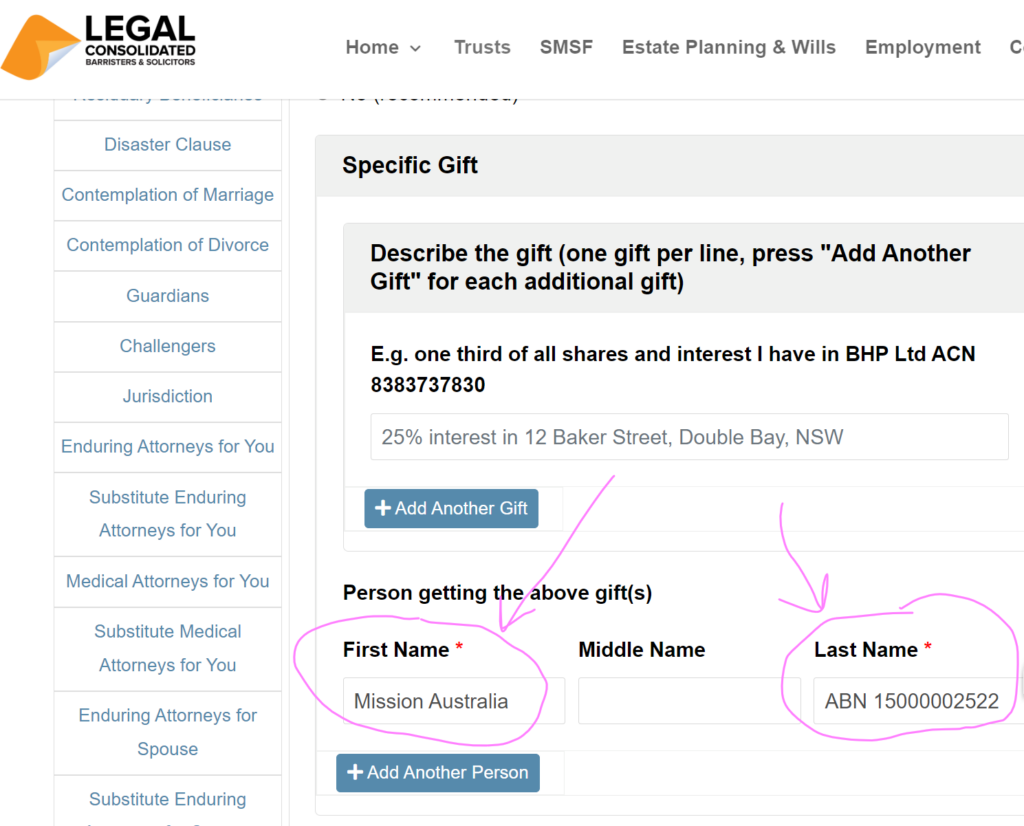

If, however, you still wish to give a Specific Gift to a charity, then here are some examples of the wording:

To benefit an Australian charity (find the ABN here: www.abr.business.gov.au) type in:

First Name: Mission Australia

First Name: Mission Australia

Middle Name:

Last Name: ABN 15000002522

First Name: Australian Red Cross Society

Middle Name:

Last Name: ABN 3838373738

First Name: Trustees of the Roman Catholic Church for the Diocese of Broken Bay

Middle Name:

Last Name: ABN 79031652544

First Name: Anglican Community Services

Middle Name:

Last Name: ABN 39922848563

First Name: Archbishop of Sydney’s Anglican Aid Fund

Middle Name:

Last Name: ABN 28525237517

Example of a Specific Gift for a USA Charity

First Name: Mayo Clinic

Middle Name:

Last Name: Federal Tax ID Number 41-6011702

Example of a Specific Gift to a Charity in the United Kingdom – in your Australian Will

First Name: Kidney Research UK

Middle Name:

Last Name: registered charity numbers 252892 and SC039245

First Name: Macmillan Cancer Support

Middle Name:

Last Name: registered charity 261017

My charity wants to put special wording in the Legal Consolidated Will

Q: My charity has given me this wording:

“I declare that the receipt for the same signed by the Bishop of the Diocese, or other designated officer, shall be sufficient discharge to my Executors and Trustees.”

A: All Legal Consolidated’s Wills include the legal wording to allow the leaving of a gift to a charity. If you leave a part or all of your estate to a charity, the appropriate legal terminology is already contained in your Legal Consolidated Will.

Letter of Wishes: Guiding Charitable Giving in Estate Planning

Gifts of cash or property to a Deductible Gift Recipient (DGR) made by an individual during their lifetime are tax-deductible. As such, instead of leaving gifts to DGRs in a Will, many Will-makers draft a letter of wishes that encourages their beneficiaries to make charitable donations in their memory. This letter serves as a private, non-binding suggestion and is not disclosed publicly, leaving it unenforceable by the executor or the charity. Consequently, there is a notable risk that the intended donations may not be made.

In this way your beneficiaries, after you are dead, get the tax deduction for the gift.

Including a letter of wishes can be a meaningful way to influence the charitable actions of one’s beneficiaries without legally obligating them. However, given its non-binding nature, it relies heavily on the goodwill and agreement of the beneficiaries to fulfil the deceased’s charitable intentions. Legal Consolidated provides a free Wish List template.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will