Disaster Clauses in Wills

Q: What happens if we both die and all our children die with us?

A: You have young children who travel with you. The car rolls over and you and your spouse, together with your children all die together.

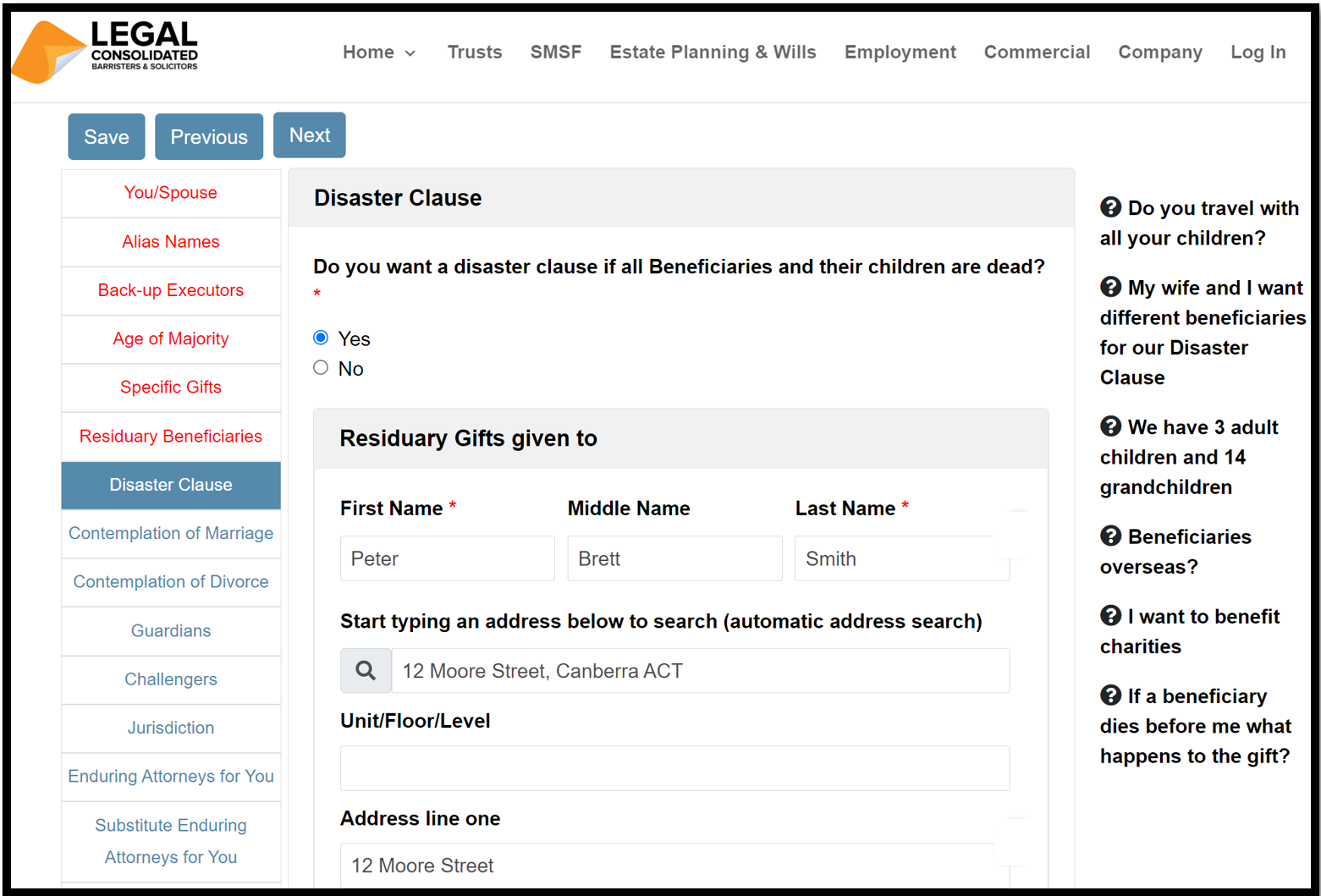

When you have young children select ‘yes‘ to the Disaster Clause question as you build your Will. Read the hints on this topic as you build the Wills.

Put in a Disaster Clause. For example:

- you leave 50% of your assets to your side of the family; and

- the other 50% to your spouse’s side of the family.

Example of a Disaster Clause in your Will

Disaster clause to your parents:

- Your Mum: 25%, your Dad 25%;

- your Mum-in-law 25% and Your Dad-in-law 25

Disaster clause to your cousins, nephews and nieces

- Your cousins – 50%;

- Your spouse’s nephews and nieces – 50%

How does a bloodline gifting clause work?

If everyone dies together, the Will’s Disaster Clause takes effect.

As with most Australian Wills, all Legal Consolidated Wills have a ‘blood line-giving clause’. (The Latin expression is ‘per stirpes‘ – down the bloodline.) This is where, if a person dies before you then what they would have got goes to their children. So, for example, if your child dies before you and they have children then what your child would have got goes to their children. For example:

Your daughter, Mary dies before you leaving children

You build your Will leaving everything to your two children: Mary and her sister.

Sadly, Mary died many years ago before you. Mary left behind Ross and Ken (your grandchildren). What Mary would have got now goes, in your Will, to your grandchildren, Ross and Ken.

This is automatic. You did not need to update your Will when Mary died. Your spouse got Dementia before Mary died so it was not possible, anyway, for your spouse to update their Will.

Your daughter, Mary, dies before you without children

You build your Will leaving everything to your two children: Mary and her sister.

Sadly, Mary died many years ago before you. Mary never, herself, had children (or they are also dead). Therefore, Mary’s bloodline has finished.

Therefore, what Mary would have got now goes ‘back to the pot’. Mary’s sister gets everything.

This is automatic. You did not need to update your Will when Mary died. Your spouse got Dementia before Mary died so it was not possible, anyway, for your spouse to update their Will.

If Mary dies before us and has no children then I want her portion to go to her husband

That is indeed rare. I have been practicing as a tax lawyer since 1988 and I have never had a client want this. Consider these questions:

-

- Does not Mary’s husband have his own parents to leave him money?

- What if Mary’s husband re-marries? Most likely, everything you gave him goes to his new wife when he dies.

- What about Mary’s first husband, second husband, gay partner and lover? Why are they missing out?

However, if you do wish to do this then read the hints as you build the Will and we will show you how to do this.

However, if you wish to do so, follow the hints during the free building your Will process. The hints tell you how to do this.

What happens when all the beneficiaries in the Will are dead?

So you are dead. Your spouse is dead. Your two children die before you. And your three grandchildren die before you? I assume you are in some type of war zone! If you die and your beneficiaries are dead then your Will fails. And your assets go to your next of kin, distant relatives or the Australian government.

If your beneficiaries start dying off during your lifetime then update your Will. You can update your Legal Consolidated Wills and POAs for free, as often as you wish. Just email us the Tax Invoice and we email you a voucher to update your Will.

But you may not be able to update your Will. You may forget. You may be of unsound mind. So best to put a Disaster Clause into your Will, especially if:

- your children are young and you travel with them

- your beneficiaries are all older than you, such as your parents

- you and your entire family live in a war zone

If all your Beneficiaries can potentially die with you, then put a Disaster Clause in your Will.

What if Mum and Dad die together?

If you travel together by car or plane, put a Disaster Clause in your Will.

Mum and Dad only have one 12-year-old child. Their backup Executors are the child, an uncle and an aunt. The child is probably in their 60s when Mum and Dad die. In that instance, the uncle and aunt are likely to renounce their positions as executors (they may be dead themselves). But what happens if Mum and Dad both die today? In that sad situation, the only Executors are the uncle and aunt. The child cannot be an executor because the child has not yet turned 18.

How does a Disaster Clause work?

If you, your spouse, your children and their children are all dead only then the Disaster Clause comes into operation in your Will.

If all your beneficiaries are dead in your Will – you die intestate

You die ‘intestate’ if all your beneficiaries named in your Will die before you.

The dangers of dying intestate or without a valid Will

Dying with a failed Will has problems:

-

Assets lost to non-tax-friendly formulas

Each Australian state and territory has its own laws that determine how an intestate estate is distributed. The laws follow a rigid and often unfair formula, typically favouring the children over your spouse. Rarely does this accord with the Will maker’s wishes. For blended families and estranged relationships, it is a mess.

-

Delays and Additional Costs by having a failed Will

Administrating an intestate estate is time consuming and complicated. In contrast with a L process than executing a will. It often requires appointing an administrator who may need to post a bond and obtain letters of administration from the court. This process can lead to significant delays and increased legal and administrative costs, which are deducted from the estate.

-

Legal Uncertainty and Disputes in an intestesty

Without a will to clarify the defceased’s intentions, there is greater potential for disputes among potential heirs. These disputes can be emotionally taxing and can further deplete the estate’s assets due to the legal costs involved.

-

Impact on Minors and Dependents

If the deceased has minor children or dependents, the lack of a will complicates the appointment of guardians. Normally, a will would specify the deceased’s choice of guardian for their minor children, but in the absence of a will, this decision is left to the courts.

-

Lack of Provision for Unconventional Relationships:

Intestacy laws may not recognise or adequately provide for partners in de facto or same-sex relationships, friends, or charities, unless legally defined relationships are clear and recognisable under the specific state or territory laws.

-

Estate Escheat:

In rare cases where no legal heirs can be found, the estate may escheat, or revert, to the state. This outcome is generally considered undesirable as it means that none of the deceased’s chosen beneficiaries or relatives receive any part of the estate.

Given these complexities and potential drawbacks, it’s generally advisable for individuals to create a clear and legally valid will. This ensures that their assets are distributed according to their wishes and can help minimise the emotional and financial strain on their family and loved ones after their death.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will