What is a blended family when making a Will?

A blended family has both stepchildren and biological children. Blended families have competing interests, requiring more care when drafting Wills.

What are the two main approaches for step-family Wills?

When it comes to Wills for blended families, there are two main approaches:

1. Leave everything to my second spouse

You leave everything to their second spouse. Once both of you die, a portion of the inheritance goes to your family, and the remaining portion goes to your second spouse’s family. This approach aims to balance the interests of both sides.

If you are worth under $5m and you have been with your second spouse for ten or more years, most second couples opt for this.

But your spouse is a good-looking fool. And someone will snap up your second spouse and steal all your money when you are dead. To reduce that happening:

-

-

-

Divorce Protection Trust

A Legal Consolidated 3-Generation Testamentary Trust Wills ensure that all parties are looked after. This includes provisions for your children from a previous relationship and your current spouse, addressing the complexities of blended family dynamics. Combining two Wills and a Contractual Will Agreement is essential to secure your family’s future with precise, legally binding documents.

-

-

Legal Consolidated 3-Generation Testamentary Wills all contain a Divorce Protection Trust. It stops your spouse from losing your assets if they marry after you are dead.

-

-

-

Contractual Will Agreement for second marriages

-

-

This is not a Will. A Contractual Will Agreement is a standalone document that forces both of you not to change your Wills. This makes sure that when both of you are dead, whatever is left goes to each side of the family. This also stops the Wills from being challenged by each other.

2. Leave nothing to my second spouse in a blended family

Alternatively, you leave nothing to your second spouse. Instead, you leave everything to your children from your first marriage. However, this potentially results in a miserable financial situation for the surviving spouse in their retirement years.

Commonly, this is for a wealthy couple – over $10m in assets. And only have been together for a few years.

There is a problem when you leave nothing to your second spouse:

-

-

-

Your second spouse challenges your Will after you die

-

-

To slow up your second spouse from challenging your Will:

-

-

- put a Considered Person Clause in your second marriage Will

- you and your spouse sign a Contractual Will Agreement

-

Which Wills do I build: Mirror Wills or two Single Wills?

This is a simple question. You have two choices:

- Leaving everything to each other? Build Mirror Wills bundle.

- Not leaving everything to each other? Build two single Will bundles, one at a time.

Clients seems confused about the potential answer. So let’s break it down:

Q: Professor Davies, I am leaving everything to my second husband, but I am leaving $100k to my son.

A: With respect, you are NOT leaving ‘everything’ to your second husband! You are, in fact, leaving $100k to your son. Therefore, you need two single Wills

Q: I am leaving everything to my second wife, but I am leaving my photographs and my Rolex watch to my daughter. Mirror or Single?

A: Do not muck around with minor issues. Scan the photos and email them to your daughter. Build a Deed of Gift for the Rolex today (before you die).

What do I do with trinkets and heirlooms in my Will?

If you have trinkets and heirlooms, then:

- it is best NOT to mention them in your Will (but you can if you want to)

- build a Deed of Gift while you are still alive

- trust that your second spouse will immediately handover the trinkets if you die first

- hand over the trinkets and heirlooms today (i.e. get the artwork, put it in the back of your car and drop it off at your child’s home)

Q: Why do first-marriage couples always leave everything to each other?

Second marriages have mixed loyalties. You want to protect your second spouse. But you also want to protect your children from your first marriage.

First marriages only have one loyalty. You and your spouse have the same children. You leave everything to each other. Once you are both dead, everything goes to your children. Since I started practising tax and estate planning in 1988 over 99% of married couples with the same children structure their Wills this way. These are called ‘mirror Wills‘.

Q: Do Joint Tenancy assets bypass the Will and go straight to my second spouse?

Correct. For example, you and your second spouse have a $3m home and no other assets. The home is owned as joint tenants. You leave ‘everything’ in your Will to your children – and nothing to your second spouse. However, when you die, there is nothing in your Will. You died with no assets. Joint tenancy assets go to the ‘survivor‘; in this instance, this is your spouse. Check out your Certificate of Title to see what happens to your home when you die.

Bank accounts and shares are by default owned as ‘joint tenants’. This is when you hold them with another person. Talk to your accountant about ‘severing’ joint tenancy. If that is what you want to do.

Q. I want my second spouse to remain in the home until my second spouse also dies

This is called a life estate or its weaker and delicate cousin, a right to reside. When you build 3-Generation Testamentary Trust Wills on our website, you can certainly add Life Estates. But they are not tax-friendly.

Q: Is my Second Spouse required to Continue Paying Child Maintenance for my Children when I Die?

Parents in blended families must consider financial obligations owed to children and partners from previous relationships, such as child support or spousal maintenance.

If you have been paying child support through the Child Support Scheme and are up to date with your payments, your death terminates the child support assessment. The executor of your estate is not required to continue making these payments. However, the Registrar may collect the necessary funds from your estate if there is an outstanding child support debt.

Q: Do Binding Financial Agreements work in Estate Planning for Blended Families?

In a second relationship, you face mixed loyalties. You love your children from the first relationship and your new husband from the second.

Achieving a fair division of your estate requires extensive discussions with both your children and your second spouse.

Include a Divorce Protection Trust and a Considered Person clause in your Will. Secure these provisions with a separate document known as a Contractual Will Agreement.

Binding Financial Agreements (BFAs) promise certainty but often fail in court. They are not reliable for estate planning. Family Courts set them aside with gleeful abandonment—not just when circumstances change, or the agreements appear unfair.

BFAs also fail because they must be invoked before you die. If you die without invoking a BFA, it stays dormant. It sits in the bottom drawer. A BFA dies with you unless it is turned on during your lifetime. This makes them impractical for ensuring your estate plan is executed as intended.

For blended families, better options exist:

- Contractual Will Agreements: These legally bind both parties to their Will. Neither party can change their Will without mutual consent. This ensures your wishes are respected.

- 3-Generation Testamentary Trust Wills: Established through your Will, these trusts control asset distribution, reduce tax, and protect beneficiaries from claims or creditors.

Forget BFAs. Use tools that work. Protect your family and your legacy with the right planning.

Why greedy children should not Inherit before your second Spouse

Q: We are worth less than $2m and have been together for over 20 years. We are leaving everything to our own children from previous relationships. We leave nothing to each other.

Your second husband has endured life with you for over 20 years. He deserves better than a nursing home where his nappy smells because no one bothers to change it.

Leave everything to your children, and your second husband is left to struggle. Two million dollars does not stretch far in aged care. Medical bills, carers, and daily living expenses quickly deplete it. Your children, blessed with Australian passports and opportunities, can succeed without your estate.

Provide for your spouse. Protect their dignity and comfort in their final years. Without proper planning, they endure hardship while your children inherit at their expense.

Your choice directly affects your spouse’s quality of life.

How do I stop my ex-spouse from challenging my new Will?

Previous Spouses Can Challenge Your Will

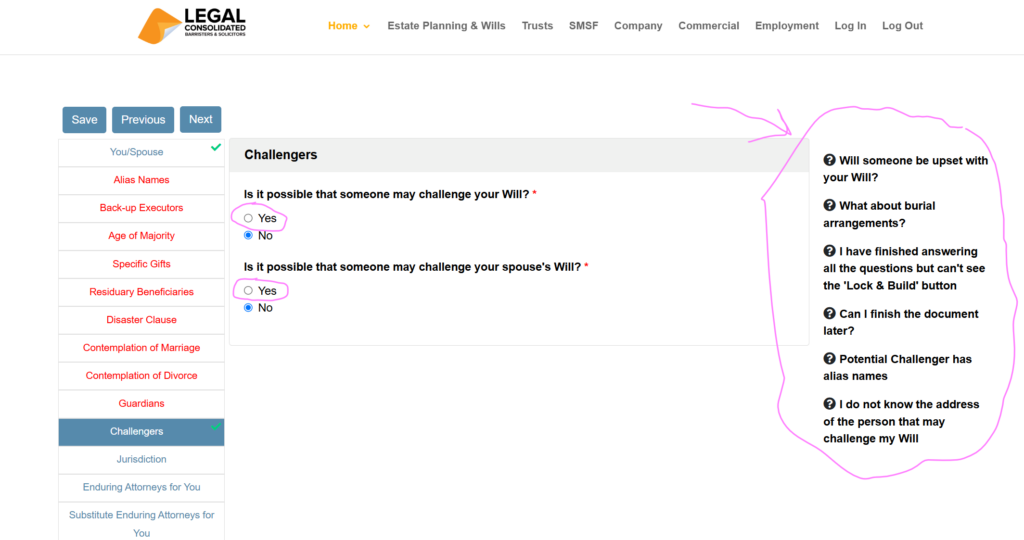

When you build your Will on Legal Consolidated’s website, you are prompted with a question: Will someone challenge your Will? Select “Yes” and include the name of your ex-spouse. This ensures they are acknowledged as a considered person, protecting your Will from legal challenges.

When building a Legal Consolidated Will for a step-family, answer yes to the question, “Will someone challenge your Will?”. Australian law allows an ex-spouse and former de facto partner to challenge your estate under family provision laws, especially if they can prove they were financially dependent on you at the time of your death. To reduce avoid disputes, include them as a considered person in your Will.

Managing Superannuation in Blended Family Estate Planning+

Superannuation may be a significant asset in your second relationship. For blended families, ensuring it reaches the intended beneficiaries requires careful planning.

- Reversionary Pension: Superannuation has to be paid out at your death. A Reversionary Pension allows your second spouse to keep your superannuation in the tax-effective superannuation environment. This continues until your second spouse, the last to die, dies.

- Binding Death Benefit Nominations (BDBNs): A BDBN directs your super fund to pay your death benefits into your 3-Generation Testamentary Trust Will. Without a valid BDBN, the trustee decides who gets your super, which may not align with your wishes. Regularly review and update your BDBN to reflect changes in your family structure.

- Superannuation Testamentary Trusts: Incorporating a Superannuation Testamentary Trust within your 3-Generation Testamentary Trust Will allow you to manage and distribute your superannuation benefits according to your specific instructions. This approach provides greater control and offers tax advantages for your beneficiaries.

- Tax Implications of super: Superannuation death benefits paid to non-dependents, such as adult children, incur taxes up to 32%. Strategic planning, like using a Superannuation Testamentary Trust in your Will, helps minimise such tax burdens.

By proactively managing your superannuation with these tools, you can ensure that your retirement savings are distributed according to your wishes, providing for your blended family as intended.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle for second marriages

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle for a second married parent

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes when you marry a second time

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts in mixed marriages

- Your Will includes:

- Divorce Protection Trust if you divorce a second time

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges from second spouses

Second Marriages and blended families protection

- Contractual Will Agreement for second marriages

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

In my second marriage, what if I:

- have assets or beneficiaries overseas?

- lack the mental capacity to sign my Will?

- sign my Will in a hospital or when isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in my second husband’s Will

- Joint tenancy assets and the family home

- Loans to spouses, children, parents and company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney in stepfamilies

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will