Getting married, divorced or defactos – does it affect your Will?

Usually, marriage revokes your Will. Marriage cancels, nullifies and destroys your current Will. Therefore, if you die as you leave the church you die without a valid Will. You are intestate.

In all Australian States and Territories, marriage revokes your current Will.

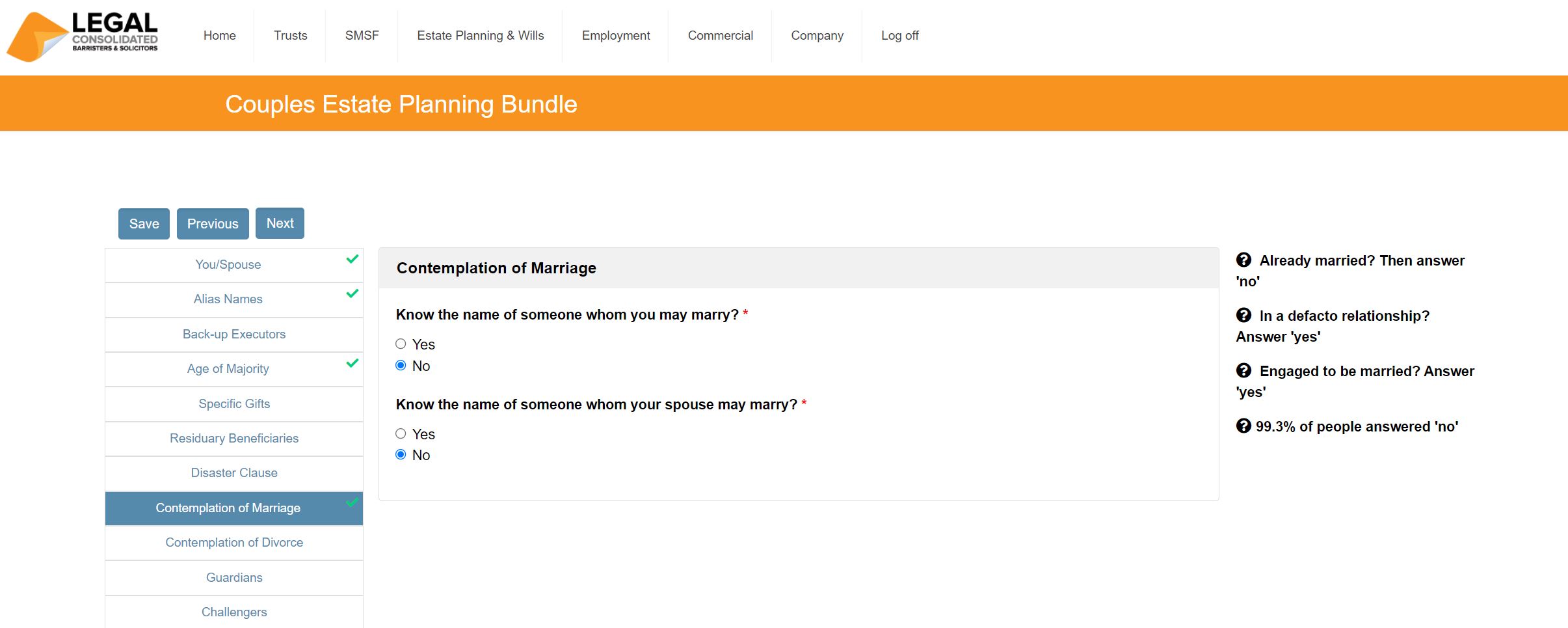

Contemplation of Marriage

There is one exemption that marriage revokes your Will. If you use special wording called a ‘Contemplation of Marriage’ clause, then your Will remains valid.

But you have to specifically name the person you are going to marry. Legal Consolidated drafts your Will, so it remains valid whether you get married to the named person or not.

Does Divorce invalidate a Will?

The ending of your marriage cancels the whole Will. This is unless there is a clear contrary intention in the Will or evidence establishing an intention that the Will is still valid despite the divorce.

Example of a Will without a Contemplation of Marriage Clause

John and Jenny have lived in a de facto relationship since the 1960s. “Free love does not need a bit of paper,” they tell their children and grandchildren.

They did their Wills many years ago.

John takes Jenny to one of the most romantic places in Australia: the Wagga Wagga Botanic Gardens. Overcome with emotion, they get married on the spot.

On the way home, John is killed in a car accident. Jenny survives.

Jenny is shocked to hear that John’s Will is invalid. This is because he got married earlier that day. Because of asset protection, all their assets are in John’s name.

The intestacy laws mean Jenny only gets about one-third of the assets. The other one-third goes to their children and the many Illegitimate children John is responsible for.

How a Contemplation of Marriage Clause works in your Will

When John and Jenny build a Legal Consolidated Will, they are always asked this question:

“Do you know the name of the person you may marry?”

Even if John and Jenny think that they will never get married, they should still answer ‘yes’ to these questions. And put in their names.

The effect of a Contemplation of Marriage clause in your Will:

- if you never get married, that is fine; your Will remains valid

- if you do end up getting married to each other, that is fine; your Will remains valid

So, if John is killed after he gets married to Jenny, his Will is still valid.

Contemplation of Marriage Clauses are strict

The drafting of a Contemplation of Marriage Clause has to be exact.

For example, in Western Australia, a Will is void if the marriage never takes place unless the wording carefully overrides that law.

In SA and the ACT, the law requires that the contemplation of marriage be expressly stated in the Will. This requirement does not extend, as it may do in other states, to the contemplation of marriage generally.

Legal Consolidated is a national law firm. Our Wills comply with all Australian States and Territories.

Australian laws on how marriage affects your Will

Each State has similar rules on how marriage revokes your current Will:

- New South Wales: section 12 Succession Act 2006 (NSW)

- Victoria: section 13 Wills Act 1997 (VIC)

- Queensland: section 14 Succession Act 1981 (QLD)

- Western Australia: section 14 Wills Act 1970 (WA)

- South Australia: section 20 Wills Act 1936 (SA)

- Tasmania: section 16 Wills Act 2008 (TAS)

- Northern Territory: section 14 Wills Act (NT)

- ACT: section 20 Wills Act 1968 (ACT) – revoking the Will makers’ s Will via marriage, civil union and civil partnership (regardless of gender)

“Valid” marriage vs Contemplation of Marriage clause

Only a ‘valid’ marriage revokes your old Will. A ‘marriage’ is valid if it complies with the Marriage Act 1961 (Cth). This Commonwealth law applies to all Australian States and Territories and overseas.

See section 88D of the Marriage Act 1961. It sets out the rules of engagement regarding the validity of a marriage, including the circumstances, consents, age, and when and where the marriage is solemnised.

Impact of Marriage and Divorce on Wills and Enduring Powers of Attorney

The table below outlines the effect of marriage and divorce on Wills and Enduring Powers of Attorney (EPOAs). There is no consistency. If you move to another state telephone the law firm to discuss if you need to update your 3-Generation Testamentary Trust Wills and POAs. Updates are free – for life.

| State | Will – Marriage | Will – Divorce | EPOA – Marriage | EPOA – Divorce |

|---|---|---|---|---|

| Victoria | Partially revoked | Partially revoked | No effect | No effect |

| New South Wales | Partially revoked | Partially revoked | No effect | No effect |

| Queensland | Partially revoked | Partially revoked | Revoked | Revoked |

| Tasmania | Partially revoked | Partially revoked | No effect | Revoked |

| South Australia | Revoked | Partially revoked | No effect | No effect |

| Western Australia | Revoked | Revoked | No effect | No effect |

| Northern Territory | Revoked | Partially revoked | No effect | No effect |

| Australian Capital Territory | Revoked | Partially revoked | Revoked | Revoked |

Impact of De Facto Relationships on Will Validity in Australia

Entering into a de facto relationship can significantly impact the validity of your Will. When you start a de facto relationship, it does not automatically invalidate your Will as marriage does. However, any provisions in your existing Will favouring your de facto partner are likely valid and enforceable.

You should update your will if your relationship changes, such as entering a de facto partnership. This ensures that your estate plan reflects your current intentions and relationships. Not updating your Will can lead to complex legal disputes among your intended beneficiaries after death.

If you die without a Will (intestate), your de facto partner is typically recognised under state and territory laws concerning inheritance. This means they may be entitled to a significant portion of your estate, depending on your relationship duration and other factors like shared children.

It’s wise to seek legal advice to tailor your Will to your specific circumstances, ensuring your assets are distributed as you wish and recognising your de facto relationship’s legal standing.

Do entering into de facto and civil partnerships revoke your Will?

Marriage and divorce nullify Wills. However, the effect on a Will is uncertain when you start or finish a de facto relationship. Do not take the risk. Telephone us for free advice on updating your Wills. You can update your Legal Consolidated Wills and POAs as often as possible. This is for free. So the safer course of action is updating your Will for free. This is if you enter into a de facto relationship. Or if you end a de facto relationship.

Typically, entering into or ending a de facto relationship does not alter estate planning documents. However, there are evolving exceptions in certain states. For instance, in Queensland, the termination of a de facto relationship now mirrors the effects of a marriage dissolution, generally resulting in partial revocation of legal documents.

See also:

- Queensland and the ACT: Entering into a civil partnership, ‘civil union’ (ACT) or de facto relationship? These revoke your current Will.

- Tasmania: Entering into a registered ‘Deed of Relationship’? It revokes your old Will.

- Blyth v Wilken [2015] WASC 486.

Does ending a Defacto Relationship destroy your Will?

A divorce certificate proves the legal conclusion of a marriage for married couples. The end is less clear and harder to prove for de facto couples.

We are not even certain what the ending of a de facto looks like, and this changes from state to state.

In Fairbairn v Radecki, the High Court noted that in assessing the continuity of a de facto relationship, consider the ‘necessary or desirable adjustments’ to maintain their shared life. It explained:

“if one party fundamentally acts contrary to the interests of the other in relation to the property of the couple, it may be possible to conclude that the mutual commitment to a shared life has ceased.”

In Queensland, ending your defacto relationship ends your Will

In Queensland, section15B of the Queensland Succession Act provides that, unless there is an express contrary intention in the Will, the ending of a de facto relationship revokes:

- Any gifts to a former de facto partner;

- The appointment of a former de facto partner as executor, trustee, advisory trustee, or guardian, except when they are appointed as trustee of property left in the will for beneficiaries that include their children

- Any grant of a power of appointment made in the will to or for the benefit of the former de facto partner, except when the power is exercisable only in favour of children shared by both the testator and the former de facto partner.

Except for QLD, ending a defacto relationship does not affect your Will

In states and territories, except for Queensland, ending a de facto relationship does not necessarily affect a person’s Will.

De factos and your Will – Blyth v Wilken

Marriage and divorce generally destroy your Will. However, until the landmark Supreme Court decision in Blyth v Wilken [2015] WASC 486 in December 2015, the dissolution of a de facto relationship did not influence the validity of your Will. In Blyth v Wilken:

- Wayne Scott and Ms Murray enter into a de facto relationship.

- Wayne makes a Will.

- Wayne and Ms Murray break up. They are no longer in a de facto relationship.

- Wayne fails to update his Will.

- Wayne dies.

- Wayne’s Will leaves most of his estate to ‘my de facto wife Kathrine May Murray’.

Wayne Scott’s Will, dated 2 December 2003, predominantly gifted his estate to his defacto wife. His Will stated:

“I give devise and bequest the rest and residue of my real and personal estate … upon trust for my de facto wife Kathrine Mary Murray absolutely …”

After the relationship between Mr Scott and Ms Murray ended on 21 December 2011, Mr Scott died on 28 August 2014 without amending his Will. The Will stated:

In Blyth v Wilken ending the defacto relationship ended the gift in the Will

The court ruled that Ms Murray was ineligible to receive the inheritance, as the couple were no longer de facto partners. Master Sanderson expressed that the bequest was made under the condition of their ongoing partnership. Once this condition ceased, the rationale for the inheritance lapsed.

This judgment marks a significant departure from previous assumptions that a former de facto partner named in a Will would still receive their intended gift unless the Will was updated post-separation. If Ms Murray had been mentioned in the Will without referencing her as “my de facto wife,” she might have retained her entitlement to the bequest. The Court states that Ms Murray does not get anything under the Will. This is because she and Mr Scott had ceased to be de facto spouses. Master Sanderson stated:

‘The deceased bequeathed the property to Ms Murray because she was his de facto wife. Once that ceased to be the case it seems to me the intended disposition should fall away’.

This case introduces a critical development with wide-ranging implications for the ending of defacto relationships in Australia:

- De facto partners should reassess their estate plans following the end of their relationship, whether to ensure the continuity of gifts to former partners or to eliminate them.

- While it may be premature to consider this ruling as a definitive legal precedent, it underscores the importance of updating estate documents to clarify intentions and outcomes.

- Similarly, individuals separated from but not yet divorced from their spouses should also revisit their estate plans, considering the potential extension of this legal reasoning to similar circumstances.

- Executors must exercise caution in estates where the Will references a former spouse, as separations could alter the intended distribution under the Blyth v Wilken decision.

The Court decided that including the words ‘my de facto wife’ in the Will placed a condition on the gift: it depended on her still being his de facto wife at the time of his death. However, the decision is ambiguous. Did the Court say that a de facto relationship ending revokes the Will? Perhaps. But the wording ‘my de facto wife Kathrine May Murray’ defines the person as a ‘de facto’.

What if Ms Murray had not been called ‘my de facto wife’? What if she is just named in the Will? Perhaps she would still have the gift.

The law is uncertain. Make a new Will. You can update your Legal Consolidated Wills for free – as often as possible.

Kemp v Findlay [2024] NSWSC 902: Old de facto Will rendered void

In 2024, the NSW Supreme Court in Kemp v Findlay considered Andrew Findlay, a tech entrepreneur. He died in a boating accident, leaving behind a Will conflict between his former partner and his children.

Andrew Findlay prepared a Will in 2015, leaving his estate to Elizabeth Kemp, his then-de facto. After their breakup in 2019, he prepared a new will, now favouring his children, which remained unsigned.

The defacto tries to enforce the Will in Kemp v Finlay

Elizabeth Kemp contested the unsigned 2019 Will. She argued for the validity of the 2015 Will. The case concerned whether an unsigned digital document could be a valid Will under NSW law.

Decision in Blyth v Wilken

The Court said the unsigned 2019 Will was valid. It accepted the unsigned Will because it clearly evidenced Mr Findlay’s intentions to benefit his children despite its lack of signature.

Ending Registered De Facto Relationships and their Impact on Wills

In Queensland, Tasmania, South Australia, and the Australian Capital Territory, ending a registered de facto relationship impacts your Will unless it states otherwise. Here are the changes:

- Gifts to Former De Facto Partner: Any gifts for your former de facto partner are cancelled.

- Appointments of Former De Facto Partner: Your former partner can no longer, generally, be an executor or guardian.

- Powers of Appointment: Any powers given to your former de facto partner to decide on the estate distribution are removed unless they concern your mutual children.

After ending a registered de facto relationship, review your Will. Make sure it matches your current wishes.

My wife is cheating on me. Do I update my Will now or after the divorce?

Q: When is a good time to renew the Will? When the client separates? Or after one year, but the client is not legally separated yet and is still sorting out their financial separation, children, etc.

A: Catch your spouse in bed with someone else. That night, you update your Will. You do not wait for the property settlement. You do not wait for the divorce. You do not wait for 12 months to pass since you separated.

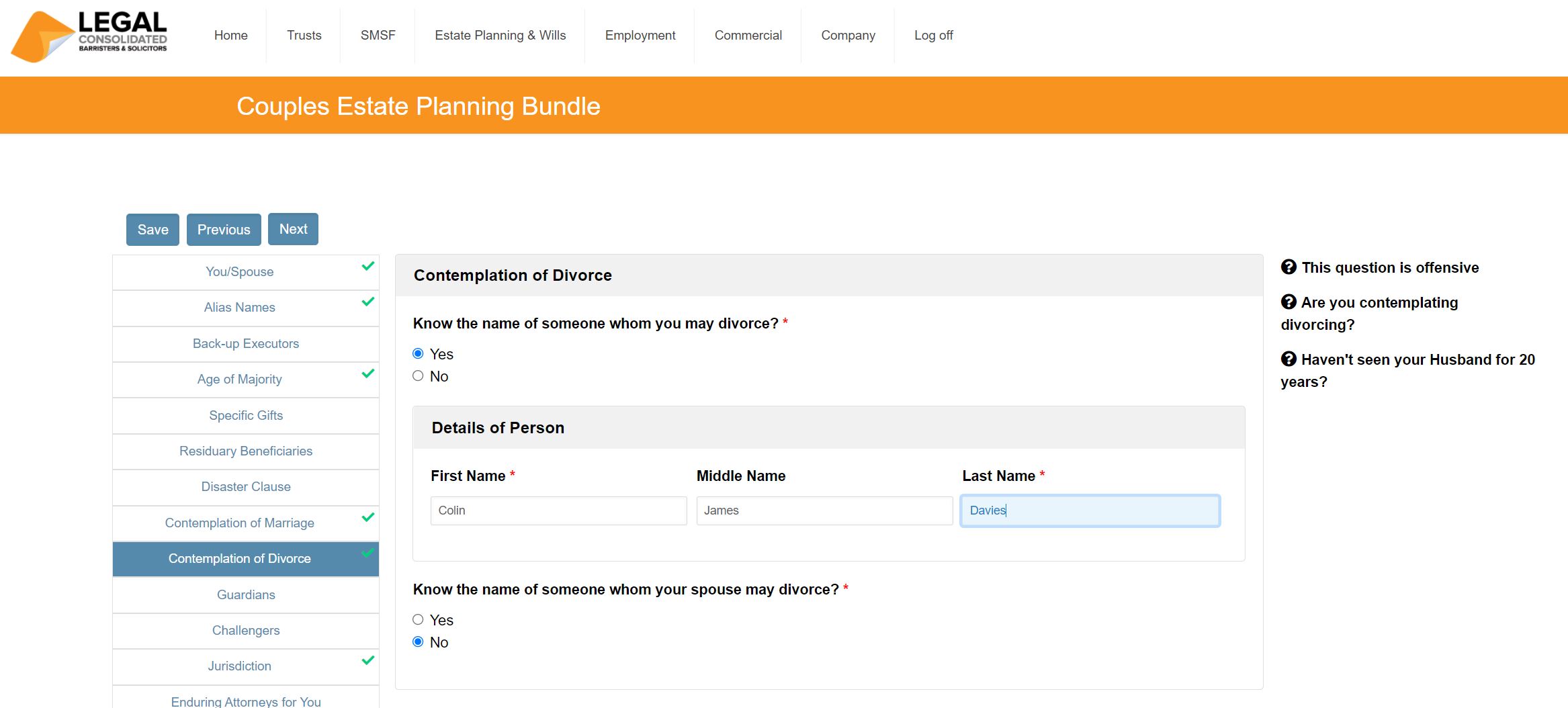

But does divorce invalidate the Will?

Yes, divorce invalidates the Will. But just put a Contemplation of Divorce clause in your Will.

As you build your new Will on our website, we ask, “Are you contemplating Divorce?”. If you are separating you tick yes to that question. You put in your spouse’s name. Now, if you divorce, your Will remains valid. And if you never actually get a divorce, then your Will is still valid.

Minors getting married can make a valid Will in Australia

Children under 18 years of age cannot make a Will. But there is an exception. This is where the minor makes a Will in contemplation of marriage.

- Like all Contemplation of Marriage clauses, you must name the lucky person you may marry.

- A standard Contemplation of Marriage works so that the Will is valid whether you marry or not.

- But with a minor’s Contemplation of Marriage, the Will is invalid until the child marries the person.

Watch our FREE Estate Planning Training Course.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will