Updating Your Will & POAs After Divorce: Free of Charge

You can update your 3-Generation Testamentary Trust Will and Powers of Attorney for free—for any reason and as often as you wish.

We understand that separation is a difficult time. While replacing a couple’s “mirror Wills” with two new individual “single Wills” have an additional cost, our law firm provides this service for free to support clients going through a divorce.

You can update your Will and POA for free if you separate or divorce.

Here’s what you need to do when you separate:

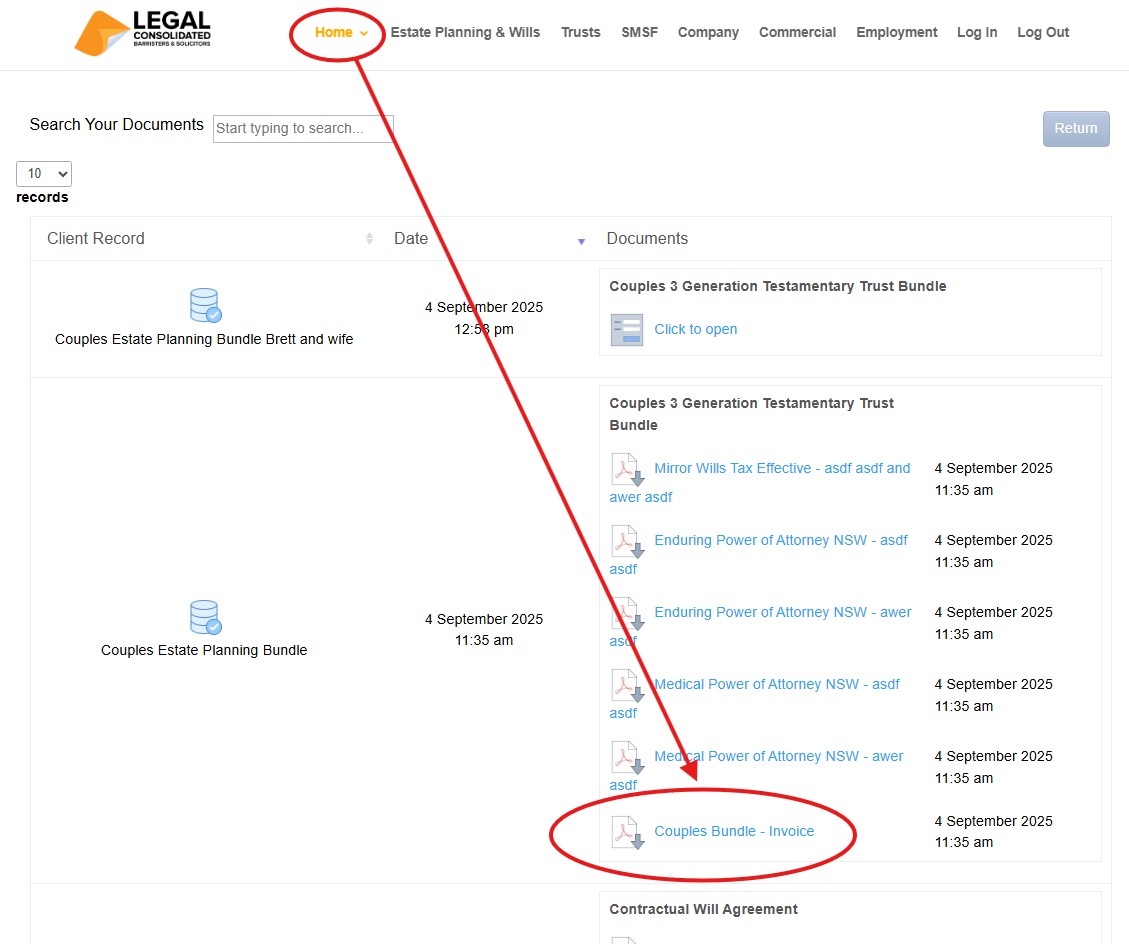

- Log into our law firm’s website. Find your original tax invoice for the purchase of the mirror Wills.

- Email to admin@legalconsolidated.com.au your tax invoice.

- In the email, simply state that you are now divorced and need to replace your mirror Wills and POAs.

Once we receive your email, we will send you a voucher to build your own single Will and POAs at no cost.

Important Note: Your ex-spouse will need to do the same. For privacy, please ask them to email us separately with the same information to receive their own voucher.

Do I wait until the divorce to get new Wills and POA?

Update your Family Trust after speaking with your family lawyer.

However, update your Wills and Powers of Attorney immediately. Act as soon as your relationship ends. Do not wait for your divorce or property settlement to be finalised. Separation does not automatically cancel these documents.

On separation, immediately update:

- Your Will: For free update, your 3-Generation Testamentary Trust Will to ensure your assets go to your chosen beneficiaries. A new Will revokes all previous ones.

- Enduring Power of Attorney: For free, build a new Legal Consolidated Enduring POA. Appoint a trusted person to manage your financial affairs when you are no longer able to do so. Notify your former partner in writing that their appointment is revoked.

- Appointment of Enduring Guardian/Decision Maker: This Medical/Lifestyle POA covers health and lifestyle decisions. For free, appoint someone new.

- Superannuation: Your Will does not control your superannuation. Contact your superannuation fund directly. If you have an SMSF update it here. However, if you have a 3-Generation Testamentary Trust, you probably already have your death benefit directed into your Will to reduce the 32% death tax on your super.

Contractual Will Agreements

If you have a Contractual Will Agreement, give express written notification to your former spouse that it is revoked.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

- Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will