Who owns my company at death? What happens when a director dies?

At death, your shares in a company go into your Will. Your shares are part of your deceased assets. Your executor in your Will looks after the shares and the company. The executor does this in the best interest of the beneficiaries named in your Will. The Executor transfers the shares in the Will to the beneficiaries as soon as possible. The beneficiaries then own the shares and can vote the shares in the company.

Can the executor sack and appoint new directors to run the company?

In Legal Consolidated Wills, your Executor, as the (temporary) shareholder, can sack and put in new Directors. This is in the Pty Ltd company, where your shares controlled all or at least 50% of the company. This is ONLY for the benefit of the beneficiaries. The executor is directed by the beneficiaries in the Will. Remember, the executor does the bidding of the beneficiaries. The Executor is the servant of the beneficiaries.

Do I ‘own’ the assets in my company?

You do not ‘own’ your company. Yes, you own the shares in the company. However, the company is a separate legal entity. It is a ‘person’ in its own right. Just like a human. Well, perhaps not just like a human. But it has the status of a separate legal entity.

You are a person. Your company is a person. You are two separate persons.

You own the shares in the company. But it is the company (not you) that owns the assets in that company. This is the basis of the ‘corporate veil’ and asset protection.

When I die, who controls the company? Does the director or the shareholder control the company?

The director (you normally only have one director for asset protection) looks after and runs the company.

- However, the director is not the ‘owner’ of the company.

- Instead, the ‘owners’ of the company are the shareholders.

The shareholder (also called ‘member’ or ‘stockholder’) can sack the director. The shareholder appoints the directors as the shareholder sees fit.

If a shareholder does not like the current director, provided that the shareholder has a majority of shares, the shareholder can unceremoniously sack the director by calling a company general meeting. The shareholder then appoints new directors more to their liking.

Do directors need a Will?

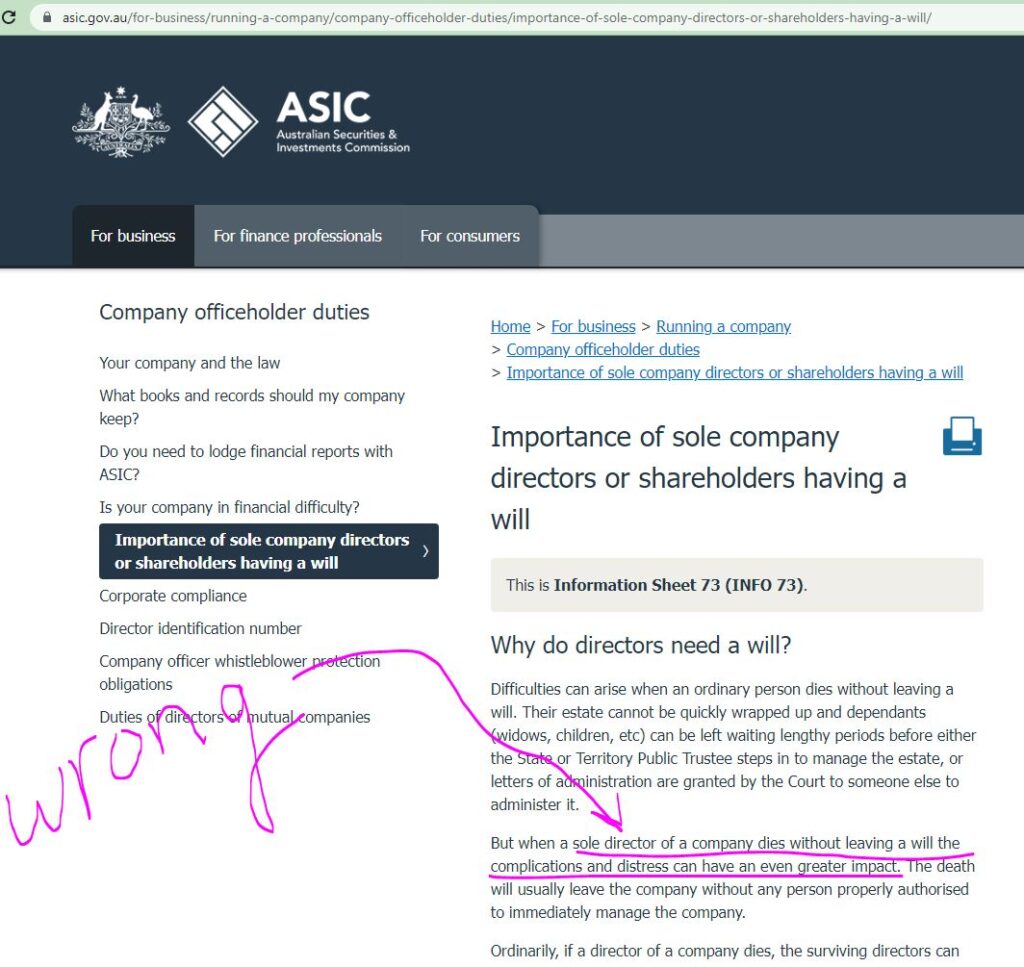

Sadly, I was delivering a paper at an accounting conference, and the accountants were making fun of yet another poorly written article by ASIC. I took a snapshot:

Can you see ASIC’s first mistake? The ‘job’ of being a director dies with them when a director dies. That is the case whether the director is a director of:

- BHP or any public company

- a Pty Ltd as trustee of a Family Trust

- Family Trust Bucket Company

- a company trading in its own right

- of a special purpose company as trustee of a Self-Managed Superannuation Fund

Do directors die?

Yes, of course, directors die. We are only human. A company may live forever. But humans eventually die.

Can I leave the job of being a director in my Will?

A director cannot leave the job of being a director in their Will. The job dies with them. Rather, the owner of the shares needs a Will. The lucky people in your Will who get your shares appoint the director or directors. (You normally only have one director for asset protection.)

Does a Pty Ltd company want to see a Grant of Probate when a director or shareholder dies?

A second error from our friends at ASIC is that because a company is private, you usually do not need Probate. Rather, the Executor is free to call a General Meeting and appoint directors as the Executor sees fit. See Section 201F Corporations Act 2001.

The Executor can also transfer the shares to the beneficiary immediately. The beneficiary is then free to call meetings and appoint a director of their choosing.

Should the executor apply for Probate to protect the company shares out of caution?

Probate is the ‘proving’ of the Will at your local Supreme Court. There are three reasons to get Probate:

- someone refuses to hand over the asset to the executors (e.g., the dead person’s real estate not owned as joint tenants)

- the Will is damaged (e.g. there are staple holes in the Will and no staple, suggesting that there may have been a Codicil)

- someone is going to challenge your Will (e.g. mistress and illegitimate child)

The cost of the Wills you build on our website includes advice on how your Executors can apply for a Grant of Probate themselves. Generally, you do not need a lawyer. So the cost of getting Probate is reduced. Still, most people only get Probate if they have to.

Can the Executors transfer the private company shares before a Grant of Probate?

The Executors are still the Executors whether there is a Grant of Probate or not. But if you are worried, then apply for a Grant of Probate. But you can, in the meantime, still transfer the shares to the Beneficiaries and protect the company.

Can the executor in my Will appoint a new director?

The executor or other personal representative appointed to administer the deceased’s estate may appoint a new director to the company. The director has all the dead director’s powers, rights and duties and keeps the company running. This is until the shares are transferred to beneficiaries, who may then appoint different directors if they wish.

Do the Public Trustee or State Trustee (Victoria) control my company when a director dies?

I also have concerns with ASIC’s expression of an ‘ordinary’ person and spruiking up the ‘Public Trustee’. The ‘Public Trustee’ and ‘State Trustee’ in Victoria charge a fee to be the Executor. This is usually a percentage of your estate! In contrast, most Will makers in Australia appoint their Beneficiaries as the Executors. They do the job for free.

For example, if you leave everything to your spouse, your spouse is the executor. Once you are both dead, you appoint all your children as executors.

In my youth, I wasted time debating with the Public Trustee about their ‘value’. On one occasion, the QLD Public Trustee, in the heat of the moment, blurted out on ABC National Radio, “But Dr Davies, by saying that people should not appoint the Public Trustee, you are just spruiking up work for you and your lawyer mates.” To which I responded:

- Legal Consolidated does not do probate or administer estates (we are a taxation and superannuation law firm).

- we do not recommend lawyers; we encourage accountants and financial planners to help their clients apply for Probate for free on the applicable Supreme Court websites around Australia.

- Legal Consolidated Wills include free advice on how the executors can administer the estate themselves – for free

What happens when a sole director dies?

Appoint a Company Power of Attorney in case the sole director dies or goes on a holiday.

Where the sole director is also the sole shareholder, the risk of uncertainty is much greater. This is even more reason to put in place a Company POA before anyone dies. However, the Attorney is not able to act while the company has no directors.

What happens if a company has no director?

A company without a director is like a ship without a rudder. No one is ‘in charge’ or managing the company. Banks may not process payments. The ATO and ASIC may refuse to ‘deal’ with the company. The company may find itself ‘frozen’.

The Executor needs to appoint at least a temporary director until the beneficiaries in the Will decide who will be the director.

Should I appoint an Alternative Director in case I die?

You should not appoint an Alternative Director to replace you upon your death. While this might seem like a convenient solution, it is a poor strategy that often causes more harm than good.

Two types of people agree to take on the role of an Alternative Director: those with no assets and those who are stupid.

Whether a director or alternative director, both positions lead to personal bankruptcy if the company becomes insolvent. Thus, you are putting your Alternative Director at great and unnecessary risk.

Directorship carries heavy legal and financial responsibilities. If your company is sued, goes insolvent, or faces regulatory penalties, the Alternative Director is often personally liable. Their personal assets, like the family home and car, are lost.

Instead of relying on an Alternative Director, consider these better strategies:

-

Implement a Company Power of Attorney

Before you die, build a company POA. -

Integrate Succession Planning with Your Estate Plan

Align your company’s future with your Will.

Should I appoint a second director in case I die?

Appointing a second director while you are alive provides continuity if you die. However, it adds unnecessary risks.

Sure, a second director automatically remains in charge when you die.

However, all directors face personal liability. Both directors often lose their personal assets if the company is sued, insolvent, or faces fines. By having two directors, you have doubled your risk. This is unacceptable, especially if you are following an asset protection strategy called ‘man of straw and wife of substance‘.

When I die do the directors lose their position?

Commonly for asset protection, Mum owns the good thing: the shares in the company. And the risk-taking Dad takes on the onerous job of being the director. (Your accountant and financial planner may call this the ‘man of straw and woman of substance‘.

- Mum, the shareholder, dies, and Dad continues to be the director. Just because the shareholder dies does not mean the director is affected in any way.

- Dad, the director, dies. Mum, as the sole shareholder, has to appoint a new director.

When you die, do you want a specific person to replace you as a director?

Your company may be:

- special purpose company trustee of an SMSF

- corporate trustee of your Family Trust

- trustee of your Unit Trust

- trading in its own right

Having you and your spouse as directors is bad asset protection. Normally, you only have a single director. 94% of companies set up with us have a single director company. (Obviously, this does NOT include SMSF corporate trustees. A company set up to be a trustee of a Self-Managed Superannuation Fund must have all the fund members as directors.)

Control the director position? Or control the shares?

Controlling the director position is the wrong way of looking at succession planning for a company. The director is just the person who does the work of running the company. This is for the benefit of the shareholder(s). The director, in that position, has no ownership of the company. Directors just look after the company.

A better question is, “How do I move ‘control’ of the company to a certain person”? This is at death.

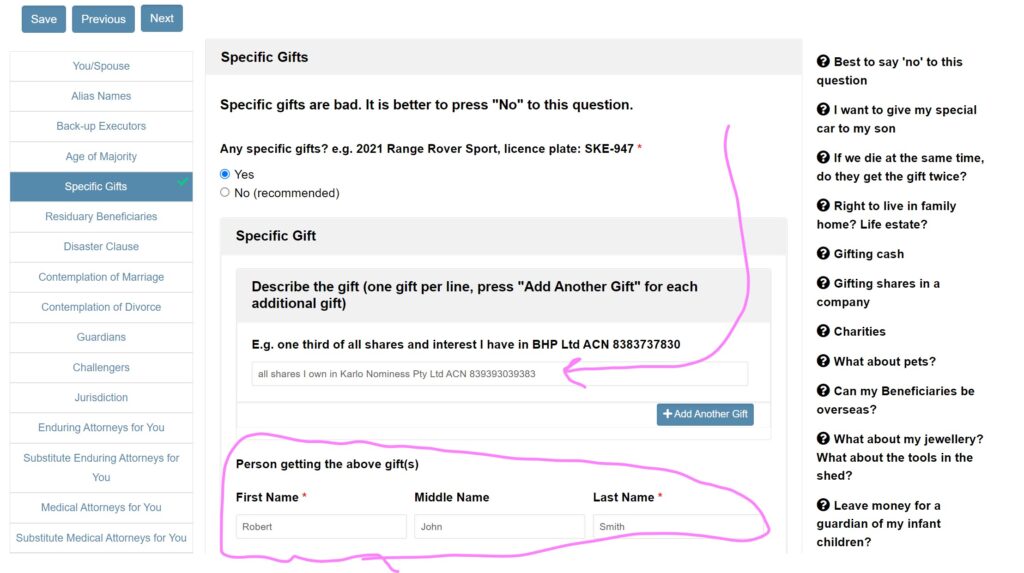

As you build your will, this is easily done in the “Specific Beneficiary” question. Just leave the shares you own to your chosen person. The chosen person then appoints themselves, or anyone they wish, as directors of ‘their’ company.

Shareholders hire and fire directors. This is as they see fit. To put it another way, the director only holds that job at the whim of the shareholders. The shareholders ‘own’ the company. The director just ‘manages’ the company. And the director must act in the shareholders’ best interests at all times.

The life of a director is horrible. The directors:

- often go bankrupt if the company fails.

- are duty-bound to do the bidding of the shareholders (or risk being sacked).

- sit only at the pleasure of the shareholders.

- must always act in all of the shareholder’s best interests.

Because Australian companies are overregulated, directorships must be considered a burden. They are not an honour or prestigious position. You need to change your mindset.

I still want to name my replacement director at my death

So after everything we told you, you still want to control who replaces you as director of the company when you die?

Interesting. It sounds like someone is trying to get some money from you to set up a complex succession structure. Speak to your own accountant, financial planner and lawyer first before you waste your money.

Is the right to be a director ‘property’?

Being a director is not an ‘asset’. The right for you, as a director, to appoint a replacement director is probably also not ‘property’.

Instead, being a director is considered an obligation. It is a job – an office. It is a burden.

Your Will only has one job. To give away your ‘assets’. So, you cannot ‘deal with’ directorships in a Will. All these Specific Gifts in a Will fail:

- “Directorship in Toorak Nominees Pty Ltd – to my son Thomas James Smith.”

- “To my wife, Louise Kelly James, the directorship in Acamme Pty Ltd.”

- “The right to be Director and Chairman of the company known as Petrus Christus Nominees Pty Ltd.”

All such gifts in a Will fail.

At the moment of your death, you lose all directorship positions. To put it another way, a condition of being a director of a company is that you are living. So even if a directorship is an asset (it is not), you have nothing to give. This is because your directorship position dies with you.

Q: But does not section 201F Corporations Act allow me to nominate my replacement director at my death?

That is not correct. And it is not the purpose of the section. Section 201F states:

Section 201F Corporations Act

Special rules for the appointment of directors for single director/single shareholder proprietary companies

(1) The director of a proprietary company who is its only director and only shareholder may appoint another director by recording the appointment and signing the record.

Appointment of new director on death, mental incapacity or bankruptcy

(2) If a person who is the only director and the only shareholder of a proprietary company:

(a) dies; or

(b) cannot manage the company because of the person‘s mental incapacity;

and a personal representative or trustee is appointed to administer the person‘s estate or property, the personal representative or trustee may appoint a person as the director of the company.

(3) If:

(a) the office of the director of a proprietary company is vacated under subsection 206B(3) or (4) because of the bankruptcy of the director; and

(b) the person is the only director and the only shareholder of the company; and

(c) a trustee in bankruptcy is appointed to the person‘s property;

the trustee may appoint a person as the director of the company.

(4) A person who has a power of appointment under subsection (2) or (3) may appoint themselves as director.

(5) A person appointed as a director of a company under subsection (2), (3) or (4) holds office as if they had been appointed in the usual way.

What happens when a director dies: Section 201F is a waste of time

Section 201F Corporations Act 2001 provide that, at the death of a single member/director of a proprietary company, the executor or other personal representative appointed to administer your estate may appoint a new director to the company. The new director:

- has all the powers, rights and duties of the dead director; and

- keep the company running until shares are transferred to beneficiaries who may then appoint new directors if they wish.

Section 201F only operates if your company is, at the date of your death, a one-director/one-shareholder company. This is rare. For asset protection, the high-risk ‘straw person‘ is the director. And the low-risk ‘person of substance‘ is usually the shareholder.

Secondly, I can not see much value in this. Would not the ‘person of substance’ who owns the shares merely appoint a director of their choice? This person has that power both before and after your death. Nothing changes—well, except for the fact that you are dead, which is sad.

Thirdly, the dead person’s executor has the right to appoint the replacement director. But, this power is subject to the shareholders. So you give the shares to the replacement director to make this work. Again, this is a waste of time since the person with the shares has the right to appoint directors anyway.

Instead, do not rely on section 201F of the Corporations Act 2001. Just expressly gift the shares to the correct people in your Will. ASIC has a similar view.

Does the Legal Consolidated company constitution allow for 201F to operate?

Yes, it does. It is a power that the Legal Consolidated Consitution does not prohibit. If you have a non-Legal Consolidated Constitution, speak with the lawyers who prepared the Company Constitution. Or upgrade your Constitution.

Does the Legal Consolidated company constitution allow for ‘successor director clauses’?

A ‘successor director clause’ is a common expression in the USA. In Australia, there is no legislation regarding the use of this expression.

At Legal Consolidated, we use the expression as the Americans would do. This is a two-stage process:

- a Shareholders Agreement; and

- a resolution setting out the rules when a certain director dies and who replaces that director.

This is explained below.

For what it is worth, the Legal Consolidated company constitution allows for such resolutions. To put it more correctly, our constitutions do not prevent the shareholders from agreeing on this amongst themselves. However, if you have a company constitution from another law firm, contact that law firm to see if that is the case or upgrade your company constitution.

Q: Can I type into the company constitution who my replacement director will be?

Company constitutions do not contain that power. So do not waste your money.

Do you disagree with me?

Well, think about it. The majority shareholder just calls a General Meeting and changes the company constitution to remove the ‘replacement’ director clause.

Also, updating the company constitution from time to time is common. Like trust deeds, they can become out of date; in this case, the special clause is lost.

Do not waste your money.

Q: Can I type who my replacement director will be in the Family Trust deed?

The Self-Managed Super Fund, family trust, or unit trust only has the power to appoint or remove the company as trustee. Thus, nothing in these deeds helps or controls the company’s internal workings.

I still want to name my replacement director when I die

You are certainly persistent.

There are three ways to help with this. The first way is in your Will. Leave all the shares in the company to your proposed replacement director. Or an entity that your replacement director controls. E.g. spouse.

The second way is a Shareholders Agreement. The third way is a Company POA.

Let us consider the Shareholders’ Agreement and Company POA.

Shareholders Agreement to force the other shareholders to accept your replacement director at death.

A Shareholder Agreement is a contract between all shareholders. Under Legal Consolidated, new shareholders must accept its terms.

- Build a Shareholders Agreement

- Pass a unanimous irrevocable shareholders resolution that all shareholders agree that your replacement director will be [Name of your Replacement Director] at your death.

- Before your death, the Replacement Director signs a “Consent to act as a Director”

Obviously, the directors are not involved in this. Their rights are subservient to the rights of the shareholders, and it would probably be illegal for them to make those promises.

Why unanimous? We do not believe a Special Resolution is enough. (A special resolution is a resolution that is passed by at least 75% of the votes cast by shareholders who are entitled to vote on the resolution.)

Company Power of Attorney vs Enduring POA

A Company POA is the company appointing a human. An Enduring POA is a human appointing a human. They are very different. A Company POA is under the common law. While Enduring POAs are creatures of statutes under each state and territory.

The simplest way is probably to get your company to appoint the lucky person to be a company POA. Do this before you die or become of unsound mind. However, the Company POA does not operate while the company has no director.

Consider also an Enduring POA. This is in case you do not die, but, rather, become of unsound mind. Therefore, the person holding the POA can exercise the voting rights for the shares you own in the company:

- An Enduring POA dies with you.

- A Company POA is an appointment by the company and continues after your death, but it cannot operate while the company lacks a director.

Succession Planning for a Self-Managed Super Fund with a corporate trustee

For a Self-Managed Superannuation Fund, get rid of the whole problem by:

- setting up a Reversionary Pension

- Binding Death Benefit Nomination

Who gives me advice on succession planning for my company?

Firstly, it is often about succession planning for a trust, such as a Family Trust. In this case, controlling the shares in a trustee company is less important.

If you wish to read my doctoral thesis on business succession planning, you can do so here.

Finally, your accountant, financial planner and lawyer know you best. Take their advice before you become involved in some exotic, expensive succession strategies.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super. Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will