Who can challenge a Will with a considered person clause?

Each state’s Family Provision Act sets out who can challenge a Will

Courts are reluctant to interfere with your Will. However, legislation exists in all Australian States and Territories:

-

New South Wales: Succession Act 2006 (NSW)

-

Victoria: Administration and Probate Act 1958 (Vic)

-

Queensland: Succession Act 1981 (Qld)

-

Western Australia: Family Provision Act 1972 (WA)

-

South Australia: Inheritance (Family Provision) Act 1972 (SA)

-

Tasmania: Testator’s Family Maintenance Act 1912 (Tas)

-

Australian Capital Territory: Family Provision Act 1969 (ACT)

-

Northern Territory: Family Provision Act 1970 (NT)

‘Provision’ vs ‘further provision’ vs ‘adequate provision’ – challenging a Will

- Certain people apply to the court for ‘provision‘.

- Or if they get something in the Will, they seek a ‘further provision‘. This is from your deceased estate. (This is why you should leave them nothing, and put in a Considered Person Clause. Any beneficiary, including a beneficiary getting 1% of the estate, gains additional rights to boss around the executor.)

- They only win if they can prove you did not provide ‘adequate provision‘. This is for the proper maintenance and support of the challenger.

But who can challenge an Australian Will?

Does leaving 1% or a small gift stop someone from challenging my Will?

No. Of course, it doesn’t. If you make someone a beneficiary they get additional rights. It’s better to leave them nothing and put a Considered Person Clause in your Will. The person, therefore, does not get the rights of a beneficiary.

The Impact of Small Gifts on Will Challenges under Australian Law

Does leaving a small gift or only 1% of an estate prevent someone from contesting the will? The short answer is no. In Australia, the size of the bequest does not necessarily deter a potential challenger from disputing the terms of a will. It’s a common misconception that a token gesture, such as a nominal bequest, can effectively prevent disputes or challenges to a Will’s validity.

Do Beneficiaries in a Will get additional rights?

When building a Will on Legal Consolidated’s website, it’s essential to understand that any individual named as a beneficiary, regardless of the size of their inheritance, gains additional legal rights and entitlements. These rights can include challenging the will if they believe it to be invalid or unfair. Therefore, leaving even a small gift confers the status of a beneficiary and the accompanying legal privileges.

To mitigate the risk of potential challenges, Will makers should instead put a Considered Person Clause within their Will. This clause expressly states that certain individuals, although mentioned in the will, are not to be considered beneficiaries for inheritance rights. By including this provision, the testator can clearly delineate their intentions and limit the legal rights of specified individuals, thereby reducing the likelihood of disputes arising.

Who can challenge an Australian Will?

In Australia, the following people can challenge your Will:

- legal spouses

- divorcees still receiving maintenance from you

- de facto spouses.

- Courts look at each case with fresh eyes

- They look at the relationship. Was the de facto ‘maintained’?

- Was the de facto part of the deceased’s household?

- Do you have a moral responsibility to that de facto?

- children of the deceased of any age.

- stepchildren in all States to some level, except Tasmania (see below)

- grandchildren, especially if their parents are dead, or the grandchild is living with you, the grandparent, as your death.

The courts have substantial powers to rewrite your Will. This is after considering the individual circumstances of each challenger. The court decides whether a distribution failed to make ‘adequate provision’. This is for the:

- proper maintenance

- support

- education

- advancement

of the challenger. The courts consider the ‘moral duty’.

What is the “moral duty” in an Australian Will in family provision claims?

Consider the “moral duty” in these two cases: Vigolo v Bostin and Lloyd-Williams v Mayfield [2005] NSWCA 189:

Vigolo v Bostin

Vigolo’s dad is a wealthy farmer.

After a dispute, the son and his dad sign a deed. Vigolo, the son, is compensated for the value he adds to his dad’s farm.

Dad dies.

The Court states that Dad’s Will makes no ‘further provisions’ for the boy. Vigolo is ‘cut out of the Will’.

The son challenges Dad’s Will. The son argues a ‘moral claim’. This arises from previous business and family dealings.

Now remember, Vigolo and his wife already own substantial assets. This is in their own right.

The son’s claim is considered against Dad’s:

-

- obligations; and

- gifts

made to all of his four siblings.

The decision: The High Court states that the son is already left with ‘adequate provision’. This is for the son’s ‘proper maintenance and advancement in life’. The challenge is rejected.

Read the judgment yourself. But the Court sees the son as greedy.

Williams v Mayfield [2005] NSWCA 189 – When children fight over you Will

In Lloyd-Williams v Mayfield [2005] NSWCA 189, Ms Mayfield is the daughter of Mr Stewart.

Mr Steward dies with no Will.

The daughter is entitled to a percentage of her father’s estate. This is under the intestacy laws.

However, most of Mr Stewart’s wealth is jointly owned. This is with his ‘evil’ second wife.

-

- The daughter only gets a few thousand dollars.

- The second wife gets all the jointly owned assets.

The second wife dies shortly afterwards. The second wife leaves everything to her niece: Miss Lloyd-Williams. The estate is worth over $8 million.

The daughter, in disgust, challenges the second wife’s will. The daughter claims that she is entitled to some of the jointly owned property. At trial and on appeal, the court agrees and awards her $850,000.

Can you reconcile the two challenging Will cases?

- In Vigolo, the court believes the son got a substantial provision during his dad’s life. Dad’s deceased estate is substantial. Even so, the assets of the competing beneficiaries outweighed the needs of Vigolo.

- In Mayfield, no testamentary promises are made. Nevertheless, the estate is large. The only competing beneficiary receives a considerable proportion of the estate.

NSW Wills are special when challenged

In New South Wales we have ‘notional’ estates. Your ‘estate’ assets include assets you transferred for less than market value three years before you die. This includes assets over which you controlled. Therefore, Family Trust assets are often caught.

NSW also has the widest group of people who challenge your Will:

- current and former wife and husband

- child

- wholly or partly dependent and at any time a member of the same household

- grandchild wholly or partly dependent

- close personal relationship at the deceased person’s death

- de facto at the time of death including “same-sex” (section 21C Interpretation Act 1987including interstate relationships)

NSW Case: Rakovich v Marszalek [2020] – a ‘friend’ challenges the Will

Even in NSW, family provisions claims are normally from family: spouses and children. But ‘friends’ can challenge. See the case of George Rakovich v Marszalek [2020] NSWSC 589. In this case, the friend cared for the dead person as if they were family.

For the Will – George is like a son

Horst Marszalek is a bachelor. He has no wife or child. He dies with no Will. Each Australian State enforces a Will on dead people that do not have a Will. These are intestacy distributions. The closest relatives were two nieces and two nephews. Marszalek never met them.

Marszalek, however, has a friend: George Rakovich.

Marszalek treated George like a son. It is a relationship of ‘mutual dependence’. As Marszalek got older his defacto son looked after him.

But George is not related to Marszalek for the Will!

Marszalek dies. George makes a claim under s50(1) Succession Act 2006. George seeks an entitlement to Marszalek’s estate. But is he ‘an eligible person’? The Court asks:

- Is George an ‘eligible person’?

- If Marszalek had made a Will how much would George have got?

What does it take to be an eligible person to challenge a Will?

The Court looks at young George’s:

- dependence upon Marszalek

- nature of George’s relationship with Marszalek

George lived with his defacto dad. George relied on Marszalek for housing, emotional care and financial support. George was an eligible person under s57(1):

- George was ‘wholly or partly dependent upon’ Marszalek: s 57(1)(e)

- George is a ‘member of the household’ to which Marszalek belonged: s 57(1)(e)

- George lived in a ‘close personal relationship’ with Marszalekat when Marszalek dies: s 57(1)(f)

But how much should the de facto son get in a Will?

So George is an eligible person. But how much should George get? What is George’s ‘proper maintenance or advancement in life’ requirement? The Court considers:

- what is “adequate by reference to (George’s) needs’?

- what is ‘proper in the circumstances’?

How much money should the de facto child get in a Will?

In family law matters there seems to be little rhyme or reason for how the Court comes to what is fair. So too in Family Provision claims. It is a dark art. There was no “scientific, or arithmetic” formula. However, the Court considers:

- size and nature of Marszalek’s estate

- relationship between George and Marszalek

- competing moral and financial claims of Marszalek’s distant relatives

- financial circumstances of the nephews and nieces

Marszalek spoke with his family on holidays and for milestone events only.

In contrast, George treated Marszalek as a father. The nature of this relationship and the bond between the two is corroborated by evidence from Marszalek’s doctors.

Marszalek owes a moral duty to his nieces and nephews. But Marszalek has a stronger moral duty to provide for George.

Marszalek’s nieces and nephews are poor.

George gets 45% of Marszalek’s estate.

Considered person clause in New South Wales’ Wills

If you have a ‘de facto son’ then add that person as a ‘considered person’. This is if you intend to leave them nothing.

For asset protection and divorce should brothers be trustees of each other’s Testamentary Trust in dead dad’s Will?

Q: As the financial planner I completed a tax-effective Will on Legal Consolidated’s website yesterday. As you requested I sent a copy to both the client’s accountant and commercial lawyer.

The 3-Generation Testamentary Trust names both sons as executors. They receive 50% each.

The commercial lawyer wants the option for each brother to be the respective trustee of the other death trust. This is so that the trustee is not also the primary beneficiary.

But the commercial lawyer does not want to force this. He wants that decision to be made by the brothers after dad dies. This is because the brothers may not like each other. Or a brother could be dead. We need to stay flexible.

A: The commercial lawyer is smart. And I completely agree.

You will be happy to know that the 3-Generation Testamentary Trust Will allows that approach (and many other versions of it) to be followed. The 3-Generation Testamentary Trust Will allows this excellent strategy. It can be put in place after the Will maker’s death.

As an extra layer of protection, our 3-Generation Testamentary Trust Wills also contain Bankruptcy Trusts, Divorce Protection Trusts and Special Disability Trusts.

The weaponry to protect your clients is built into the 3-Generation Testamentary Trust Will. And available to be used as their own lawyer, financial planner and accountant advice after the Will maker is dead.

The 3 Great Unknowns of a Will

- We do not know the date of Dad’s death.

- We have no idea what assets he may own.

- And we have no idea of the changes to the law. Tax, superannuation, family law and bankruptcy rules continuously change.

So, flexibility in a Will is the greatest gift that a dad can give. The most flexible Will is the 3-Generation Testamentary Trust Will.

Can grandchildren challenge your Australian Will?

When can stepchildren challenge a deceased estate?

Depending on the State, in Australia there are four approaches:

- Is the stepchild wholly or partly dependent on you the step-parent before your death?

Then in New South Wales, Western Australia, South Australia, the Australian Capital Territory and the Northern Territory, the stepchild challenges your Will. There is no need to show a ‘moral responsibility’. - Is there a moral responsibility owed by you the step-parent? If so, then in Victoria a stepchild also challenges your Will.

- Is the natural parent and the step-parent married at the date of death? If yes then the stepchild automatically challenges the Will in Queensland.

- In Tasmania, stepchildren cannot challenge their step-parent’s estate.

What does the Court consider when a Will is challenged?

What happens when a court decides to vary a Will? The judge then decides the size of the provision for each person. The court looks at:

- any considered person clause in the Will (see below)

- estrangement from, or poor relationship between, the challenger and the deceased;

- the conduct of the challenger towards the deceased;

- the overall size of the estate; and

- the age and circumstances of the challenger.

The area that is the most hostile is ‘family provision’ for an adult child. Court decisions vary between:

- amending a Will simply because the relationship exists; or

- to varying a Will only where a special need is demonstrated.

Can both a lover and a spouse challenge your Will at death?

Bigamy seems to now be legal in Australia. In the court case Sha & Cham [2017] FamCAFC 161, 16 August 2017, Mr Sha had both a wife and a mistress. He is deemed, under the eyes of Australian law, at least, married to both his wife and his sex worker. This now lends support to the argument that both a wife and mistress can challenge your Will.

Considered Person Clause – helps protect the Will from challenges

It is not a good idea to leave a nominal $1,000 to someone to stop them from challenging a Will. It just does not work. And it makes that person a ‘beneficiary’ with all the privileges that a beneficiary gets – such as access and power over the executor.

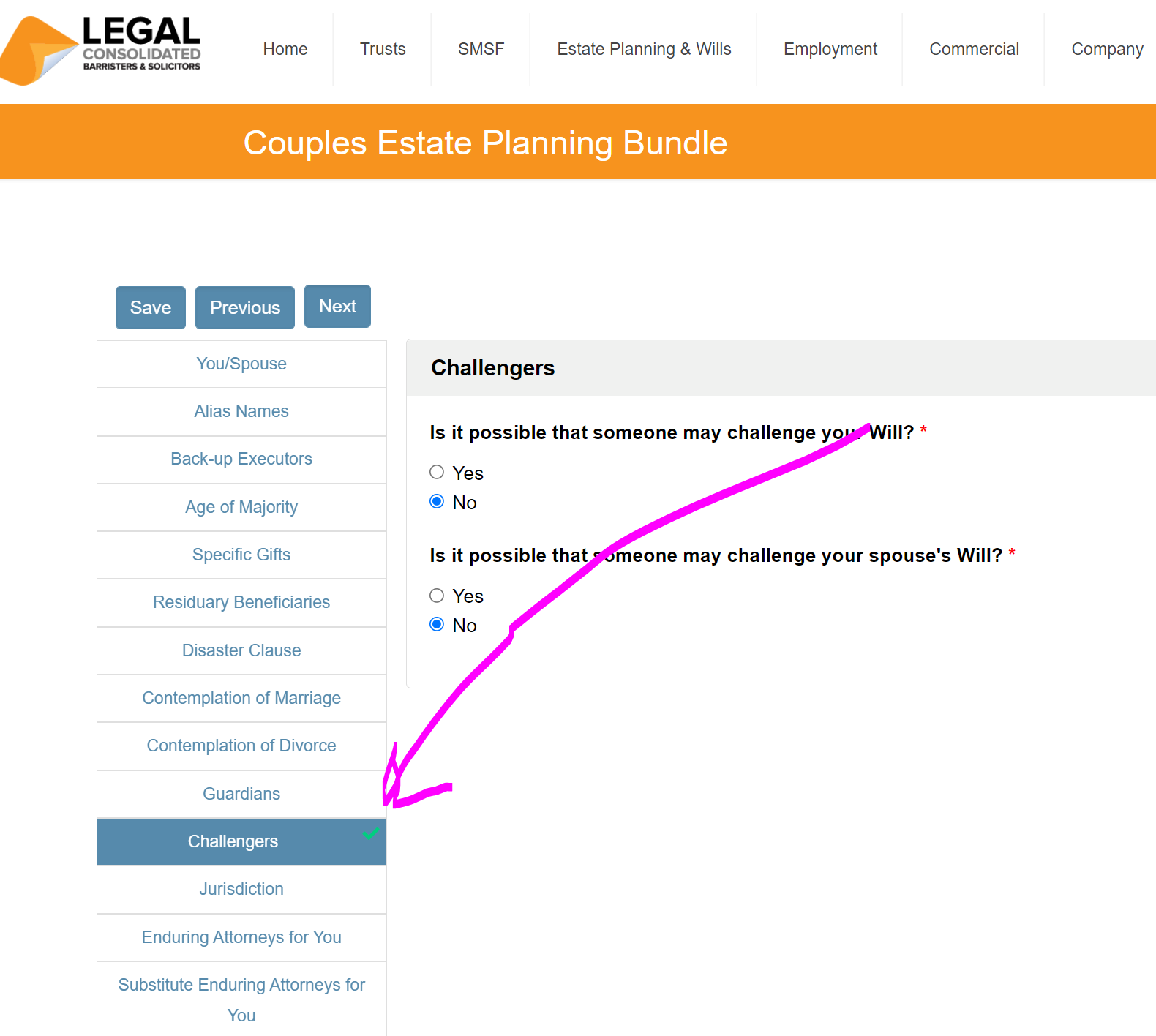

Instead, when you build a Will on our law firm’s website you are invited to insert a ‘Considered Person Clause’ for any person that is both able to challenge the Will and may want to challenge the Will. We have a specific question on this with all our Wills. To see the wording of the Considered Person Clause just go to any of our Wills and open up the Sample.

The Considered Person Clause merely states that you have ‘considered’ a certain person and you are happy with what they have already got. The wording we use is based on the latest Court cases. The Considered Person Clause makes it more expensive and difficult for that person to challenge your Will. However, it does not stop them from challenging, nothing can achieve that. It just makes it harder for them.

What should the Executor do if a Will is challenged?

What happens if an executor becomes aware that a Will may be challenged? Your Executor postpones distributing your estate. Reasonable periods of postponement are set out in each Australian jurisdiction. What if the executor has obtained a grant of probate? The executor is then entitled to call in the assets and pay debts. If the Will is successfully challenged, the Supreme Court does not render it null and void. It merely exercises the power to apportion the estate differently to the terms set out in the Will.

I want to challenge a Will. How do I get a copy of the Will?

There are two ways to challenge a Will. Claim the Will is faulty or say the Will is unfair. Either way, you want to get hold of the Will and the Executor. Under the Family Provisions Acts in most States, you only get 6 – 12 months to automatically bring a challenge. This is from the date that probate is granted. For example, in NSW it is 12 months and in WA it is 6 months.

In some states, only a residuary beneficiary can demand a copy of the Will. Again, NSW is the widest. These people can request a copy of a NSW Will:

- any person named or referred to in the Will, whether as a beneficiary or not

- any person named or referred to in an earlier will as a beneficiary

- the surviving spouse, de facto partner (same or opposite sex) and children

- a parent or guardian

- any person who is entitled to a share of the estate if the person died intestate

- a creditor – Succession Act 2006 (NSW) section 54

Otherwise, check with the Probate Court in the relevant State – from time to time. If there is an application for a Grant of Probate the Will is with it. Any person, including the press and members of the public, can get a copy of the Will from the Probate Court.

If I treat my children equally, can they still challenge my Will?

Is treating my children equally always fair?

Q: My Legal Consolidated Will provides equality in percentages to all children. This is a third for each child. Can one of those children still challenge the Will? Does ‘fairness’ play a part?

A: Leaving everything equally to your children is common. And sure this is often ‘fair’. But:

- It may NOT be fair. For example:

- “Dad gave $2m to my brother before Dad died. There is now only $1m left in his Will. My brother gets $500k. And I get $500k”.

How can you say that is fair?

- even if it is ‘fair’ (whatever that word means) it does not stop a child from challenging your Will. For example:

- Adrian is the favourite child. Adrian is left 99% of Mum’s estate in her Will. Adrian’s brother and sister are left with only 1% of the estate between them. Adrian is still unhappy with that! He challenges Mum’s Will. Sure, Adrian is unlikely to win. But he still has the right to challenge Mum’s Will. This is the case even though he is getting virtually everything in Mum’s Will anyway.

How long before the ex de facto can no longer challenge my Will?

Q: I understand that an ex-de facto partner can still challenge my Will. How much time has to pass before they lose that right? What if a long-term girlfriend from University days 30 years ago shows up at my funeral ready to challenge my Will?

A: De facto couples do not share the same legal rules as married couples. You do not go through any formal process (such as applying for divorce) to end a de facto relationship.

A de facto relationship is when two people, who may be of the same or opposite sex, are not married but live together. Or have lived together as a couple on a genuine domestic basis.

Section 57(1)(d) Succession Act 2006 (NSW) provides that your former spouse and de facto partner of a deceased person can make a family provision claim against the deceased’s estate. The other States have similar rules.

However, in Queensland, the answer is most likely, “no”. This is because Queensland law does not recognise a de facto partner as an “eligible person”.

This means that even an ex-partner from a de facto relationship may be able to make inheritance disputes. This is if they believe they have not been treated fairly.

Regardless of how long ago the relationship ended, a former spouse contesting a Will may be offered compensation. This is if the Court agrees there was a moral obligation for the deceased to have provided for the individual.

But in practice, the passing in time between the ending of the de facto relationship and your death, the weaker the ex de facto’s claim.

To protect yourself put a Considered Person Clause into your Legal Consolidated Will.

Who pays the cost to challenge a Will?

The Courts have the discretion as to who pays the legal costs. This is for both sides. The Court decides who covers the legal expenses. Often the estate pays most of the legal fees for both sides. Typically, if the challenger wins they receive most of their legal costs back from the estate.

However, if the challenger’s claim is weak then the challenger may have to pay their own fees and also the executor’s fees in defending the Will.

We are seeing a tendency for the courts to make the challenger pay their own legal costs if there is a Considered Person Clause in their Will. To see the wording of a Considered Person Clause just start building, for free, a Legal Consolidated Will. And read the hints on this topic.

Hall v Carney

Without a Considered Person Clause, it is more likely that the estate pays the challenger’s costs. See Hall v Carney (No 2) [2012] SASCFC 105.

However, the successful challenger can not assume their litigation expenses are automatically covered by the estate.

Fielder v Burgess

See Fielder v Burgess [2014] SASC 98:

“It is not clear to me why a testator’s errors in creating a Will should lead to the successful beneficiary incurring losses in estate-related litigation.”

The challenger faces great risks. This is especially true if there is a Considered Person Clause in the Will.

As noted above Superannuation does not automatically form part of your deceased estate. At death, your superannuation only goes to:

- directly to your dependents; or

- into your Will (your estate)

If it goes directly to your dependents then it does not go into your Will. In which case, if someone challenges your Will they cannot attack your super. This is because, in this example, the super is not in your Will. Well, that is the tried and tested rule until the Benz case.

(For the moment, let us forget the 32% tax on superannuation when going to adult children.)

Who controls where my superannuation goes at my death?

Three methods to decide where your super goes at death:

- a valid binding nomination;

- the SMSF Trustee’s discretion; or

- the SMSF Deed (free training course on Self-Managed Super Funds)

Notional Estate

In NSW, the property can be designated a “notional estate”. This is by courts. This is where the dead person either:

- Moved their assets around to stop these assets from being part of their estate. For example, transferred:

- Asset from tenants in common to joint tenants.

- The asset to a life estate.

- Assets into a Family Trust.

- Assets ‘sold’ for less than ‘full valuable consideration’. The Court in Kastrounis v Foundouradakis [2012] NSWSC 264 states:

- “the Act requires “full valuable consideration” and not just “valuable consideration”. The word “full” must be given meaning and effect. The valuable consideration given must be, therefore, approximately equivalent to the value of the property that is disposed of by the deceased.”

- Failed to take steps that would have made the property available to their estate. This is 3 years before their death.

Currently, only NSW has this strange rule. But, Legal Consolidated, is planning for other states to adopt ‘notional estates’, as well. In this court case, Dr Benz’s wealth is in superannuation. There is not much in his estate.

For notional estates when a person dies leaving a Will, their assets (their estate) are distributed. This is under their Will. However, if certain conditions are met, the Succession Act 2006 (NSW), gives the court discretion. This is over some (non-estate) assets that:

- were not directly owned by the person at death; or

- the person distributed the assets before the death

as ‘notionally’ part of their estate.

Notional estates vs SMSF Binding Nomination

But, the binding nomination is correct. And it is binding!

Sure, the death benefit nomination is ‘binding’ on the trustee of the super fund. But, section 63 Succession Act 2006 (NSW) allows the Court to:

- treat property

- that does not form part of a deceased estate

- as notionally part of the estate.

This is in certain circumstances.

In Benz, the dead husband is survived by his six children. They are from:

- his first marriage; and

- his second spouse, the lovely Erlita

The dead husband signed a binding death benefit nomination to Erlita. This is for the superannuation held in his self-managed superannuation fund. It totals a healthy $13m.

But the dead husband’s residuary estate is only a miserable $200k. So there are only $200k of assets in his Will.

Three of the dead husband’s children start a family provision claim. This is to challenge the distribution of assets only in his Will. Or, so we all thought. The children claim that a bit of the tiny residuary estate in the Will is woefully inadequate. The Court agrees.

In an alarming decision, Justice Ward orders $3.7m to be paid to the three children. This is from the dead husband’s superannuation fund.

On a close reading of the case, Legal Consolidated believes that a Reversionary Pension would have stopped the Court from doing this.

Both bundles protect your family from death duties, divorcing and bankrupt children and a 32% tax on super.

Build either online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will