What is the difference between an executor and a guardian?

Executor: In a Will, the ‘executor’ carries out the instructions in your Will. The executor administers your estate. The executor sets up the appropriate trusts.

Guardian: A guardian looks after your young children.

Can the Executor and Guardian in your Will be the same person?

In Australia, the executor of your Will and the guardian of your children may be the same person. This arrangement simplifies the management of your estate and the care of your children by placing both responsibilities under the stewardship of one trusted individual(s).

The executor manages and distributes the assets of your estate according to your Will, including settling debts and ensuring that beneficiaries receive their inheritances. Meanwhile, the guardian takes care of your minor children, making decisions about their education, health, and welfare.

Should the Guardian and Executor be the same person?

Having one person(s) serve both roles of Guardian and Executor reduces conflicts and miscommunications. Select someone capable of effectively managing both the financial and personal care aspects, and who will balance the needs of the estate with the best interests of your children.

Consider the individual’s aptitude for both roles. Although it simplifies the management process by consolidating responsibilities, consider whether this person can impartially and effectively handle both money and provide care and attention to your children’s upbringing. This ensures that both your estate is managed efficiently and your children’s welfare is prioritised.

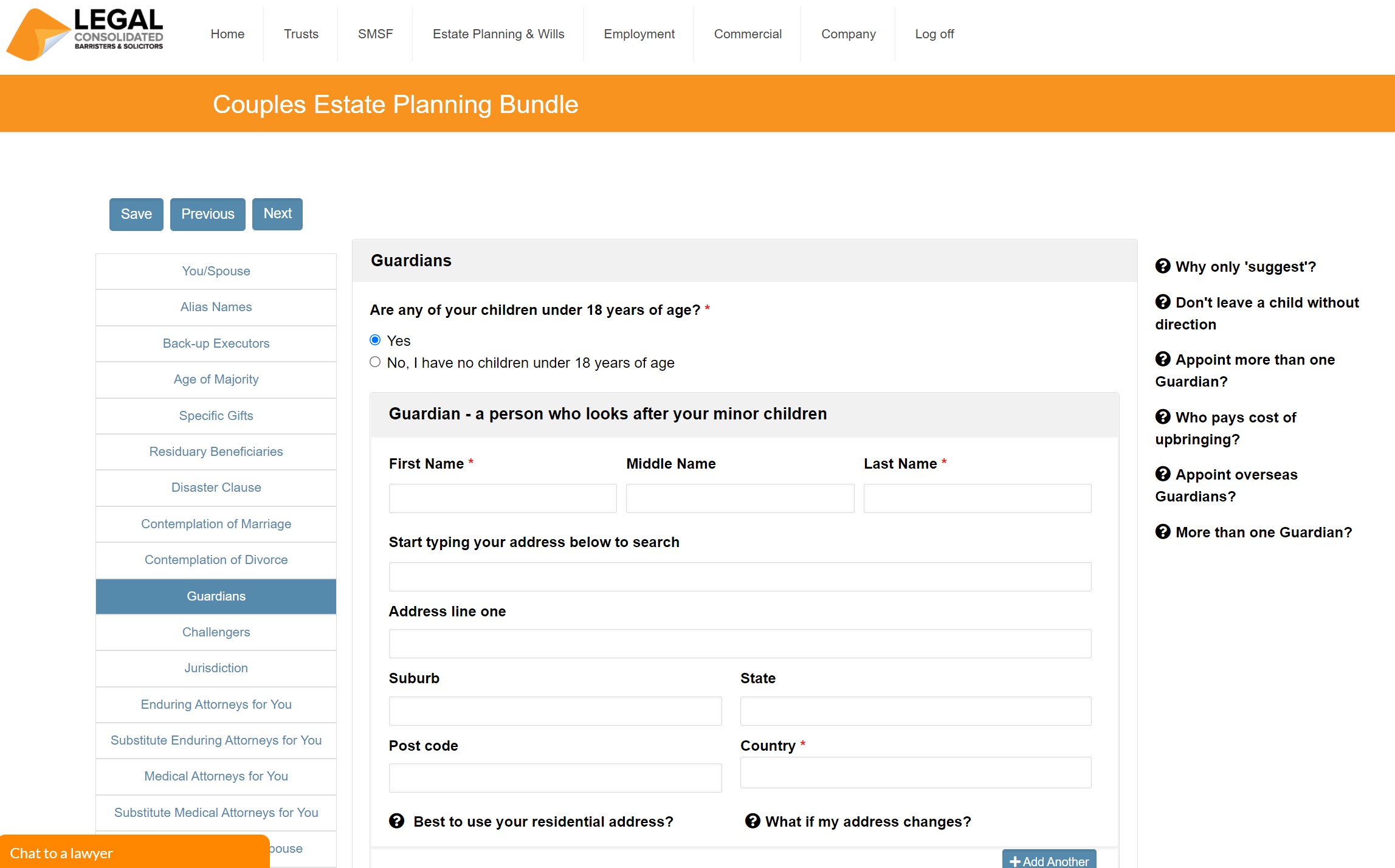

Put Guardians in your Will if you have children under 18-years-of-age.

Is the Guardian for my minor children named in the Will?

The guardian for your minor children should be named in your Will. The guardianship clause in your Will specifies states who will take responsibility for your young children’s care if you and the child’s other parent are both dead. Naming a guardian in your Will ensures that your preferences for their upbringing are considered and helps prevent potential legal disputes or uncertainty regarding their care.

Choose a guardian you trust and who agrees to take on this responsibility. Discuss your intentions with the chosen guardian(s) beforehand to ensure they are willing and prepared to fulfil this role.

How does my Guardian get money from the Executor in my Will?

In your Will, the guardian of your minor children, through the Legal Consolidated Maintenance Trust, receives funds from the executor. This is for minor children’s expenses. All 3-Generation Testamentary Trust Wills contain a Maintenance Trust. This is how a Legal Consolidated Maintenance Trust operates:

- Estate Management: The executor of your Will manages and distributes your estate’s assets for the ‘best interests’ of your minor children.

- Trusts: Through the Legal Consolidated Maintenance Trust the guardian has access to funds to cover expenses for the children’s care. The executor oversees the Maintenance Trust and ensures that the funds are used for the children’s ‘best interests’.

- Regular Distributions: Legal Consolidated Maintenance Trust allows for regular disbursements and allowances to be paid to the guardian for everyday expenses such as food, housing, and schooling.

- Special Allocations: Legal Consolidated Maintenance Trusts also provide for specific sums to be paid out for particular needs, such as medical expenses, and education fees.

- Documentation and Approval: The executor may require the guardian to provide documentation or receipts for larger expenses to ensure that the funds are being used for the ‘best interests’ of the children.

The Legal Consolidated Maintenance Trust provides the mechanisms in your Will to ensure that the guardian has the necessary resources to care for your children without undue financial burden, while also ensuring that the funds are managed and used responsibly.

Can the guardian steal and abuse the money in my Will?

Anyone in a position of trust can abuse their position. For example, while they risk going to jail if caught a child can use Mum’s POA to steal money. Elder abuse exists. However, most people trust their family and friends more than the government, Public Trustee (State Trustee), Trustee Companies and (heavens forbid) lawyers.

You will notice above that we use the expression ‘best interests’. This is the test for both executors and guardians. For example:

Is what I am about to do or spend money on in the ‘best interests’ of the child.

It is a difficult question to answer. Cleave to the bosom of your accountant and financial planner to sign off on that question.

What safeguards are there to protect my minor children?

A guardian can misuse the funds intended for the care of minor children. These are the safeguards to minimise risk:

- Legal Obligations and Penalties: Guardians, like executors, are bound by legal duties to act in the ‘best interests’ of the beneficiaries—in this case, the children. Misusing funds can lead to legal consequences, including criminal charges.

- Oversight by the Executor: The executor of the Will is responsible for overseeing how the estate’s funds are distributed and used. They can require the guardian to provide receipts or detailed accounts of how the money is spent.

- Independent Audits: Usually more to protect both the executor and guardian either can instruct an independent party, like an accountant or financial planner, to review the expenditures, and confirm that such actions are in the children’s ‘best interests’.

- Choosing Trusted Individuals: While the risk of abuse exists, selecting a guardian whom you deeply trust and who has demonstrated responsible behaviour can significantly reduce this risk.

The concept of acting in the “best interests” of the child is a legal standard that guardians must adhere to, but it is complex to interpret and apply. Regular consultations with financial and accountants help ensure that decisions meet this standard and provide an additional layer of oversight.

Do I name my ex-spouse, the other biological parent, as the Guardian of our young children?

As you build your Will on our law firm website you come to a question on Guardianship. This is for your young children.

In a Legal Consolidated 3-Generation Testamentary Trust Will, the guardianship clause for your named guardians typically becomes effective only after both you and the other natural parent are dead. The activation of this clause requires:

- Your death.

- The death of the other biological parent.

For example, if your ex-spouse is still alive and capable, they would normally take on guardianship of any mutual minor children. However, there are exceptions:

- The child is legally adopted by another person.

- The other biological parent is unfit to care for the children, due to reasons such as involvement in criminal activities or incarceration.

Include a guardianship clause in your Will, regardless of the other natural parent’s current status. This clause serves as a precaution for scenarios where the other parent dies before you or is unable or unwilling to take on parental responsibilities.

Executors older than you?

Q: My husband and I have appointed my father-in-law as executor. He is nearing his 70’s. For the longevity of our Wills, can we nominate two executors, or change executors? We did not appoint our unborn children or our 5 and 8-year-olds.

A: You should go back and read the hints on this. As Back-up Executors, you should have appointed your unborn children, and the 5 and 8-year-olds. On average your children are in their 60s when you both die. In the unlikely event, that you die in the next few years, then you also put in a few additional people – this is in addition to the unborn and current children. This may be your father-in-law, and a few other people, such as your brothers and sisters. When you die, and your children are old enough these people can renounce and let your children do the job of being executors.

You can update your Wills and POAs for free. As often as you wish. This is provided you are still of sound mind and alive.

Young and Vulnerable Children tool kit

Free resources to help protect young and vulnerable children:

- Vulnerable children in Wills – watch the training course

- Loans to children – in case they divorce or go bankrupt

- Divorce Protection Trusts in Wills – in case a beneficiary, child or grandchild separates

- Making Wills for Your Children

- Elder Abuse – protecting the children as well

- Life Estates do NOT protect children

- Child renounces a gift or Family Trust distribution for Centrelink and stops Trustee-in-Bankruptcy

- Children paying 32% on your super when you die

- Only disabled children can take your SMSF Reversionary Pension

- Parent dies child pays 66% tax

- Dad’s Will: child vs charity

- Son loses the farm to his two smarter sisters!

- Disabled dad has $9m, two children and no Will – Statutory Will to the rescue

- Court rewrites disabled Dad’s Will to protect children

Can the people who look after my infant children (guardians) use the money in my Will to help my children?

Starting the free building process for your Wills. Start that journey. Read the hints and watch the training videos it answers these questions. But, to answer this question, of course, money can be used to protect your children. We are working on a matter at the moment where the Executors and Guardians have decided to put an aunt in the family home until the children all finish high school. But start building the Will to get the full answer.

Guardians in the Will suffer ‘minimal financial burden’

Q: The Will states the “executor and trustees exercise such power as to ensure that the persons caring for any of my children suffer a minimal financial burden or loss as a result of caring for them.” What is generally considered a minimal financial burden? How is this determined?

A: Ask the Executors they answer that question. They control the purse strings. They must do so with only one criterion: what is in the best interests of the children. This is more than just toilet paper and Woolworth’s shop. It may be money to get married. It may be a car to get to university. It may be a carer to live with the children until they finish school. Speak to the Executors.

When a beneficiary reaches the Age of Majority does the trust ‘vest’? Or is there just a change of control?

A 3-Generation Testamentary Trust Will contains many trusts. For example, if you die with a child under 18 then the ‘Maintenance Trust’ is automatically activated. When the child turns 18 they take control of the trust. The adult child can, at any time, change the trustee. Whether the trust ‘vests’ (finishes) is a question you need to ask the child – it is their decision. However, the child is likely to continue using the Testamentary Trust because:

- there are many tax benefits.

- the child can borrow money from the trust, or buy a boat or a house. They do anything they want. The 3-Generation Testamentary Trust merely saves tax it doesn’t stop the child from using the money as that child sees fit.

- if the child, grandchild or great-grandchild separates the wealth in the Trust is not available to the family court or the bankruptcy court. This is because there is a Divorce Protection Trust and Bankruptcy Trust in the Will.

You can increase the age of majority to above 18. You can make it 21 years of age – or even 99 years of age if the child is mentally challenged.

Autistic child in Will v’s Centrelink

Q: My autistic child is on invalid support from Centrelink. He is set to inherit under my 3-Generation Testamentary Trust Will. How does it affect his Centrelink pension?

A: Best to watch the Vulnerable Children in Wills course for the full answer. The short answer is that the 3-Generation Testamentary Trust is designed to allow the Centrelink pension to be drip-fed just the right amount of income to continue to get Centrelink disability support. But let your Accountant and Financial Planner help you with how much that is.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will